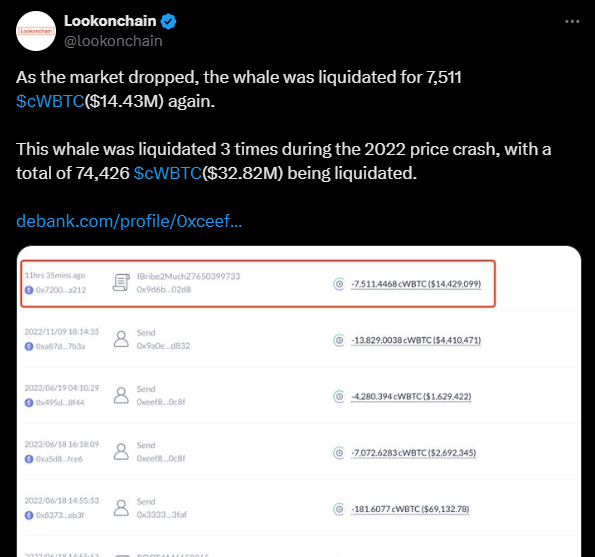

A Bitcoin whale recently lost $14.43 million in liquidations during the crypto market crash. This marks the whale’s second-largest loss after a $32.82 million loss in the 2022 crash, highlighting the risks of leveraged positions.

How the Loss Happened

The whale, identified by the wallet address "IBribe2MuchZ7650399733," had 7,511 cWBTC (worth $14.43 million) liquidated in the downturn. The same whale lost $32 million in 2022, showing the unpredictable nature of the market. This serves as a warning to investors about the dangers of leverage during market volatility.

What Caused the Market Crash?

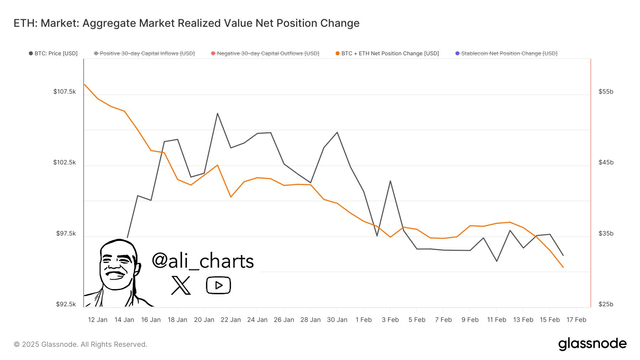

Bitcoin’s price fell below $95k, triggering panic and a decline in major cryptos like Ethereum, Solana, and XRP. Global economic uncertainty, including tariffs imposed by U.S. President Donald Trump, added to the bearish sentiment. Capital inflows into Bitcoin and Ethereum dropped over 30%, and the LIBRA meme coin scam further damaged investor confidence.

Can the Market Recover?

Recovery may take time. Most cryptos are consolidating with low investor confidence. A recovery could begin if Bitcoin's bull run continues and Bitcoin ETF inflows rise, attracting institutional interest. Without sustained bullish momentum, the market will likely stay volatile in the short term.

2025 started strong, but the market quickly became volatile, leading to significant liquidations. The whale’s $14 million loss marks the second major liquidation, the first being in 2022. A recovery could happen if positive trends, like a Bitcoin bull run, return. However, the near-term outlook remains uncertain.

https://coinpedia.org/price-prediction/bitcoin-price-prediction/