The interest rates set by the Federal Reserve are important for the performance of the American economy and the household balance sheet, for those who have invested savings or ongoing mortgages. After holding interest rates at an all-time low for a long time, the Fed seems to want to change course. A few days ago the announcement of the 0.75 percentage point increase in interest rates for the second consecutive time.

The interest rates established represent the cost of money with which individual American banks borrow money from the Fed. The banks use this liquidity to provide loans to their customers (the young couple who want to access a mortgage to buy a house, the craftsman who needs a loan to buy new machinery for his business, etc …).

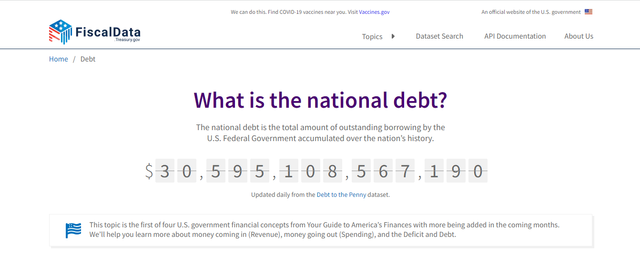

The higher the interest rates, the higher the cost of loans provided to customers. On the contrary, if the interest rates are lower, the cost of financing is lower and therefore convenient. This pushes businesses and households more to ask for investments and to get into debt. This triggers a very high demand for raw materials, goods and services (especially after the restart of the economy after the Covid-19 pandemic). When demand exceeds supply prices begin to rise and this imbalance increases inflation. The annual inflation rate for the United States is 9.1% for the 12 months ended June 2022, the largest annual increase since November 1981. Here the Fed intervenes. Raising interest rates discourages the provision of new loans because they become more expensive, the demand for goods and services falls, the currency in circulation falls and inflation tends to fall. On the other hand, however, this could further increase the public debt (which to date in the United States alone has exceeded $ 30 trillion) and lead to an economic recession.

What could happen to the cryptocurrency market?

As the Federal Reserve feared to start raising interest rates in November 2021, the price of Bitcoin (BTC) has fallen.

Usually in moments of fear, people tend to accumulate liquidity and sell the assets they hold (including BTC and other Cryptocurrencies). This could trigger a sharp drop in prices in the Cryptocurrency market. There are also other factors:

an uncertain winter on the energy front;

the conflict in Ukraine that does not tend to subside and which involves a difficult supply of raw materials;

the Covid-19 pandemic not yet completely overcome with lockdowns in some key countries of the world (such as China);

mood of uncertainty globally.

All this could have a negative impact on traditional financial markets and therefore also on Cryptocurrencies. As for Bitcoin, however, its scarcity could protect its value during times of rising inflation.

Drop a comment and tell me what you think about Cryptocurrencies and inflation. Consider this space a place to talk without censorship.

A winner is a dreamer who never gives up.

Disclaimer: Trading cryptocurrencies carries a high level of risk and may not be suitable for all investors. Before deciding to trade cryptocurrency you should carefully consider your investment objectives and your level of experience. Do Your Own Research. All opinions expressed here are owned by the respective writer and should never be considered as financial advice in any form.

Your post was upvoted and resteemed on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit