Introduction

In order to support the needs of the growing cryptocurrency merchant community,

GRAFT collected qualitative data using an online survey to better understand what

barriers merchants are facing in adopting cryptocurrency payments at the point of

sale. Over 125 respondents completed the survey which provided valuable insights

into what motivates merchants to accept cryptocurrency, along with perceived and

real barriers to the uptake of cryptocurrency as a payment option.

Respondents were merchants of various goods and services who incorporate both

physical and/or an online presence in their business models. The respondents had

not adopted cryptocurrency at the time of the survey.

Survey Finding 1: Marketing and Reduced Fees Drive

Merchant Interest in Cryptocurrency.

The merchants who participated in the survey clearly see the potential in attracting

new customers by offering cryptocurrency as a payment option at the Point of Sale

(POS). Many merchants have considered the potential benefits of offering

cryptocurrency and are looking for a way to implement it in their business, whether

they are online, physical or both. Merchants contend that increased customer

demand, reduced transaction fees and loyalty programs are among the most

alluring factors when it comes to adopting cryptocurrency. As such, it is necessary

to find ways to roll the option out to vendors and ensure that uptake is as easy as

possible. That being said, if cryptocurrency adoption surges, so will the expectations

of customers seeking cryptocurrency as a payment option, which is what makes the

loyalty program side of the coin so important, as evidenced in the numbers below.

However, what is interesting to note is that the same story isn’t always true across

the various types of providers. The responses of online, physical and combination

stores highlighted diverging priorities for each merchant type. Segregated across

store types, there are some different conclusions as can be seen in the above

diagrams.

From the numbers above, it is clear that merchants who have both online and

physical presence are seeing potential benefits transcending both platforms and

focused on the benefits of cryptocurrency in terms of being seen as innovators, and

benefiting from loyalty programs and cryptocurrency integration leading an

increase in customer demand.

As for online merchants, they believe that cryptocurrency payments can lead to an

increase in customers, as well as higher payment amounts and faster

decision-making times (which generally leads to higher volumes of sales). This is in

fairly strong contrast to merchants with physical locations only, who are not so

swayed by the argument that cryptocurrency payments will lead to greater demand

for them, but are conscious of being seen as innovators and are interested in

lowering transaction fees.

Survey Finding 2: Integration Issues, Transaction

Fees and Delays Are The Main Barriers To Adoption

When looking at the barriers to adoption, merchants found that a lack of

integration with existing software/hardware to be one of their biggest concerns -

no matter the store type. Additionally, long transaction times and cryptocurrency

fluctuations consistently ranked higher as the key concerns for all merchants,

across the board.

Online merchants were concerned with transaction fees being reduced (or not) and

the fluctuation of cryptocurrency causing potential problems, or indeed barriers in

uptake. The situation was slightly different for brick-and-mortar merchants, who

were far more concerned with integration into existing Point of Sale systems, as

well as transaction times at the cash register and who pays fees. These differences

appear to be quite self-explanatory and consistent with the nature of the issues

that confront an online store versus a physical one.

For those merchants who have both physical and online stores, interestingly, their

concerns almost mirrored those of online merchants. While they were also

concerned with Point of Sale integration like those who owned physical stores, they

were more concerned with crypto fluctuation and less concerned with fee direction.

.png)

Survey Finding 3: Merchants Want Cryptocurrency

Integrated Into Existing Systems To Facilitate

Uptake

Research showed that merchants want to see cryptocurrency fully integrated into

existing payment systems. To be more precise, both Point of Sale and terminal

integration is a high priority for all merchants and constitutes the most significant

barrier, as well as the most desired feature for merchants when it comes to

accepting cryptocurrency. In this context, ecommerce integration only serves to

further underscore that point. Another recurring issue for traders was instant fiat

payouts and the fluctuating rate of cryptocurrencies.

Conclusion

In conclusion, the survey shows a healthy appetite for cryptocurrency acceptance

among both on and offline merchants, mainly driven by the new customer and

demographic appeal. Business owners find digital money innovative and perceive

cryptocurrency as a potential driver of their business development. Furthermore,

the desire to use cryptocurrency is driven by its attractiveness to new customers,

transaction fee reduction, potential for easy to integrate loyalty programs and

positive perception by customers.

One of the key takeaways from this report, is that integration is both the biggest

barrier and most desired feature for all merchants.

However, this acceptance and interest comes with conditions. Merchants want to

see the full integration of cryptocurrency into existing POS/eCommerce software

and hardware. Moreover, they are interested in instant fiat payouts or flat value

token conversions. This will not be possible if barriers like high transaction fees,

cryptocurrency market fluctuation, high transaction times and lack of integration

with existing POS/eCommerce software make business owners feel uncertain about

adopting cryptocurrency in their businesses. Overcoming these major hurdles could

certainly usher in a new era for cryptocurrencies.

GRAFT Mobile Wallet App

The GRAFT Mobile Wallet mobile wallet is ready, for both iOS and Android.

GRAFT Multi-currency Mobile Wallet for iOS

GRAFT Multi-currency Mobile Wallet for Android

GRAFT CryptoFind App

GRAFT CryptoFind allows users to find locations that accept crypto! This application allows merchants to update their status as well as for users to find those stores.

GRAFT CryptoFind for iOS

GRAFT CryptoFind for Android

GRAFT Mobile POS App

GRAFT Mobile POS allows merchants to accept cryptocurrencies. With this application, merchants can use their iOS/Android mobile device to accept payments!

GRAFT Mobile POS for iOS

GRAFT Mobile POS for Android

GRAFT Terminal Integration

Most stores, from convenience to large chain retailers, use payment terminals to handle payment. Traditionally this allows the stores to take payment with payment forms such as debit and credit cards.

In order to truly integrate cryptocurrencies into the modern economy, the acceptance of cryptocurrency payment must come in a form that existing businesses are already familiar with. The integration also has to be easy, and free.

GRAFT has been able to integrate on both Verifone and Ingenico payment terminals. That means existing store-owners can install a free application onto their terminal and start accepting payment in crypto!

Below are demo videos show casing both of the terminals:

Verifone Terminal Integration

Ingenico Terminal Integration

GRAFT Integration and Fees

Credit cards typically charge merchants large fees for every transaction a customer makes. This makes them costly, and that cost is carried over to the customer.

GRAFT does not charge the customer, as the fees are paid for by the merchant. These fees are a fraction of what average credit companies charge.

Transaction Fees

Credit Cards:

Typical credit cards charge merchants somewhere around 2~3% for every transaction.

GRAFT:

For RTA based GRAFT transactions, the fee is a constant 0.5% across all volumes, plus 0.25% to 0.75% for SLA & services.

This means that GRAFT costs the merchant about half of what credit cards are charging them!

Use-Case: Imagine

Imagine a world where cryptocurrencies are at every point of sale. You accumulate cryptocurrency through work, playing games, exercising and other crypto-related activities. You are able to easily use these earnings to buy goods as well as services. Things like foreign transaction fees are a forgotten concept. Interest rates become negligible because of the competitive market established by p2p lending platforms. Exchanging to fiat is unnecessary. On top of that, the individuals who join the network to perform authorizations, exchanges and maintain gateways are rewarded for strengthening the GRAFT infrastructure.

Real Time Authorizations

How does GRAFT Network Eco-system work?

How do merchant service providers, pay-out brokers, application developers, authorization Supernode owners all fit together on the GRAFT Network? How the network is scaled, regionalized, and managed? Find out!

.png)

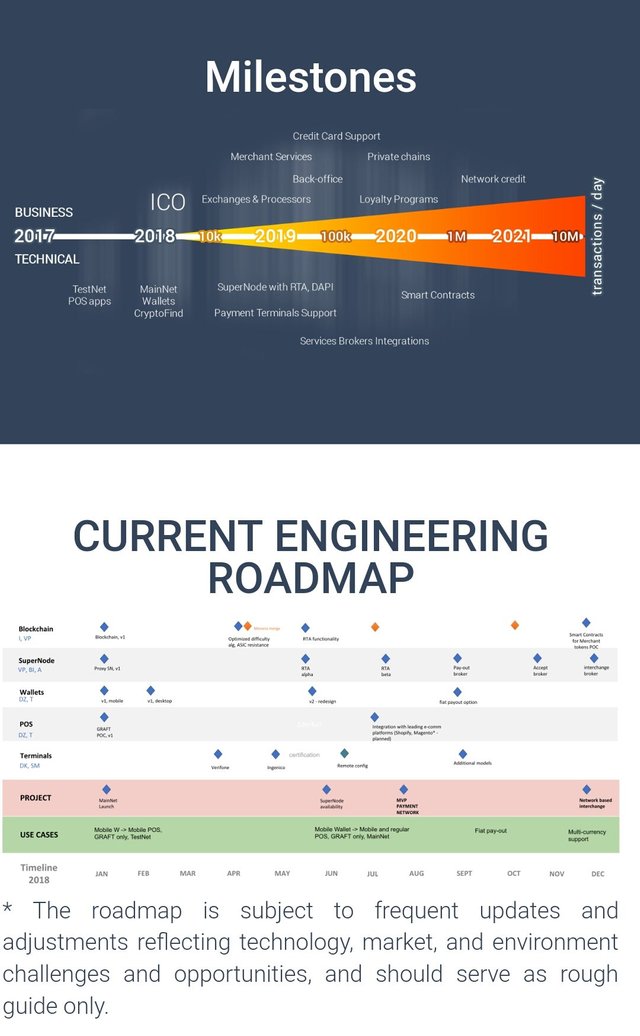

The GRAFT Network

The Graft network is already in testnet mode with prototype wallets and POS devices with the MainNet and Wallet set to go online Q1 2018. The initial launch will be followed by broker integration and a Graft compatible debit card to launch later in 2018. Both are important to the project as they provide the back end structure to make the network work. Brokers provide the exchange between various coins allowing the merchant to determine the desired settlement coin and the customer to pay with a desired form of payment. This allows the network to work anywhere in the world seamlessly for any coin accepted on the network.

.png)

Pay Anywhere Using Crypto in 2018 Graft ICO the FUTURE!

Hi @selina2, I'm @checky ! While checking the mentions made in this post I found out that @graft2018 doesn't exist on Steem. Maybe you made a typo ?

If you found this comment useful, consider upvoting it to help keep this bot running. You can see a list of all available commands by replying with

!help.Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit