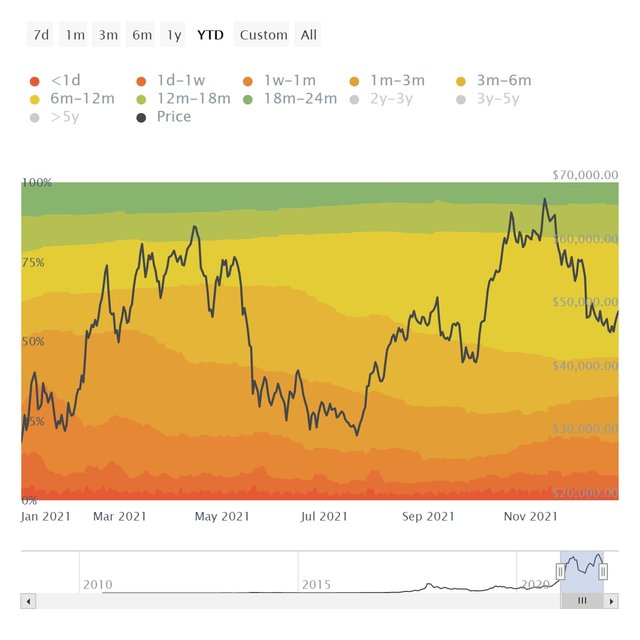

With not much activity of LTHs ( Long term hodlers) and increasing activity of STHs ( Short term hodlers), an increase in BTC held by STHs especially within 1 - 3 months is an indication of BTC being spent from aged addresses to new ones around the top.

According to Glassnode's weekly report, around 30% of net loss was realised after the drawdown from recent ATH which confirms it. Around 25% of outstanding BTC was bought at the top by STHs which means 1 out of 4 btc is being held at loss right now.

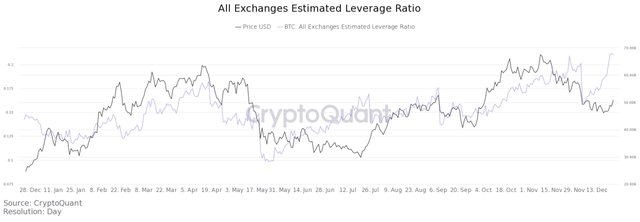

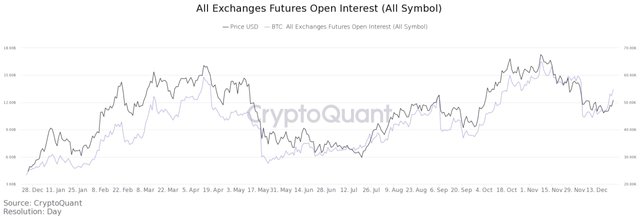

And now lets jump to the derivatives markets to have a little sense of sentiment around the market. The OI in futures have increased in recent days with increase in BTC price especially this week with increase in leverage ratio in all exchanges.

This indicates that the traders are willing to take exposure to the risk with hopes of expecting a further bullish movement. But what indicates that they are betting for Longs ( upside price movement) rather than Shorts?

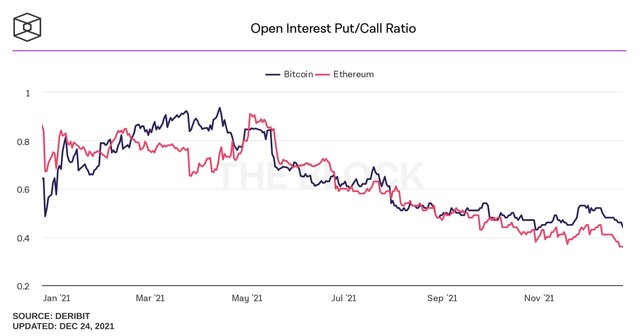

So lets dive into the BTC options

The Put/Call ratio for BTC is currently at 0.46 and 0.36 for BTC and ETH respectively which indicates bets on Calls ( upside movement) being more than puts ( downside movement). On binance, The Long/Short ratio for BTC futures being at 1.58 ( 61.26% Long & 38.74% short) indicates That people are expecting bullish movement in the market. But the flat PnL realisation within few days may show some sort of exhaustion in the market from both LTHs and STHs.

So, will STHs with BTC being held at loss bought at top stand their grounds or cause domino effect if the Price goes down?

That only market decides but with taking these bullish indications in consideration, i'm more than slightly bullish in market in right now but still keeping risk managed and keeping some $$ aside for any dips anyway.