November 14, 2017 (The Ferowich Report) — Days after bitcoin (BTC) dodged the SegWit2x hard fork the gold standard in cryptocurrency was confronted by a new threat, the meteoric rise of bitcoin cash (BCH).

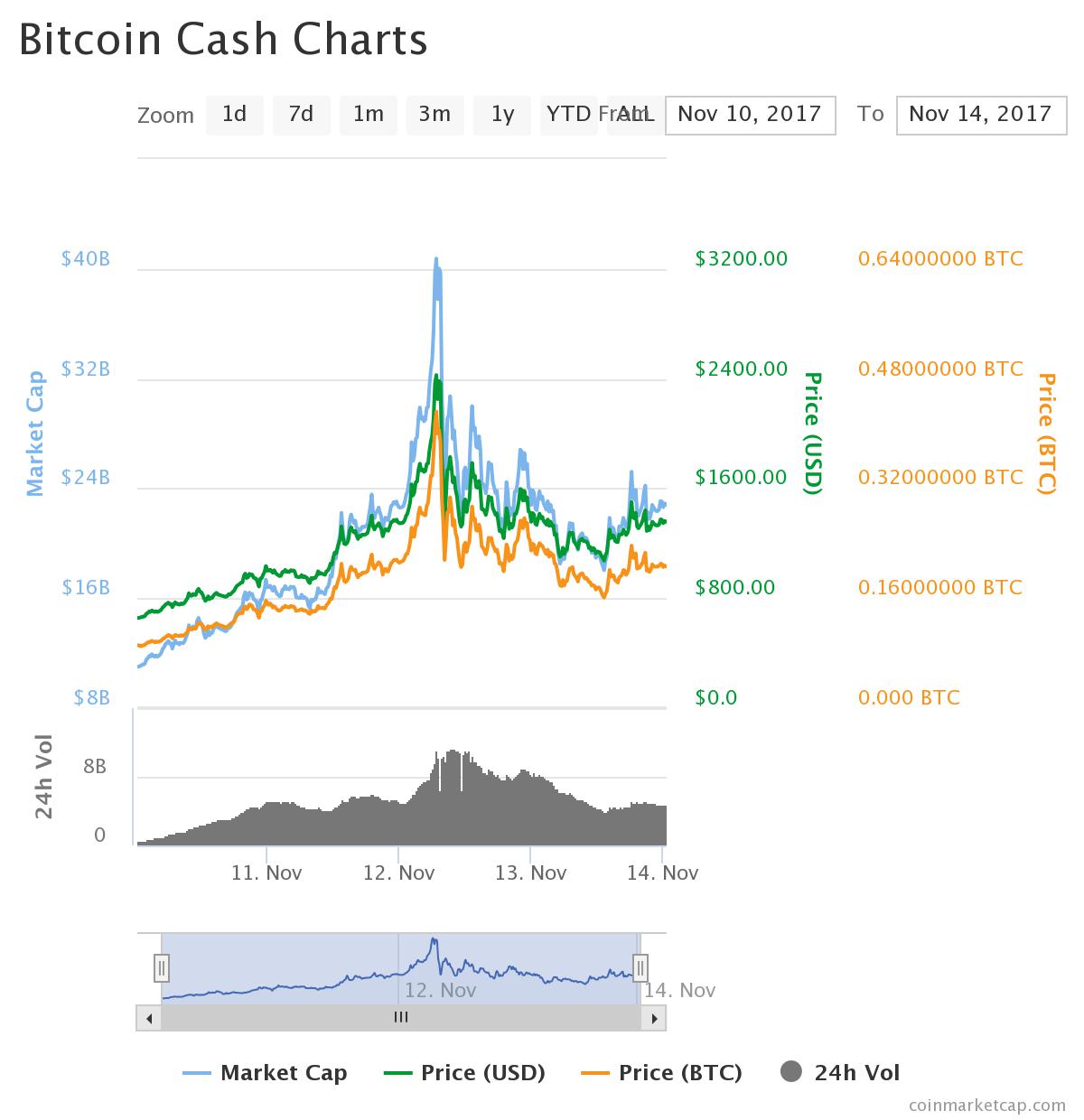

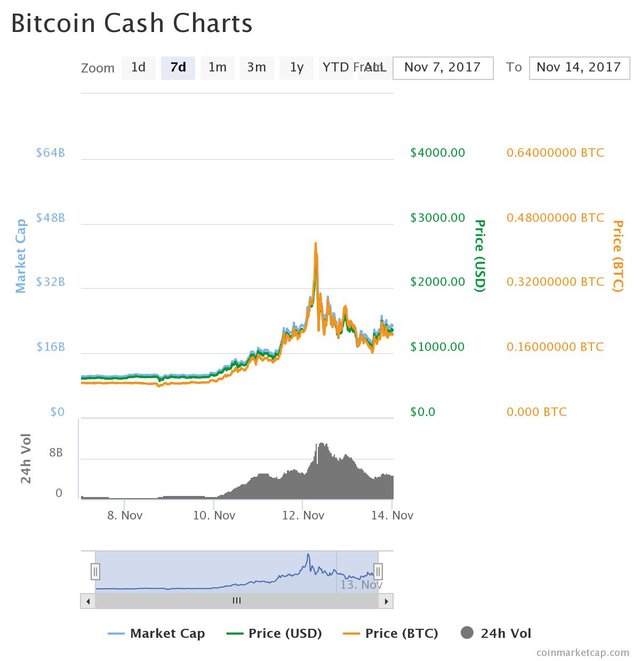

As of Friday, November 10, BCH was trading at $656. On Sunday, 48 hours later, BCH topped out at $2,365.

Tuesday’s BCH price as of 00:40 UTC, $1357.47, constituted a 124 percent return on investment over seven-day period. Traders could’ve snagged BCH for $604 Novermber 7.

Almost two-thirds of BCH trading activity, 64.23 percent, was transacted over South Korean cryptoexchanges, according to analyst Chris Burniske, partner at Placeholder Capital.

The SegWit2x project to increase transaction speeds was called off November 8, a little more than a week before the hard fork slated for November 16. Worried about the strife and in-fighting that might ensue as a result of the project, project leader Mike Belshe said, “this was never the goal of SegWit2x.”

“Although we strongly believe in the need for a larger block size, there is something we believe is even more important: keeping the community together,” Belshe said.

After the SegWit2x proposal flopped traders decided the underlying idea, greater block sizes for faster transactions, remained a profitable trade. The play became Bitcoin Cash.

A self-proclaimed Bitcoin Cash CEO, Rick Falkvinge, published an “official communique” on November 12 simultaneously exalting and deprecating himself “as Chief Executive Officer of this disorganization with made-up titles, where every document is as official as people pretend it to be.”

Despite acknowledging the irony of declaring himself the CEO of an entity that isn’t actually an organization, but a disorganization, Falkvinge’s letter proceeds with the authority of a manifesto.

Under the guise of CEO of Bitcoin Cash, he lays out a strange, but not boring, vision for how to promote the bitcoin cash network playing off of known human tendencies, particularly the profit motive. “We create liberty through profit motive,” Falkvinge gushes.

“As developers, ambassadors, evangelists,” everyone has a different motive for joining the BCH “movement,” the author says, including “fast transactions.”

“A key part of our identity is that Bitcoin Cash was created in response to several years of mismanagement of the Bitcoin Legacy network,” Falkvinge says, pointing to low transaction capacity as one of the “mistakes” BCH should “never” replicate (emphasis Falkvinge’s.)

Falkvinge’s letter drops November 12, when BCH is skyrocketing to the point of reaching an exchange rate where 4 BCH = 1 BTC.

Mass publicity around a cryptocurrency is a canary in the coal mine for potential pump-and-dump schemes. When NBA star Dennis Rodman showed up at a Beijing airport during a lay over on his way to visit North Korean Supreme Leader Kim Jon-un, he sported a PotCoin t-shirt. The digital currency shot up more than 90 percent in 24 hours, Rueters reported.

The BCH letter didn’t necessarily come out of the blue. As it turns out, Palm Beach Capital (PBC) saw the downfall of SegWit2x as a buying opportunity--or, arguably, an opportunity to pump-and-dump the currency to make quick profit on speculation and shrewd market psychology.

A November 13 PBC buy alert reads, “on November 8, several prominent members of the bitcoin community announced they were abandoning the proposal (called SegWit2x) to increase BTC’s block size. That decision caused a fracture in the bitcoin community. And now we’re seeing some money flow from BTC to BCH.”

“Over the last few days, we’ve seen BCH’s hashing power (mining) grow by 500 percent. We can’t ignore this rapid growth of mining support. This is an encouraging sign and suggests that BCH deserves a home in our short-term portfolio,” PBC said.

PBC then reccomends traders buy bitcoin cash at a “buy-up-to-price” of $1,400.

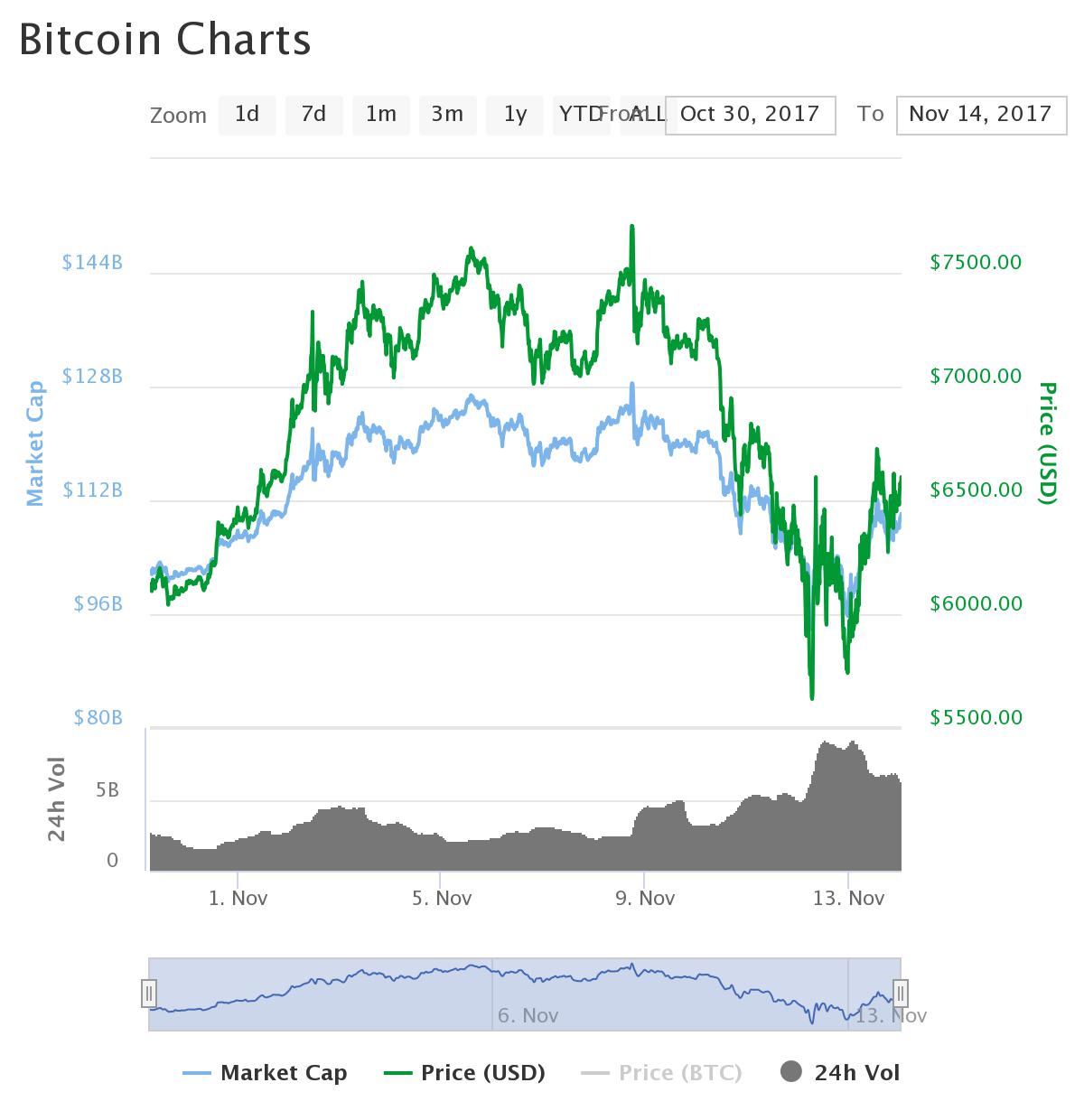

BCH’s rise overwhelmingly corresponded with a plummeting bitcoin price. One trader, @btcWhaleclub, dubbed the BCH surge “the worst attack bitcoin suffered.”

Some investors saw the BCH “attack” as a solid entry point for BTC while the market irrationally priced-in news that artificially deflated BTC’s value. “During the latest pullback over the weekend” ex-hedge fund manager at Fortress Investment Group, Mike Novogratz, scooped up $15 to $20 million worth of bitcoin, Reuters reports. The financier put bitcoin’s price target for March at $10,000.

good post...please follow me. https://steemit.com/@sakib1122

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you! Followed-plz follow back?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit