Seriously, another ICO? Yes, Bloom is yet another ICO. But that's not a bad thing, as I don’t think we are anywhere near the end of the age of the ICO. The applications for blockchain technology and in-network tokens to streamline and improve existing processes are legion. Of course, Cryptocurrencies can dramatically reduce the overhead of moving money across international borders, thus replacing arrogant, uber-rich men, such as Jamie Dimon, whose profit comes from exchange rate margins and international bank transfer fees.

But there are a number of other scenarios where a blockchain-based token infrastructure not only cuts out profiteering middlemen but also increases the overall security of the system while creating a more level playing field for everyone involved.

One potential blockchain application is the credit scoring system. The recent Equifax hack highlights everything that is wrong with the current system — it’s almost like a laundry list of what the blockchain is not:

- Credit scoring is centralized — scores are produced by proprietary, agency-specific (and somewhat shadowy) scoring formulas.

- Credit scoring is compartmentalized in ways that make it very difficult to cross international borders.

- Credit scoring involves a manual reporting process that relies on humans within large bureaucracies to process paperwork in an accurate and timely fashion.

- Credit scoring involves a manual reporting process that relies on humans within large bureaucracies to process paperwork in an accurate and timely fashion.

- Credit scores can be obtained from your bank or another lender, but you may have to use another mechanism to request the details behind your score.

- Credit scoring errors can be hard to detect since the information is provided to organizations who are requesting (and paying) for that information.

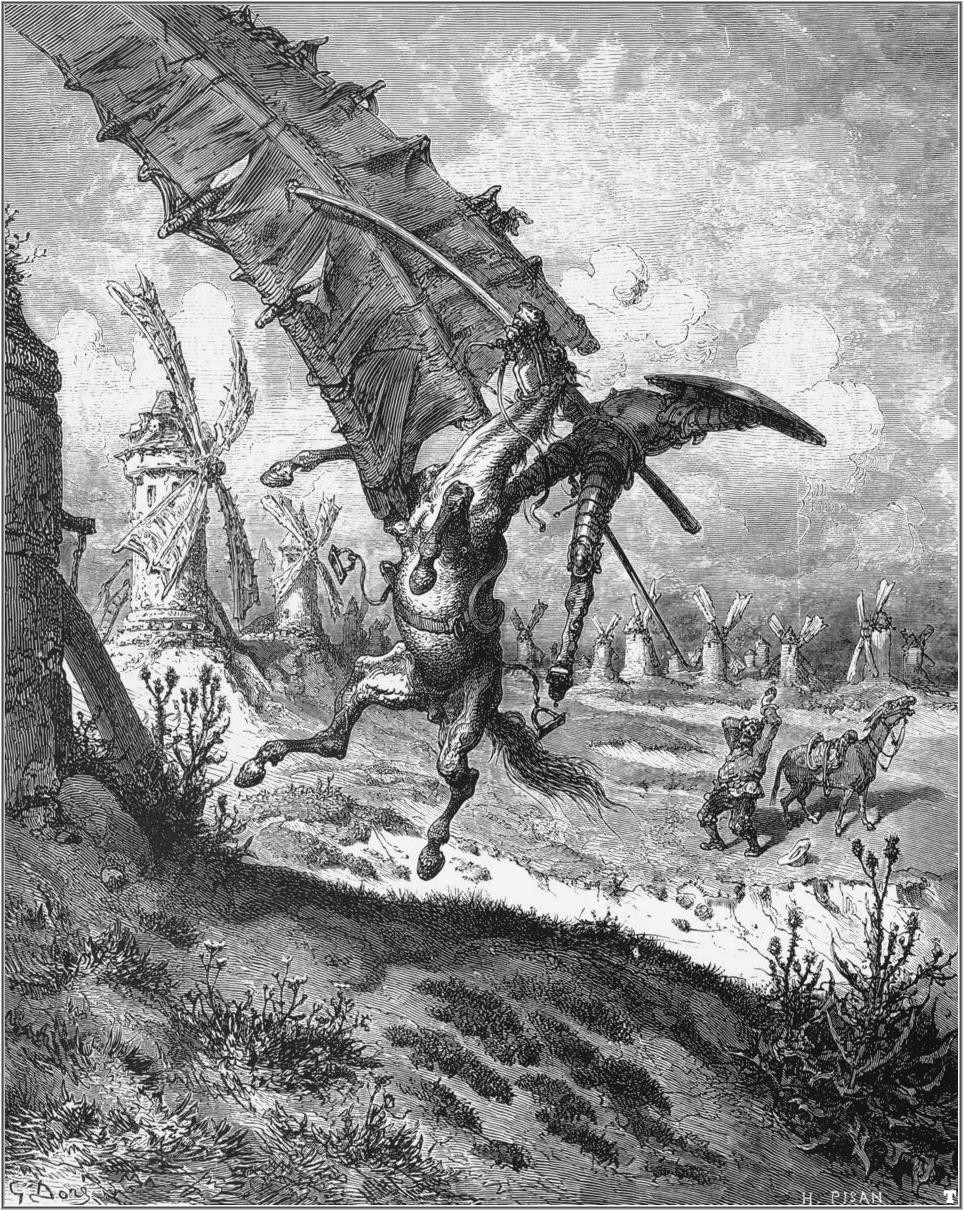

Bloom’s mission is to bring credit scoring to the blockchain. And the global credit system represents a real problem with a huge opportunity for blockchain technology, but global credit is giant system of systems and processes to replace. Will Bloom be able to slay this giant? The Bloom team appears committed and has been aggressively forming partnerships with the right organizations and bringing on the new team members, but just as importantly in this social media-saturated age, they have been blogging about every step at such a feverish pace it’s hard to keep up with all that is going on.

And in the interests of full disclosure, because their efforts to build a Bloom community have been so successful, there has been such overwhelming interest in their upcoming ICO. As a result, Bloom just announced what they call the Bloom Community Rewards Program, which helps ensure that would-be investors also make investments in building the Bloom community (and write blog posts like this one).

I’m not sure Bloom will succeed in slaying the global credit giant, but I do think it’s more than just a romantic idealism of bygone age.

What do you think? Say hello to Bloom and decide yourself: https://hellobloom.io/