Here we dive into the technique of analyzing specific trading ranges of the market, with a focus on accumulation.

If you haven't heard of The Wyckoff method, or haven't read my first article on it, here's a link: https://steemit.com/wyckoff/@esq.monegasque/the-wyckoff-method-for-crypto-beginners-pt-1

One objective of this method is to improve ones timing in the process of establishing a position, in anticipation of a market move where a favorable risk to reward ratio is present.

Trading ranges are places where the previous trend has been halted, and there is a relative equilibrium between supply and demand, also known as "trading sideways."

It is my personal opinion that sideways trading is a huge indicator of market manipulation in crypto, as these markets are 10x more volatile than stock markets. They should always be moving. The only real way to keep these markets from moving in a definite direction is to place large dual buy and sell walls at the top and bottom price ranges so that the order supply on either side of the books will outpace demand. The only reason a person could have to do this, is because they want the price to remain cheap enough for them to accumulate, while not dropping low enough for the crowd to lose confidence in it. You want the crowd to be confident when they buy in at 3x the price they sold out to you a month ago. -Esq

Institutions and large professional interests prepare for the next bull or bear trend as they distribute, or accumulate throughout the TR. In both accumulation and distribution, the composite man is actively buying and selling, with the distinction being that in accumulation, the shares purchased will outnumber the shares sold, and vice versa in distribution.

A great way to really watch composite man investors in crypto is rich-lists, such as this: https://chainz.cryptoid.info/crypt/. If you really want to be thorough in your fundamental analysis research prior to trading and investing in crypto, check that website and see what the largest wallet addresses, aside from exchange storages, and genesis blocks, are doing. Are they accumulating, or are they slowly releasing shares? This matters, because these are the people who can dump your coin down 60% in price, due to their long accumulation campaigns at floor prices. Whale exits are brutal and unforgiving. You can't always avoid them, but you can get a sense of whether or not their mind is on pump or dump. And they will dump. Better to be dumping with them, than buying into their dump. Remember, trading is zero sum game. Eat or be eaten. I want nothing more than to help you succeed with me as a trader, but if you're breaking these rules, I will be taking your money/coins, or someone else will.

(Better me than them right? At least I warned you.) -Esq

A successful Wyckoff analyst must be able to predict the direction and magnitude of a market move out of a designated trading range. Wyckoff offers guidelines for identifying and delineating the phases and events within a TR, which in turn provide the basis for estimating price targets.

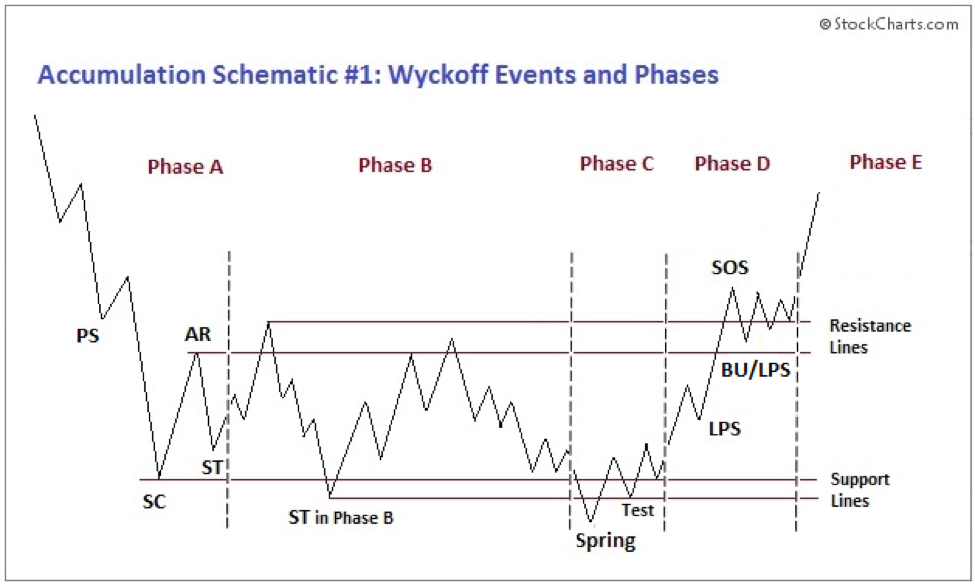

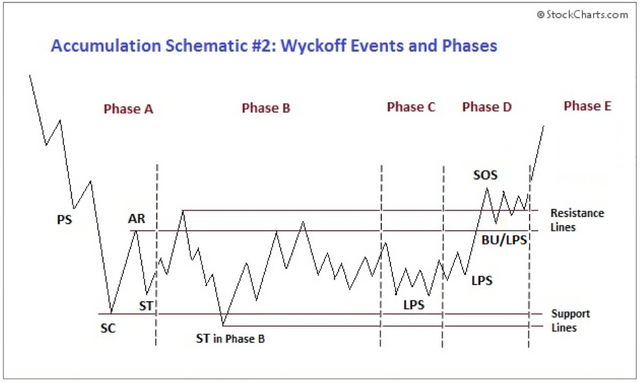

These concepts will be illustrated in two examples of accumulation and distribution.

Here is a glossary of terms/phrases to familiarize yourself with beforehand.

PS = Preliminary Support: This is where substantial buying begins to provide pronounced support after a prolonged downtrend. Volume increases, and price spread widens, signaling that the down-move may be ending.

SC = Selling Climax: The point at which widening spread and sell pressure usually climaxes, and heavy or panicky selling by the public is now being absorbed by larger professional interests at or near a bottom. Often price will close well off of the low in a SC, reflecting the interest of large buyers.

AR = Automatic Rally: Which occurs because intense selling pressures have diminished. A wave of buying intensity easily pushes prices up. This is further fueled by short covering. The high will help define the upper boundary of an accumulation trading range.

ST = Secondary Test: In which price revisits the area of the SC to test the supply/demand ratio at these levels. If a bottom is confirmed, volume and price should be significantly diminished as the market approaches support in the area of the SC. It is common to have multiple ST's

Test = Large operators always test the market for supply throughout a TR, and at key points during a price advance. If considerable supply emerges on a test, the market is often not ready to be marked up. A spring is often followed by one or more tests; a successful test, indicating that further price increase will follow, typically makes a higher low on lesser volume.

SoS = Sign of Strength: A price advance on increasing spread and relatively low volume. Often a SoS takes places after a Spring, validating the analysis interpretation of that prior action.

LPS's = Last Point of Support: The low point of a reaction or a pullback to support that was former resistance, on diminishing spread and volume. On some charts, there may appear more than one LPS.

BU = Back Up: This term is shorthand for a colorful metaphor coined by Robert Evans, a leading teacher of Wyckoff in the 30's to 60's. Evans analogized the Sign of Strength to a jump across a creek of price resistance, and the back up to the creek represented both short term profit taking and a test for additional supply around the area of resistance. A Back Up is a common structural element preceding a more substantial price mark up, and can take on a variety of forms, including a simply pullback, or a new TR at a higher level.

A note on springs and shakeouts:

PHASE A: Phase A marks the stopping of a prior downtrend. Up until this point, supply has been dominant.

The approaching diminution of supply is evidenced in preliminary support (PS) and a selling climax (SC). These events are often very obvious on bar charts (although I apply this method to candlesticks), where widening spread and heavy volume indicate the transfer of a substantial number of shares from the public to large professional interests.

Once these selling pressures subside, an automatic rally (AR), consisting of both institutional demand for shares as well as short covering, typically ensues. A successful secondary test (ST) in the area of the (SC) will show less selling than previously, a narrowing of spread, and decreased volume, generally stopping at or above the same price level as the (SC). If the (ST) goes lower than that of the (SC) , one can anticipate new lows or prolonged consolidation.

The lows of the (SC) and the (ST) and the high of the (AR) set the boundaries of the trading range.

Horizontal lines may be drawn to help focus attention on market behavior. Sometimes the downtrend ends less dramatically, without climactic price and volume.

In general, however, it is preferable to see the PS --> SC --> AR --> ST , (What I refer to as the "P.S, Scar St." pattern), because these provide not only a more distinct charting landscape, but also clear indication that large operators have definitely initiated accumulation. In a re-accumulation trading range, which occurs during a longer term uptrend, the points representing the (PS), (SC) and (ST) are not evident during Phase A.

Rather, in such cases, Phase A during re-accumulation resembles that more typically seen in distribution. Phases B-E inr e-accumulation are similar too, but are usually of a shorter duration and smaller amplitude than those in the primary accumulation range.

PHASE B: In Wyckoffian analysis, Phase B serves the function of building a new case for a new uptrend. In Phase B, institutions and large professional interests are accumulating relatively low priced inventory in anticipation of the next markup. The process of institutional accumulation may take a long time, sometimes a year or more, and involves purchasing shares at lower prices, and checking advances in price with short sales (the phenomenon we sometimes refer to in crypto as whale dumping.) There are usually multiple secondary tests during Phase B, as well as up-thrust type actions at the upper end of the trading range. Overall the large interests are net buyers of shares as the TR evolves, with the goal of acquiring as much of the remaining floating supply as possible. Institutional buying and selling imparts the characteristic up and down price action in a TR. Early on in phase B, the price swings tend to be wide, accompanied by high volume. As professional interests absorb supply, however, the volume on downswings tend to diminish within the TR. When it appears that suupply has been exhausted, the stock crypto is ready for...

PHASE C: It is in Phase C, that the cryptos price goes through a decisive test of the remaining supply, thus allowing the smart money operators to ascertain whether the stock is ready to be marked up. As illustrated above, a spring is a price move below the support level of the TR established in Phases A or B, that quickly reverses and moves back into the TR.

It is also an example of a bear/short trap because the drop below support appears to signal resumption of the downtrend. In all reality, this marks the beginning of a new uptrend, trapping late sellers.

In Wyckoff's method, a successful test of supply represented by a spring or a shakeout provides a high probability trading opportunity. A low volume spring indicates that the crypto is likely ready to move up, so this is a good time to initiate at least a partial long position (You can also paper trade.)

The appearance of a Sign of Strength (SoS) shortly after a spring or shakeout validates the analysis. As noted in accumulation, the testing of supply can occur higher up in a TR without a spring or a shakeout; when this happens, the identification of Phase C can be challenging.

PHASE D: If we are correct in our analysis, what should follow is the consistent dominance of demand over supply,. This is evidenced by a pattern of advances ( (SoS's) on widening price spreads and increasing volume, and reactions (LPS's) or last points of support), on shorter spread and diminished volume. During Phase D, the price will move to at least the top of the TR. LPS's in this phase are generally excellent places to initiate or add to profitable long positions.

PHASE E: In Phase E, the crypto leaves the trading range, demand is in full swing, and the mark up is obvious to everyone. This is what we call the pump. Setbacks such as shakeouts and more typical market reactions are usually short lived. New, higher-level trading ranges compromising both profit taking and acquisition of additional shares (re-accumulation), by large operators can occur at any point during Phase E. These trading ranges are sometimes called stepping stones on the way to higher price targets, a.k.a. MEWN.

And here I will conclude this article, as I have coins to chart, whales to watch, white papers to read, and trading techniques to study. Hopefully this has been of some use to you, and helps guide you into better trades in the future.

Until next time, -Esq.

Other sources of information on Wyckoff below.

http://mboxwave.com/wyckoffian-logic

https://www.readtheticker.com/Pages/IndLibrary.aspx?65tf=84_richard-wyckoff-method

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

http://stockcharts.com/school/doku.php?id=chart_school:market_analysis:the_wyckoff_method

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @esq.monegasque! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit