Altcoins

Long before the Stake Evidence entered into cryptoconsciousness, people played with the Cash Work Test. In exchange for blocking a part of the tokens and working on a masternode, you can earn verification rewards. Earning a passive income through helping to secure a network seems as comfortable as it is noble. The truth, having said that, is that most of the masternode's cash is a scam.

Also browse: Crypto Trade launches in Gibraltar

Node masses but minimal utility

Almost all operators have an approach to gain through fantastic and thin times. Some enroll in ICOs and remain firm in the current market to improve some scalp gains in the place they can through the investment of business days and some install masternodes. Sprint is the altcoin credited with starting the trend for masternodes. Again, when the currency was priced below one dollar, the coin of the Work of Evidence of the Work launched a masternode process called Assign 1,000 Sprint.

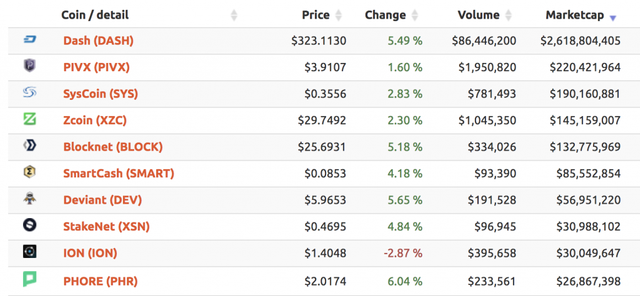

The best nominal currencies of 10 per marketplace cap. See how thin the volume is for many of them

The plan turned out to be very successful, each as a regular means of governing the network, and as a source of income for people working in a node, who were being generously compensated by the time when the cryptoactive market grew in 2017 At its peak, it would have charged $ 1.5 million to buy Sprint more than enough to set up a masternode. The good results of the scheme, which produced the first users of the incredibly rich masternode process, were soon copied by countless more coins. Sprint has at least a minimum of real utility of the environment, but most of the imitators that have arisen have no other purpose than to enrich their first adopters and executors.

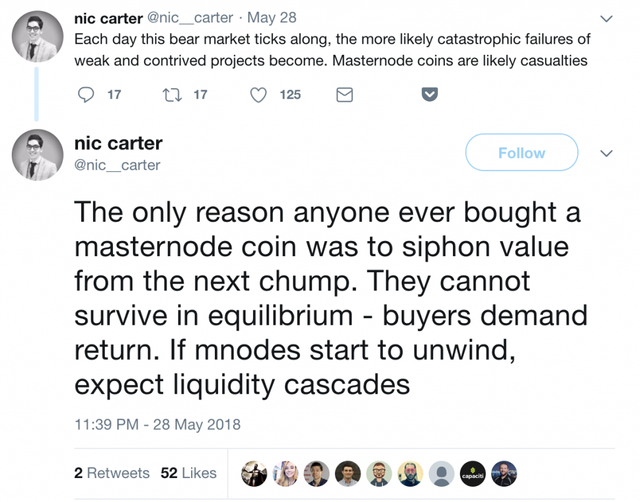

Masternode currencies are the new lending platforms

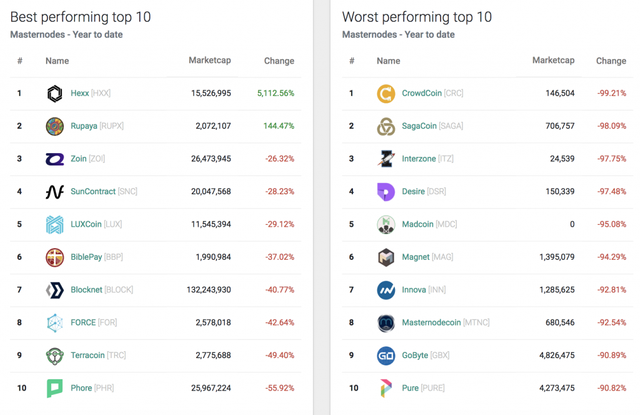

The cryptographic winter of 2018 has been especially unpleasant with master coins. Dash has been on a slide considering that in mid-December, when he reached a maximum of $ 1,580 a coin, and is at $ 320 today. The least known masternode coins have gone even worse. Year to day it keeps a checklist of the best and the worst master capital of 2018, and it's not very, even the third most executed currency of the calendar year is crimson.

While the master currencies are not a scam in the sense of Bitconnect, like the lending platforms, they are a plan that seems to be successful in a bullish sector when everything is pumping, but when the tide turns it gets badly discovered. Websites such as Cryptopia and Trade Satoshi are cemeteries in which the abandoned master's money is going to die.

Masternodes as a service

Environment up to a masternode is relatively simple, all that is normally needed is a VPS and the ability to change some strains of the Linux code, but for people who lack knowledge, companies like Electronic Cost will take care of the configuration and web hosting. Even without receiving the dirty weapons, the operation of a masternode is, however, a small dangerous company that offers the possibility that your cash waged to drop 90% of its value in a matter of months. Volatility operates both strategies at the same time, and it is also possible to enjoy large profits from the master coins that pump, usually because they are still bought in bulk by other traders who also look for coins. This type of procedure is unsustainable in the course of study, and when a group of node operators choose to download their surplus currencies, the current market is blocked.

The main winners and losers of this year's masternode

Despite these inherent weaknesses, the strategy of the main nodes remains a solid one: it's just that for the method to do the job, the community should be worth defending in the first place, and for that to happen, the currency wants be used for something more than for redefinition, such as remittances, P2P payments or electronic commerce. As a result, it helps builders make more sense to focus on initially producing a customer demand from a chain of blocks rather than launching masternodes and expecting utility to continue. The newer works, such as Origin Protocol, Dadi, Essentia, REMME and Zencash, will present long-term main nodes. The difference, with these networks, is that the nodes will be one aspect rather than the defining attribute. The next technology of master coins can possibly value anything. Current technology is largely scamcoins.

Do you think that most masternode cash is fraud, or provide a separate attempt to provide a passive income to the participants? Let us know in the opinion portion below.

Photographs courtesy of Shutterstock, Yearto.Day and Masternodes.on the network.

Do you need to calculate your stocks of bitcoins? Examine our tools section.

This user is on the @buildawhale blacklist for one or more of the following reasons:

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Couldn't agree more, Dash is the only one I would consider but with a 1000 Dash requirement its an expensive endeavor.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit