With the recent change in the overall economy coming from not only rate cuts by the FED but also now a massive stimulus coming from China assets primarily dividend and also crypto, gold and silver overall these systems should start increasing from this massive injection of the two worlds largest economies now injecting liquidity into the system.

This shift in the winds of crypto has opened up a number of possibilities again including the DeFi space which is something I was decently invested in but now am heavily.

DeFi was once a very big aspect of the crypto world. It offered the possibility for every day people to act as banks and start tapping into the massive potential of APRs, APYs, loads and other aspects that DeFi brought to the table.

However it quickly became riff with scammers, rug pulls and hacks which still continue to this day however with lesser impact. That lesser impact however might simply be a result of less usage of the platforms and really nothing has been fixed but time will tell in this next bull market.

One of these big players now are within defi which I'm expanding on. Primarily I'm looking for popular pairs that people interact with often. This high volume of trading mainly matters to be because of the fees that are generated off of it.

For example even though a DeFi platform tells you the general APY on a token pair that's more of a passive amount that often does not include the fees that were generated.

If you can find a good solid pair (preferably something stable in price so you have to worry less about impermeant loss. These pairs with an APR of say 5% - 7% if they have very high trading activity those fees can add up to massive results.

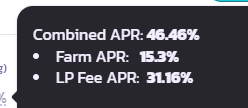

For example a current pair I'm in as a test just for this post is currently showing me a 15.3% APR on the trading pair. With only $4.77 in it's generated $0.24 in the native token and however the fees generated are $0.38 which is crushing that APR showing me 31.15% APR from fees alone.

This is where as an investor you need to be aware of a number of factors when it comes to investing into the defi market. By finding unique pairs that have low liquidity and high trading volume can quickly explode your earnings over any general APY. It will be something for sure that needs to be watch and stayed up with as volumes and changes in how the defi platform works etc. So always keep a watchful eye and take action on it when you feel is necessary.