BY CRYSTAL STRANGER, CO-FOUNDER, PEACOUNTS

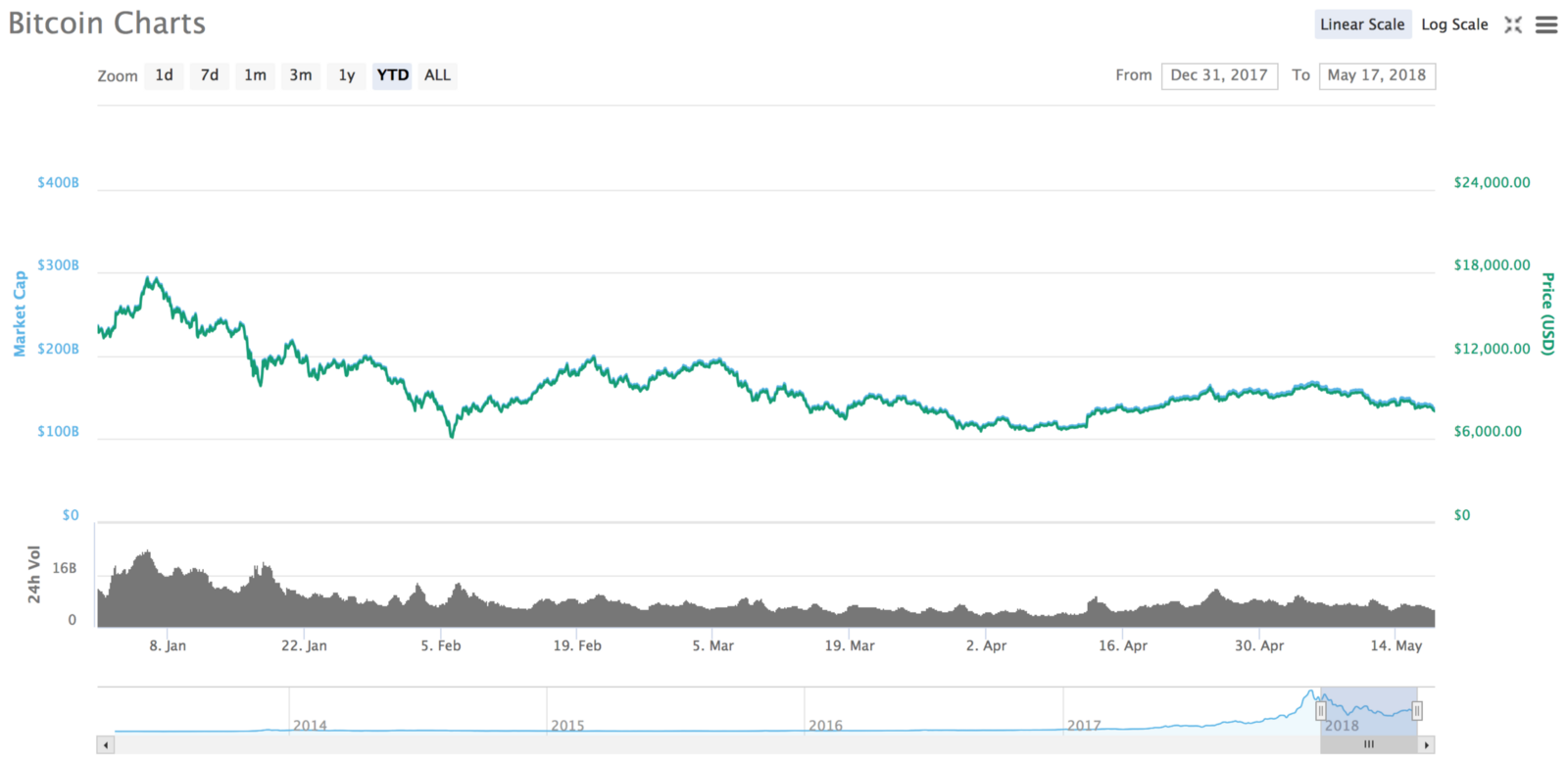

Bitcoin Prices Year To Data / CoinMarketCap

The cryptocurrency market is exciting. Fortunes are made and lost. Mainly on the loss side lately, as the price of Bitcoin dropped by roughly 70% since the highs at the beginning of the year and recovered only slightly. But this is also exciting because a gain back to a new all time high will mean more than 100% gains from the prices today. Still, there are other cryptocurrencies that will do even better. There will be 10x,or even 100x gains out there for some tokens. But the million dollar question is, how do you find these tokens?

Financial pundits say that 95% of the tokens on the market have no inherent value, but that remaining 5% are poised for meteoric growth. Beyond that, there are tokens you can buy during an initial coin offering (ICO), where you get a bonus of tokens, as well as getting a boost when the token is listed on an exchange. Whether you are buying on an exchange or at an offering though, the principles of determining value remain the same.

