The future of Bitcoin is an exciting and ever-evolving topic. As the world’s first decentralized digital currency, Bitcoin has been around for over a decade and has seen its fair share of ups and downs. But despite its volatility, Bitcoin continues to be a popular choice for investors, traders, and users alike.

In recent years, the cryptocurrency market has seen tremendous growth. The total market capitalization of all cryptocurrencies is now over $1 trillion, with Bitcoin accounting for nearly 70% of that figure. This meteoric rise in value has made Bitcoin one of the most sought-after assets in the world today.

But what does the future hold for Bitcoin? Will it continue to rise in value or will it crash? Will it become a mainstream form of payment or remain a niche asset? These are all questions that investors and users alike are asking themselves as they look to the future of this revolutionary technology.

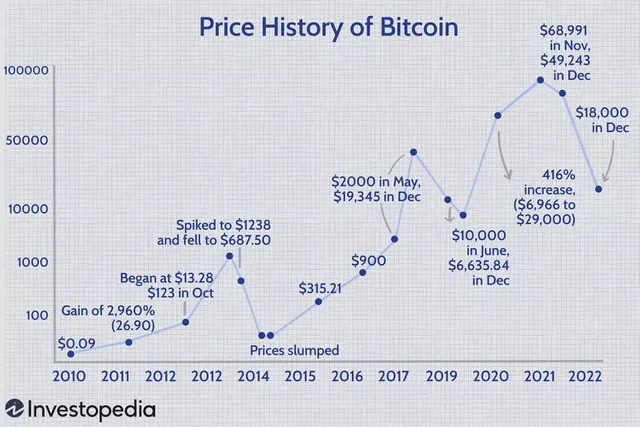

One thing is certain: Bitcoin’s current state is strong and growing stronger every day. The chart below shows just how far Bitcoin has come since its inception in 2009:

Bitcoin Chart

As you can see from the chart above, Bitcoin’s price has been on an upward trajectory since its inception in 2009. In 2017 alone, it rose from around $1,000 to nearly $20,000 before settling back down to around $10,000 at the end of 2018. Since then, it has continued to rise steadily and is currently trading at around $60,000 per coin as of April 2021.

This steady increase in price is due to a number of factors including increased institutional investment from companies like Tesla and Square; increased adoption by merchants; and increased demand from retail investors looking for alternative investments outside traditional markets like stocks and bonds.

The future looks bright for Bitcoin as more companies continue to invest in it and more people adopt it as a payment method or store of value. As more governments recognize its legitimacy as an asset class and create regulations around it, we can expect even more growth in the coming years.

At the same time, there are still some risks associated with investing in cryptocurrencies like Bitcoin such as extreme volatility and potential hacks or scams that could lead to losses if not managed properly. It’s important for investors to do their research before investing so they can make informed decisions about their investments.

Overall though, the future looks bright