How It Helps

The Radar platform is built using a cross-chain solution that combines a regular asset management platform with complete freedom through the power of DeFi and cross-chain interoperability. As a result, Radar offers investors a group of asset management vaults they can choose from, based on their preference in terms of the fund manager, the weighted ratio of the fund, and specific investment currencies used within a Vault, to name just a few of the variables available for allocators to sort by. Furthermore, even managers have the right to select their clientele, i.e. the allocators who are allowed to join a particular Vault. Funds can be run passively or actively via whitelisted decentralized finance (DeFi) protocols. A distinct Radar X-Fund LP Token, which is equal to the contribution that the investors made to the fund will be issued for every investment. We will refer to these tokens moving forward as rFund(n) where n is just a random number to differentiate between various Vaults.

More Important Things About Randar Globe

Investors can then exchange their rFund generic token for the underlying asset of that particular vault. Typically, an investor deposits crypto assets that are accepted by a specific fund in exchange for LP tokens. Those tokens represent a partial ownership of the fund. The rFund1 tokens are unique and different from rFund2 tokens and can be traded among the investor circle or be redeemed for its underlying assets within the fund. In the future a Radar - rFund(n) pool might exist. A fund manager sets a fund up by formulating his investment strategy and defining the fee structure. The fund manager also 10 decides which assets will be accepted and how access limits different safelisted DeFi protocols. Radar Protocol allows the fund managers to explain investment tactics to facilitate the attraction of appropriate investors. The funds are, after that, pooled from investors into a smart contract to allow the fund manager to distribute them passively by following a particular index or actively assuming the management of several financial product streams.

How It Works

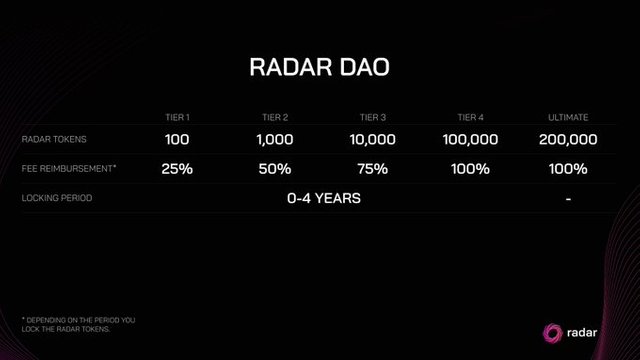

The fund manager is allowed access to all the necessary and required permissions depending on the given smart contract for individual investment funds, enabling the manager to distribute and assign funds to specific whitelisted DeFi protocols or use several other available options. It is mandatory that the funds allocated to each DeFi protocol must not pass a pre-established and defined limit and can only be reviewed via fund-level governance. In exchange for asset management service, the fund manager is compensated through a fee-based model, where investors are allowed to take all the gains and losses while paying a commissionbased or fixed fee to the fund manager.

Hashtags: #crypto #radarglobal #radar #trade #invest #ethereum

Learn More

• Website: https://radar.global

• Twitter: https://twitter.com/radarprotocol

• Telegram: https://t.me/radarprotocol

• Medium: https://radar.blog/

• Radar Token Explorer:https://etherscan.io/token/0xf9fbe825bfb2bf3e387af0dc18cac8d87f29dea8

Author

• bct user name: Agaventy

• bct profile link:https://bitcointalk.org/index.php?action=profile;u=2252802;sa=summary

• Telegram: @agaventy

• Binance Smart Chain(BEP20) wallet address: 0x6aaedeB9cEee7b492ec5251034A8dA4C4B115196