You often hear traders quarreling about trend trading vs mean reversion trading. I'm going to help settle the dispute. The two trading styles are often pitted against each other, with no consideration of finer details. Read on for those finer details.

What are 'trending' and 'mean reverting' markets?

In order to understand what strategies can be used in each, let us have a detailed look into the key differences in markets.

Trending markets

What is a trend?

Many people broadly consider a trending market to be one with which the market structure has higher highs and higher lows (and vice versa). This can also be defined by the use of trend lines, though these may not be helpful depending on which candlestick chart you use.

A statistic which is often thrown around - 'markets trend around 30% of the time'. As far as we are concerned, this statistic has no basis in reality. I have never seen proof of the claim and believe it to be extremely difficult to measure. It is a decent enough guideline, but must be taken with a pinch of salt.

What are the characteristics of a trend trading strategy?

Longer hold time - trend trading usually requires the trade to play out over a relatively longer time. This is due to the nature of a trend, building value in a single direction.

Higher reward-risk ratio - often the trader will make multiples of gain for every unit of risk taken. An old adage is to 'ride the trend'. If you believe a market is uni-directional, you should be trying to capture the bulk of the move and let your winners run.

Lower winrate - by virtue of having a larger average payoff on your trades, your winrate will decrease. The inverse relationship between reward-risk and winrate means that trend followers will often have less than 40% wins. Some trend followers have an even lower winrate, yet still turn a profit.

Mean-reverting markets:

What is a range?

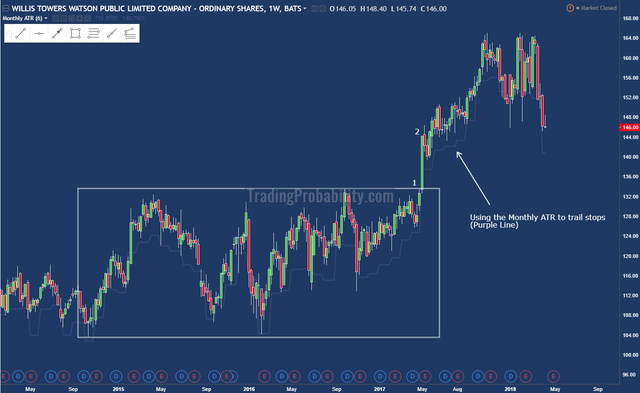

I would define a range as being an area of price consolidation, with relatively clear upper and lower boundaries. Visually, a range will look much like a 'box', a rectangle will be able to be drawn around it.

If we're going off of the conventional wisdom, markets range for 70% of the time. This may mean that there is more opportunity in the mean reversion trading space.

What are the characteristics of a mean reversion trading strategy?

Shorter hold time - due to the 'snap back' nature of mean reversion trades. Mean reversion traders often like to take advantage of short-term corrections back towards the mean.

Lower reward-risk ratio - prices stepping out of line from their mean usually won't offer a huge number of ticks to be captured. This is in contrast to trend trading.

Higher winrate - due to the inverse relationship with reward-risk. This means that mean reversion traders will often have much higher winrates than trend traders, upwards of 60% for the most part.

How to trade trending and mean-reverting markets

Trend trading strategy

A commonly used trend trading strategy is the breakout. A simplified example of this would be watching a range for breakouts and getting on board when the new trend starts. This strategy was used by Nicolas Darvas, which he details in his book 'How I Made $2,000,000 in the Stock Market'. Ignoring the very 'instagram trader' title, there are some very useful lessons on trend following.

Darvas would often enter on a stop order as we break the current trading range. As price breaks the top of the 'box', as Darvas called them, the trend follower can enter the market and assume a long position. This is just one way to get on board these market moves.

A more cautious trend follower could get on board at the close of the breakout candle. This could protect against a 'false breakout' or 'false start' to the trend.

Ideal market type for trend trading

A tricky question. It depends entirely on where and when you want to get into the trade. As discussed previously, some trend traders opt to get in as the trend is starting. On the other hand, many traders will wait for a more mature trend and enter the market later.

Most trend traders will want to see a clear directional move for as long as possible. This is the nature of trend trading - direction. This is often defined by moving averages having a slope to them, trendlines facing a particular direction, higher highs and lows, or a simple visual check.

The clear direction enables many trend trades to put their stop-losses beneath swing lows, or at an ATR measurement below the high water mark or a trendline.

Advantages of trend trading

Firstly, attempting to enter a trend at the start of the move means that you're not going to miss any of the trend. You are getting in as the trend starts, especially if you use the trend trading strategy I outlined. This is useful as it guarantees you'll be involved in at least the first portion of a trend move.

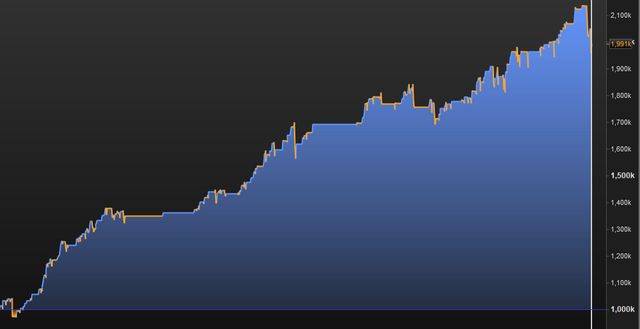

The other advantage to getting in at the start is exactly that: you're in at the very start. Trends can last for years and you bought at the bottom, that is great! This should enable you to get the majority of the trend.

Trend traders often boast that their entries don't need to be pinpoint precise. They are quite right in this respect. Trend trading doesn't always require the perfect entry, you know where the trend is headed after all. Your entry has less importance than how you manage the trade to capture the most upside.

You can also afford to be less precise because your winners will be multiple times bigger than your losers. The art of trend trading makes this a requirement. If your average winner is four times that of your average losers, trend trading gives you 4 chances to be wrong for every winner. Of course this is just to break even, but the point holds true.

Disadvantages of trend trading

If using the simple strategy outlined by Darvas and myself in this article, you may find yourself at the mercy of 'false breaks'. This is when you enter on a breakout, but price quickly dips back into the consolidation. Trend traders want to avoid this. It's akin to a false start in a race, wasted energy and wasted capital. However, some traders have creative ways to counter false breaks.

Although not an essential when trading with the trend, some trend traders can be sloppy with their entries into the market. Sometimes trend entries can be improved upon heavily. Instead of entering on the breakout, why not wait for a pullback? Why not try to enter before the breakout even occurs? These can be things to think about if a trend trader is seeing a lot of drawdown on their entry.

My main qualm with trend trading is the low winrate. Trading with high reward-to-risk can be useful, but the low winrate that comes with it can wreak havoc on an equity curve. Lower winrates come with higher drawdown, this is mathematical fact. What this drawdown can do is make variance incredibly high. Missing a handful of trades can make or break a trend trading system. In addition to this, the psychological hurdle of seeing 10 losers in a row is incredibly large. This is without mentioning the difficulty in forward-projecting results. With a higher winrate trading strategy, you have a much better idea of what to expect in the future.

Mean reversion trading strategy

Range trading strategy can be slightly more difficult to design than trend trading. Mean reversion trading strategies usually involve selling into up moves and buying into down moves. This is in order to take advantage of an overreaction and assumes that price will return to it's longer term average.

One such strategy is the SFP. Without going into too much detail, this strategy requires a 'peek' above or below swing points. You then assume a position for reversion to the mean.

Ideal market type

Mean reversion trades often require price consolidation, at least so that you can determine the mean price effectively. Rangebound markets are the most suited, due to there being a clear range. We then expect price to reject the boundaries of the the range and reverse towards the centre.

Since there is a broad array of mean reversion trading strategies, the market types suitable can be broad.

Advantages of mean reversion trading

Going off of the 'markets range 70% of the time' rule, we would potentially get more opportunities with a mean reversion trading strategy. The amount of time spent in a ranging state will mean more reversion to the mean, an advantage over trend trading.

All things considered, mean reversion trades also have a lower average hold time than their trend trading alternatives. The reduced time in market could act as a safeguard against external shocks. Mean reversion strategies have a lower average hold time than trend trading due to the in-and-out nature of snaps back to the mean. These trades aim to take a small chunk of the correction back to average value.

Mean reversion trading strategies usually benefit from shorter drawdown periods. Higher winrates are arguably the main benefit of mean reversion trading. These give you the ability to have shorter drawdown periods and go through longer winning streaks. Reducing drawdown gives a huge advantage due to your psychology not being affected, you can predict future returns better and missed trades aren't as damaging to your bottom line.

Disadvantages of mean reversion trading

Missed trades can be a huge factor in determining the success of mean reversion trading strategy. The more precise nature of entering market for a return to the mean can cause you to miss fills. If entering on limit orders, price will not always stretch far enough for you to get on board.

Another disadvantage to mean reversion trading is actually determining the mean. Is it a visual representation? A moving average? Which period moving average? These factors must be taken into consideration in order to construct a trading strategy effectively.

Finally, not all traders are comfortable with a small pay-off ratio on their trades. Most mean reversion trading strategies have near equal average winners and average losers. Often you will find that your average winning trade is smaller than your average losing trade! Due to conventional thoughts such as 'always trade with a 2:1 reward-risk ratio', traders often reject strategies with a lower average payoff. This is despite the inverse relationship between average R and winrate which almost guarantees that your win percentage will increase.

A combination of trend trading and mean reversion trading?

While the two styles are relatively distinct in their own right, you may be able to combine the two for even great effect. Let's take a look at a simple example strategy:

- Use a 200MA as a trend filter (above the moving average is an uptrend)

- Enter long (on next day open) when the 2-day Cumulative RSI value is less than 33

- Exit (on next day open) when 2-day RSI is above 20

This strategy has an approx 80% win rate, akin to many mean reversion strategies. However, it also has average winners just over half the size of it's average loser. This is simply an example of how both trends and mean reversion can be used in tandem to create trading strategies.

Wrapping up

Personally, I prefer to mix the two trading styles. However, I lean towards mean reversion more than trend trading. Finding a way to combine both is a genuine solution, if you find yourself on a particular side of the argument. Avoiding dogmatic thought such as 'the trend is your friend' and staying flexible will never hinder you when crafting strategies.

Please don't forget to subscribe below if you haven't already. You will receive notifications for the latest posts and more email exclusives.

Posted from my blog with SteemPress : https://www.tradingprobability.com/trend-trading-vs-mean-reversion-trading/