Greetings, Readers!

Step into my latest post

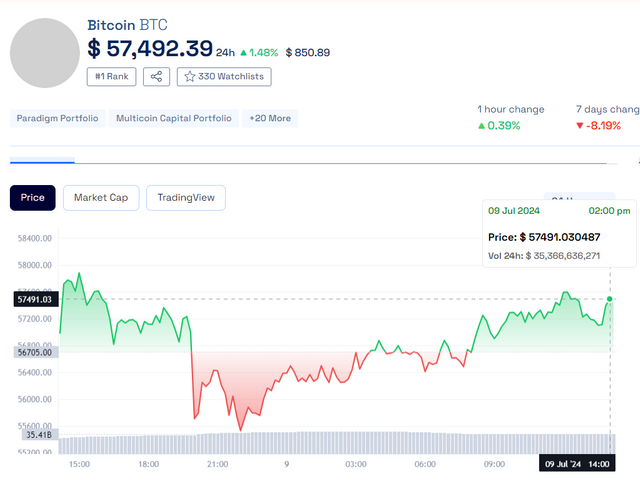

Bitcoin has bounced back by 1.48% in the past 24 hours, reaching $57,492.39 after recent declines that saw it drop to $53,600 on July 5, its lowest point since February. Despite challenges such as a sell-off by the German government and an $8.5 billion repayment by Mt. Gox to creditors, institutional investors are showing renewed confidence in Bitcoin's potential for recovery.

.png)

US Institutions Lead the Bitcoin ETF Surge

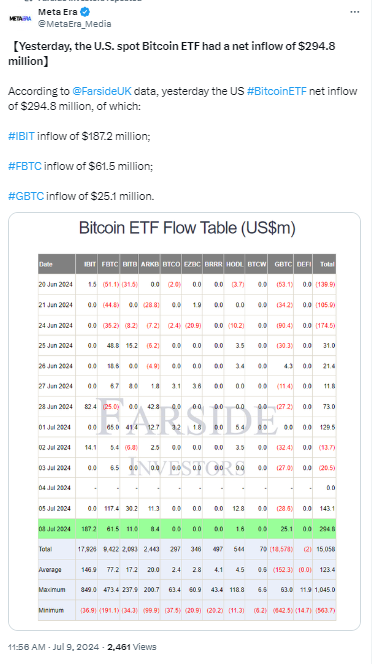

A surge in Bitcoin ETF investments has swept the market, with major U.S. financial institutions making substantial purchases despite recent market fluctuations. Leading the charge is Blackrock, which purchased 3,320 Bitcoin ETFs, followed by Fidelity with 1,100 ETFs, signaling growing institutional belief in Bitcoin's long-term value.

.png)

Spot Bitcoin ETFs Signal Market Optimism

Spot Bitcoin ETFs in the US reported a significant $294.8 million net inflow, reflecting continued institutional buying amid market volatility. Global crypto asset investment products saw $441 million in inflows last week, influenced by Mt. Gox developments and German government actions, according to Data.

.png)

Bitcoin's Price and Market Outlook

Bitcoin's recent gains suggest a potential rally above $60,000, driven by institutional demand and positive sentiment on Wall Street. Trading volume has risen by 36%, indicating heightened trader interest, while derivatives markets show robust buying activity, particularly on exchanges like CME and Kraken. However, caution is advised ahead of key economic data and Federal Reserve announcements this week.

.png)

Market Dynamics and Investor Sentiment

Despite recent volatility, investor sentiment towards Bitcoin appears bullish, with institutions like Grayscale Bitcoin Trust (GBTC) recording $25.1 million in inflows after consecutive outflows. This underscores strong institutional demand amid fluctuating market conditions.

Bitcoin's resilience and institutional support are evident in its recent price rebound and strong ETF inflows. As market dynamics evolve, continued institutional interest and economic indicators will likely influence Bitcoin's trajectory in the near term. Investors and traders alike are navigating these factors with cautious optimism amidst ongoing market volatility.