Company Value

The first question is how do you gauge the value of the underlying company? The team is critical. You must make sure the people involved have the power to succeed. This doesn't necessarily mean experience or fancy degrees, as has repeatedly been proven in the tech world. An understanding of the crypto market and a well-rounded team covering both technical and marketing aspects is more important than any one member. I've noticed a number of crypto token websites list advisors first, then the actual team members later, and this can be a little deceptive. While it is helpful to have a great advisory board, the passion and dedication of the team working day in day out will be the key to success.

Next, you want to think about the concept competition. For example, there are a number of crypto companies competing for the "Internet of Things" marketplace. And while several of them are technologically strong, it can be hard to determine which of these companies, if any, will succeed in this market. Especially when you consider competition from blockchain development at companies such as IBM with virtually unlimited resources, it could be tough for these companies to succeed in the marketplace.

Token Value

Verge coin logo / Crypto News India

Understanding the company and how it creates value is only half of the equation. How the token fits into the ecosystem of the company is, in the long run, the main factor that will drive value. I have seen several ICOs with companies that have a brilliant idea and a fabulous team, but offer a token that doesn't actually do anything. If people can buy the company's services or products with fiat money, and the token exists only to create the underlying blockchain for network security issues, where will the demand for that token come from?

Of course some tokens are not intended to run any system and they are issued to be used as a digital currency. Bitcoin is the most famous, although there are a number that focus on privacy such as Monero or Verge, and others that started out as a joke such as Dogecoin and Jesuscoin. Others still, such as Ethereum, have value both as a currency and as a token for development on the Ethereum network. For popular tokens such as these it is more important how the leadership team adapts to changes and challenges than calculating inherent value. But for these coins to give 1000% returns going forward, there will need to be a huge influx of money into the crypto market at large by new investors.

Earnings

A few tokens provide earnings when held directly in a wallet, like Ethereum issuing Gas to holders. This is rare now, but I suspect this to be a trend in the future as more conservative investors enter the cryptocurrency market and seek an annual return on their investment rather than just speculative gains. For example, my company, PeaCounts, an automated small business accounting solution, will be sharing the fees from financial payments made on our system with the token holders, as well as white labeling our products to other companies in exchange for tokens. This way we can reward investors' support with a dividend of sorts in addition to driving value increase through driving demand for the token.

Other cryptocurrencies have had hard forks, where you get a free token by holding over a certain time period. You must be careful on this though, as only in certain wallets and exchanges will your account actually be awarded the extra token.

Market Capitalization

Explaining market capitilization /Troy Feldman/YouTube

Market cap, meaning the market value of a company’s tokens in circulation, is a factor that cannot be overlooked, especially when viewed in comparison to the overall market. It is important when comparing market cap to look both at the issued tokens, and if a mineable coin, the total tokens available. To find the current market cap of any token you can search online or just multiply the current cost by the number of shares outstanding. You can also check the projected market cap of an increase in value the same way.

Some of the most traded crypto currencies, like Ripple and Tron, look inexpensive with their values sitting at less than a dollar. But this is an illusion. These companies have often held values that make up 10% or more of the total market cap. Yes, at 7¢ a token, Tron can look like a bargain that will increase 100 times over, but with 100 billion tokens outstanding to reach that point the market cap would have to be $700 billion!

Initial Coin Offerings

Buying crypto tokens as part of an ICO can be a great opportunity. Most companies during their ICO offer bonuses at different stages of buying, ranging from 10% to 50% of additional tokens awarded. Typically the largest bonuses are for the pre-sale investors, so getting in early is crucial. To find the next hot ICO there are several ICO listing sites, but most of them are “pay to play” for the organizers, so only list the companies that have paid to have articles posted. Message boards such as Reddit or BitcoinTalk.org have forums about ICOs and you can gauge the popularity of an upcoming token sale there. Be careful though, as there have been some heavily hyped-up tokens lately that proved to be scams.

The risks aside though, ICOs can be some of the best places to look for a token that will have meteoric growth. For example, if you buy a token at $0.10 and get a 50% bonus, you have actually paid $0.075 per coin. For a 100% gain you only need the price to increase to $0.15, and for a 1000% gain you only need the price to reach $0.825; not beyond the scope of reason. In comparison, for Bitcoin to make the same gains, at the current almost $9,000 price tag, it would need to reach a $99,000 price point. Not impossible, but that type of growth would likely take longer than if you buy a hot ICO, most of which see significant gains after listing on any big exchange.

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

I am not an investment professional, the views contained in this article are just what have made me successful, and past results may not equate to future returns.

More on me 👇 Founder of PeaCounts

Crystal Stranger, EA

Author of The Small Business Tax Guide (Clear Advantage, 2014), wanted to help her tax clients who struggled when it came to bookkeeping. Looking to help entrepreneurs focus on business instead of finances, she co-founded PeaCounts, an accounting software using AI and blockchain. Peacounts was created to be the easiest automated accounting platform for small businesses by providing a simple and intuitive bookkeeping system that improves the financial system of any small business, helping to save time and money. PeaCounts is tokenizing their payroll system using the token PEA with an ICO starting in July.

I’ve Got Socials Too 😎

Twitter — @crystalstranger

Linkedin—Crystal Stranger