While the answer is still somewhat speculative, Flourishing AI offers a unique product that could lead the charge for artificial intelligence technology in crypto.

Created Powers

The speed with which mathematical decisions can be made by Artificial Intelligence (AI) technologies overturned convention in the business world.

AI promises a future in which highly complex monotonous jobs are taken from the hands of humans and moved to intelligent systems.

While A.I. may sound futuristic, exciting, and perhaps even scary, the truth is that self-learning robots have been utilized in the world of commerce for some time now.

Big financial institutions such as JP Morgan & Goldman Sachs have been using trading algorithms for years, which has raised the question-if automated performance managers can be used in legacy finance- imagine its use case in the world of decentralized finance.

Portfolio Management - The Artificial Intelligence Way

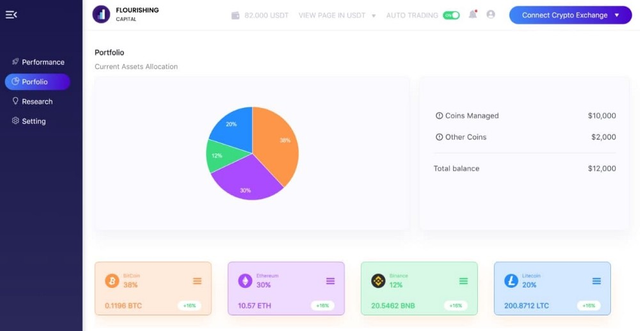

A soon-to-launch platform named Flourishing AI now appears to be applying artificial intelligence and large-scale data mining to provide portfolio management driven by macro movements in the market and whale patterns which are hard to detect by humans.

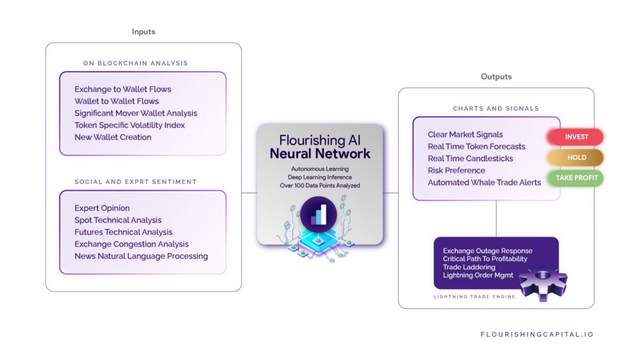

In our talks with Eric Gonzalez, CEO of Flourishing Capital, he explains how the Flourishing AI portfolio manager analyzes and learns from over 100 data points collected from the blockchain and from sentiment data to predict bearish or bullish price movements before they happen.

It can process correlation data within the blockchain and is capable of reading information based on exchange congestion price range to determine whether executing buy or sell is ideal.

It also takes into account market sentiment through a combination of expert & influencer NLP and news & analysis NLP.

Other self-learning mechanisms include whale alerts, token forecasting, and a risk profile and portfolio composition filter that can establish whether an aggressive or more conservative approach is required.

He further explains Flourishing AI gathers on-chain metrics and human sentiment into its neutral network.

It then analyzes that data to provide pattern detection, simple market signals (buy, hold, take profits), and insights into market dynamics soon to impact digital assets.

The difference is Flourishing AI does this every second of every day, constantly learning.

Typically, trading bots assume past historical patterns but Mr. Gonzalez explains the Flourishing AI system does not assume past patterns hold.

"The system tests and retests its assumptions constantly, ever assuming past patterns perfectly predict future patterns. The AI many times will catch new patterns which indicate "the unpredictables" in market swings, " he claims.

The Market for AI-Based Portfolio Management

Mr. Gonzalez emphasizes there are two types of crypto commodity buyers who can benefit from artificial intelligence-driven portfolio rebalancing.

Flourishing AI is designed to serve cryptocurrency veterans and new market participants alike.

For newer users, AI portfolio management provides a systematic approach to risk-adjusted digital asset purchasing and selling.

For experienced users who need to step away from trading to spend time on other pursuits, AI-based systems provide the ability to define strategy and let systems automate the transactional elements of portfolio rebalancing.

Gonzales believes the AI portfolio management sector in the digital asset space will be a two billion dollar market by 2024.

Accessing AI-based Risk-Adjusted Portfolio Rebalancing

After years of development and hard work, Flourishing Capital will IDO its $AI token on September 21st, available on PancakeSwap.

The AI token can be staked to receive access to Flourishing AI's analysis and automatic portfolio rebalancing features.

About Flourishing Capital

Flourishing AI is the most advanced artificial intelligence, portfolio management, and insights solution in the market.

The live platform supports portfolio risk-adjusted returns by combining deep learning inference, active blockchain monitoring, high-frequency trading, active portfolio rebalancing, automated arbitrage, target price probability analysis, and early pattern recognition of bull markets, bear markets, or unexpected market events.

Founded in 2020, Flourishing Capital is led by experienced entrepreneurs who have held key roles at Goldman Sachs, Nvidia, Oracle, and Planview.

The team has a combined three decades of experience in digital assets research and development, payments systems, scalable platform deployment, and acquisitions at companies such as Paypal.

Your post was upvoted and resteemed on @crypto.defrag

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit