Tel Aviv-based Colu is a blockchain startup that aims to "change the face of your local economy" through the issuance of local community currencies aimed at boosting a community's economic activity.

Founded in 2014, Colu has already issued local digital currencies in Tel Aviv, Haifa, London, and Liverpool, and has been expanding operations since its February 2018 token sale which raised almost $23 million.

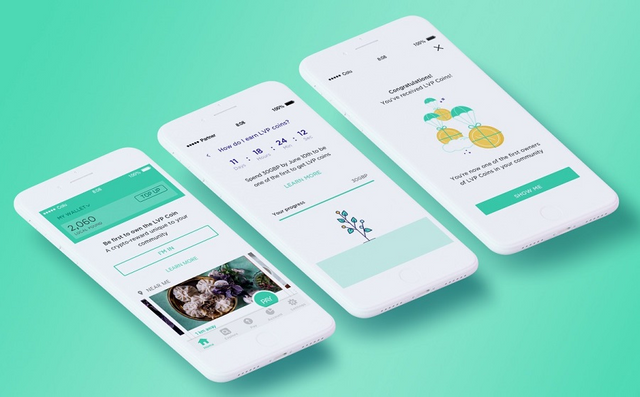

The concept is simple. Colu issues a local digital currency specific to a community within a major city that is pegged to the city's national fiat currency, which can then be used to pay at participating local merchants. This, in turn, boosts local commerce within the neighborhood as the money stays in the local community.

When Colu launched the Local Pound, East London in London in June 2017, for example, new users were incentivized to download the mobile application by providing each new user with five pounds in Colu's new local digital currency for signing up. Additionally, every time a new user topped up their Local Pound holdings, they were rewarded with a ten percent bonus.

"Small businesses are the backbone of the UK economy, and an investment in local businesses is really an investment in the residents of East London said" Amos Meiri, CEO and co-founder of Colu,

Since the launch of Colu's Local Pound in London, almost 200 merchants in East London have onboarded. In the three years that Colu has rolled out local currencies in four cities, the startup has grown its user base to almost 100,000 and boasted over 70,000 transactions per month.

Going forward, Colu reportedly plans to create city currencies that come with incentive systems to boost positive behavior among residents. The idea is to issue a digital currency in cooperation with the local city government that can be used to financially rewards residents for positive social actions such as volunteering, participating in civic activities or spending their digital currency on local products.

Kintetsu Harukas Coin

On the other side of the globe, in Japan, another digitized local currency initiative, called the Kintetsu Harukas Coin, is showing that digital currency can work as spending currency.

As reported in September 2018, publicly-traded company, Kintetsu Group Holdings, conducted a second cryptocurrency trial - targeting over 1.6 million potential users - for its blockchain-powered, mobile app-based shopping system after its first trial digital currency indicated that people were willing to use Kintetsu's digital coin.

The first test, which was run in September 2017, resulted in 85 percent of users reporting that it was easy to use the digital currency despite the fact that around 90 percent of the participants were not familiar with the concept of virtual currencies prior to the experiment.

As a result of positive uptake of its local digital currency, Kintetsu plans to officially roll the Kintetsu Harukas Coin out to the general public in early 2019 as part of the company's commitment towards helping to build a "cashless society."

Whether bitcoin will truly become a global borderless currency that everyday people use to pay for goods and services or whether its volatility will be a too greater hurdle for widespread adoption as a transactional currency remains to be seen.

What is clear, however, is that digital local currencies have the potential to boost local economies and that digital currency can be used as "real" money, even by non-techy users.