Introduction:

In the ever-evolving landscape of cryptocurrency, one phenomenon that captures the attention of traders and enthusiasts alike is the notorious "crypto pump." These sudden and substantial increases in the value of a digital asset can lead to exhilarating profits or devastating losses. In this blog, we will delve into the dynamics of crypto pumps, exploring their causes, consequences, and the broader implications for the crypto market.

Understanding Crypto Pumps:

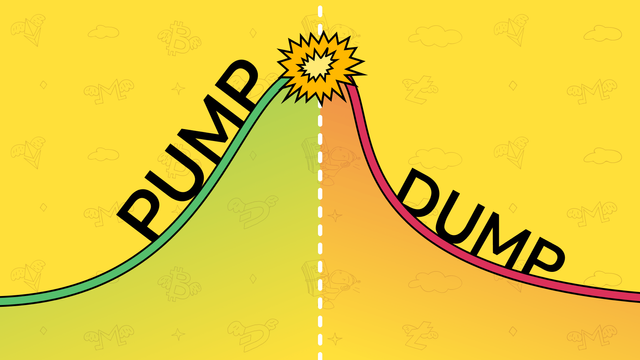

A crypto pump, short for pump-and-dump, refers to a coordinated effort by a group of traders to artificially inflate the price of a cryptocurrency. This rapid surge in value is often followed by a sharp and equally swift decline, leaving those who bought in during the pump at a significant loss.

Causes of Crypto Pumps:

Market Manipulation:

- Crypto pumps are frequently orchestrated by coordinated groups aiming to manipulate the market for personal gain. These groups use various means, including social media, forums, and messaging apps, to hype up a specific coin and attract unsuspecting investors.

Low Liquidity and Small Market Cap:

- Cryptocurrencies with lower liquidity and smaller market capitalizations are more susceptible to pump-and-dump schemes. Traders can exploit these conditions to inflate prices with relatively small investments, creating the illusion of a larger market movement.

FOMO (Fear of Missing Out):

- The fear of missing out on potential profits often drives investors to hastily join the rally during a pump. This influx of buyers further fuels the surge in price, but it is unsustainable in the long run.

Consequences of Crypto Pumps:

Financial Losses:

- Investors who enter the market during a pump may experience significant financial losses when the inevitable dump occurs. Timing is crucial, and those who join late may find themselves on the wrong side of the trade.

Market Volatility:

- Crypto pumps contribute to increased market volatility, making it challenging for traders to make informed decisions. This volatility can have a cascading effect, affecting other cryptocurrencies and even traditional financial markets.

Regulatory Scrutiny:

- As pump-and-dump schemes gain attention, regulatory bodies are increasingly scrutinizing the cryptocurrency space. Authorities are working to implement measures to prevent market manipulation and protect investors.

Conclusion:

While the crypto market holds immense potential for innovation and financial growth, the presence of pump-and-dump schemes highlights the need for caution and due diligence. Traders and investors should be aware of the risks associated with sudden market movements and be cautious when participating in volatile situations. As the cryptocurrency space matures, increased regulatory oversight and investor education may play pivotal roles in mitigating the impact of crypto pumps on the broader market.