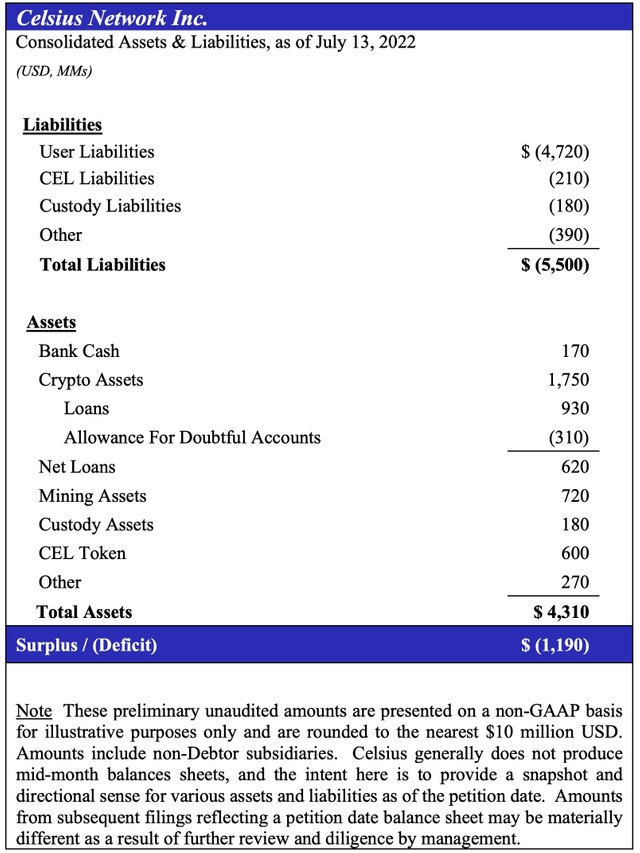

There is worrying news about Celsius (CEL), as the July 14 so-called Chapter 11 bankruptcy filing has resulted in a nearly $1.2 billion deficit for the crypto lender.

According to a new document filed with the U.S. According to the Bankruptcy Court of the Southern District of New York, Celsius has $4.3 billion in assets versus $5.5 billion in liabilities, for a $1.2 billion deficit.

The bulk of the company's liabilities consisted of customer deposits, which totaled $4.72 billion. On the assets side, the company held $1.75 billion in cryptocurrencies and $170 million in cash.

Specifically, Celsius' CEL token assets have been valued at $600 million, although at press time on July 15, the token has a total market cap of just $172 million and a fully diluted market cap of $500 million, according to CoinMarketCap would have.

Source: U.S. Bankruptcy Court of the Southern District of New York

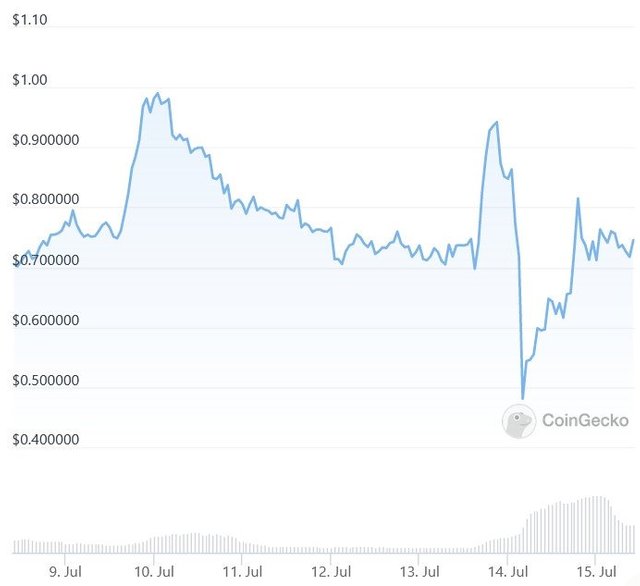

As of 8:30 a.m., the CEL token is up just over 26% in the past 24 hours and has remained flat for the past 7 days. It's also up 6% in a month and down 87% in a year.

CEL 7-day price chart. Source: coingecko.com

Meanwhile, according to the filed document, the company's mining operation, Celsius Mining LLC, could "over time" generate enough assets to pay off some loans, as well as "generate bitcoin that will provide revenue for the company in the future ".

The document added that Celsius's mining arm owns 80,850 mining rigs, of which 43,632 are "operational".

"Mining is currently generating approximately 14.2 bitcoins per day for the past seven days," the filed document continues, and is forecast to generate 10,118 bitcoins in total for 2022.

It was previously reported that crypto exchange FTX backed out of a deal with Celsius after gaining access to its financial reports. According to a report by The Block, people familiar with the matter cited a "$2 billion hole" in Celsius' balance sheet as the reason FTX lost interest.

Since then, Celsius has repaid some debts, including $78.1 million worth of USD coin (USDC) to lending protocol Aave (AAVE).

Hello welcome to Steemit world!

I'm @steem.history, who is steem witness.

This is a recommended post for you.Newcomers Guide and The Complete Steemit Etiquette Guide (Revision 2.0) and, recommended community Newcomers Community

I wish you luck to your steemit activities.

(The bots avatar has been created using https://robohash.org/)

@steem.history

My witness activity

Reference

SPUD4STEEM project

Newcomers Community,Steem Sri Lanka ,WORLD OF XPILAR, GLOBAL STEEM, Scouts, Latino Community

My featured posts

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post was upvoted and resteemed on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a one-time notice from SCHOOL OF MINNOWS, a free value added service on steem.

Getting started on steem can be super hard on these social platforms 😪 but luckily there is some communities that help support the little guy 😊, you might like school of minnows, we join forces with lots of other small accounts to help each other grow!

Finally a good curation trail that helps its users achieve rapid growth, its fun on a bun! check it out. https://plu.sh/somland/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is a one-time notice from SCHOOL OF MINNOWS, a free value added service on steem.

Getting started on steem can be super hard on these social platforms 😪 but luckily there is some communities that help support the little guy 😊, you might like school of minnows, we join forces with lots of other small accounts to help each other grow!

Finally a good curation trail that helps its users achieve rapid growth, its fun on a bun! check it out. https://plu.sh/somland/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit