Image from andywltd

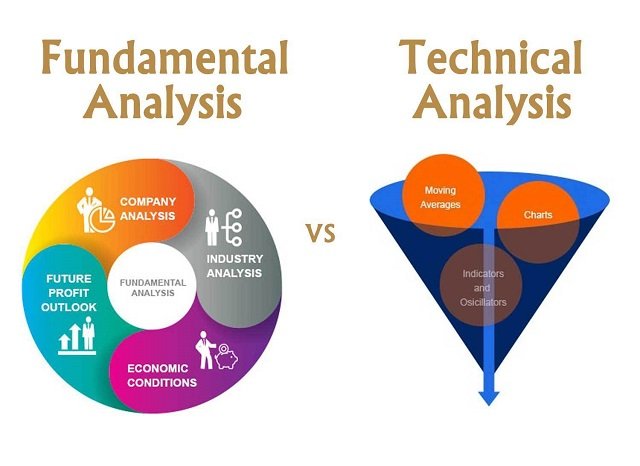

When trading cryptocurrency, deciding on your plans or strategy is essential. A smart place to start is by learning Fundamental vs. Technical analysis.

It's unclear whether technical analysis can totally take the place of fundamental research. Still, there's no denying that combining the advantages of the two approaches may aid participants in developing a greater understanding of the markets.

The key distinction between technical research and fundamental research is that technical analysis examines a security's price movement and uses this information to forecast future price changes. Instead, a business's economic and financial environment is examined using fundamental analysis. Let's explore further into the specifics of how these two methodologies vary, the arguments against technical analysis, and the potential applications of combining technical and fundamental research.

How to Choose the Right Analysis for Your Investment Strategy

It's significant to brush up on some of the knowledge you'll gain from studying traditional financial markets regarding the crypto technical analysis. Technical indicators are used by traders in the forex, stock, and futures markets, too, and cryptocurrencies are not an exception. Regardless of the asset being traded, technical indicators like RSI, MACD, and Bollinger Bands attempt to forecast how the market will behave.

When it comes to Fundamental Analysis, crypto assets cannot be assessed using tried-and-true techniques. Contrary to common opinion, the fundamental analysis used in cryptocurrency markets is very different from that used in traditional markets.

Can Technical analysis and Fundamental Analysis Co-Exist?

Although fundamental research and technical analysis are sometimes viewed as opposed methods of examining stocks, some investors have found success by merging the two disciplines. For instance, a trader may utilize fundamental research to uncover a cheap stock and technical analysis to determine the best times to enter and exit a position. When security is heavily oversold and joining the position too early might be detrimental, this combination frequently works well.

Closing Thoughts

What is the best analysis for a comprehensive strategy for stock marketing, you ask? To be quite honest, neither. In my many years of trading, I've come to the conclusion that to be a great trader, you need to mix the two types of analysis. It's a recipe for catastrophe to choose only one or the other.

Why? Because applying just one approach only gives you a partial view of the situation. Your only chance of being a successful trader is if you use both methods in your trading strategy.