US based investors will now have the option of buying a Bitcoin ETN!

For years now, basically the only way for someone based in the US to have bitcoin exposure through traditional brokerage accounts in their IRA was for them to buy GBTC.

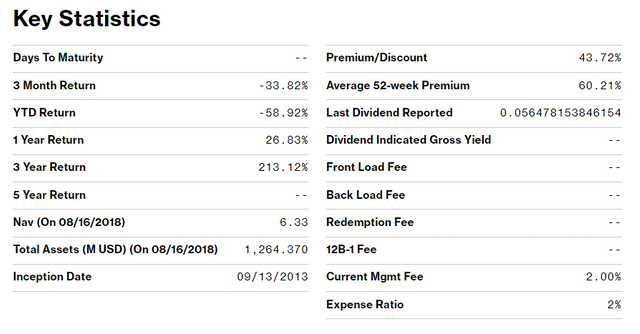

For this reason GBTC has always traded at a significant premium relative to its underlying assets.

How much premium might you ask?

On average, over the past year, GBTC has traded with roughly a 60% premium.

(Source: https://www.bloomberg.com/quote/GBTC:US)

However, at times it traded as high as 100% premium!

That means that a fund that was designed to be a bitcoin tracking investment tool really wasn't doing a very good job of that with its premium increasing and decreasing all the time.

Enter a better alternative - CXBTF.

CXBTF launched in the US on Wednesday of this week.

It is not an ETF, but it is the next best thing.

It's a physically backed ETN.

Meaning that the price of the fund is designed to move in lockstep with the price of bitcoin. Instead of just holding a set amount of assets like GBTC, it will actually go out and purchase more bitcoin if demand increases and sell bitcoin if spot prices are going down.

In effect, it will function similar to a physically backed bitcoin ETF.

More about how it works can be found here:

This is great news for the investing community as a whole as it opens the door to a whole host of US based investors that would like some exposure to bitcoin but don't want to go through the hassle of using a cryptocurrency exchange or being responsible for private keys.

What happens to GBTC?

That is the 64 thousand dollar question, especially if you currently own it!

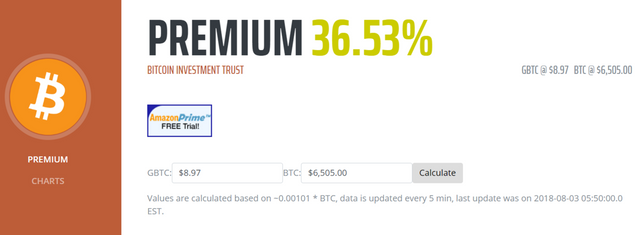

At the time of the launch of CXBTF, GBTC was trading at roughly a 53% premium.

Yesterday that premium dropped to around 43% premium.

Today, it trades at a 36% premium:

(Source: https://www.neotechdevs.com/gbtc/)

As you can see the premium seems to be dropping out rather quickly.

This is a trend I would expect to see continue.

As more bitcoin products become available, I think the premium in GBTC likely falls close to zero. Though, to get all the way to zero it may take some time and it make take a bitcoin ETF being approved.

Either way, if you are currently holding GBTC in an IRA like I was, it probably makes a lot of sense to move at least some of that over to CXBTF in order to avoid the potential premium fall out likely to happen in GBTC.

Some final thoughts:

We finally have a better way to invest in bitcoin in our IRAs!

The premium in GBTC is likely to go away over time.

CXBTF likely offers a better alternative for people wanting to invest through their IRAs.

CXBTF is currently available through Etrade, but I am not sure if it's available through many others. I know some are not making it available, yet.

Keep in mind that this product is very new and may not be completely understood at this point, so make sure you do some research before investing.

Stay informed my friends.

Image Source:

https://www.chepicap.com/en/news/2955/forget-the-bitcoin-etf-there-s-already-a-bitcoin-etn.html

Follow me: @jrcornel

You gonna invest @jcornel?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I already did yes. I moved my GBTC over into CXBTF.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for the valuable information. I need to call my pals at Ameriprise and see if they've got this on their radar for clients.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I know Etrade allows trading in it, and I have heard that Merrill does not. Beyond that I am not sure.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thats Really An Amazing news.

Thanks for sharing

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Interesting

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I think an additional point to make is that this nee ETN will also provide the SEC and others with more data points that would help them with their future decision on ETFs. It could demonstrate that allowing ETFs does no add to the volatility of the underlying bitcoin prices and actually helps in price discovery vs the alternative like you mention that trade at a premium. This would benefit investors and thus should allow them to permit ETFs into the market. However, the data will be needed for them to review and not sure if a couple of weeks of data will be enough.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

That is a good point. Yes, if things go well with this ETN launch in the US, it likely would make getting an ETF approved by the SEC that much easier.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanx for sharing valuable information

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You got it.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ofcourse m8

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You really don't think September bodes well for us, huh?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Bodes well in what context? Do you mean for the ETF to be approved?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes. At least for the SEC and their inclination towards speculative assets, or things of that sort.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am not sure. I could see the SEC approving by September 30th, but I could also see them pushing it all the way out into the March-May 2019 time frame. Either way it is only a matter of time, and that is bullish.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Its something but if the USA wants to lead its not any help.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Its something but if

The USA wants to lead

Its not any help.

- feelsomoon

I'm a bot. I detect haiku.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

FYI that's not really true. It was the only way to have BTC exposure in your IRA through traditional custodians. I set up a crypto IRA through a company called Broad Financial which allows me to invest in any cryptocurrencies with my IRA funds and I control all of the keys.

I'm not saying the ETN is not a big deal, just wanted to clarify that one little piece!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Haha yes I knew that when I typed it and I wondered who would be the first to point that out. Winner!

I'll make a slight edit to make it more factual.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

what's a ETC?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Do you mean ETN? Exchange Traded Note.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

oh was it ETN not ETC?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Very beautiful wrote

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

the new exposure of crypto market is certainly a great thing :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

https://steemit.com/crypto/@durval/crypto-market-will-have-a-strong-explosion-later-this-year-mercado-de-crypto-tera-forte-explosao-ainda-esse-ano

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You may be right on this. I am hoping so.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit