Evaluating cryptocurrencies by capitalisation alone doesn't provide the whole picture of their credibility. For example, the FTX crypto exchange's FTT token had significant capitalisation but lacked the necessary liquidity. Conor Ryder from the Kaiko analyst agency suggests paying more attention to liquidity when assessing investment risks.

Trading volume

When assessing liquidity, analysts often look at trading volume. The larger the volume is, the more participants there are with orders at different price levels, making it possible to trade without slippage when executing orders. But if a large participant dominates, the significant trading volume isn't a sign of liquidity. This allowed FTX subsidiary Alameda Research (which holds up to 50% of all FTTs) to manipulate the price. Trading volume was substantial, but liquidity wasn't.

Market depth

This is one of the best indicators for assessing liquidity. It takes into account trading volume and the number of open (buy and sell) orders in both directions at different price levels. A market depth of 2% has been applied in this analysis.

The higher the indicator is, the easier it is for buyers and sellers to exchange at a price displayed in the order. The more stable the asset is in the event of shocks and significant price movements, the harder it is for large individual participants to manipulate the price. This last point is crucial for the Wild, Wild Crypto Market.

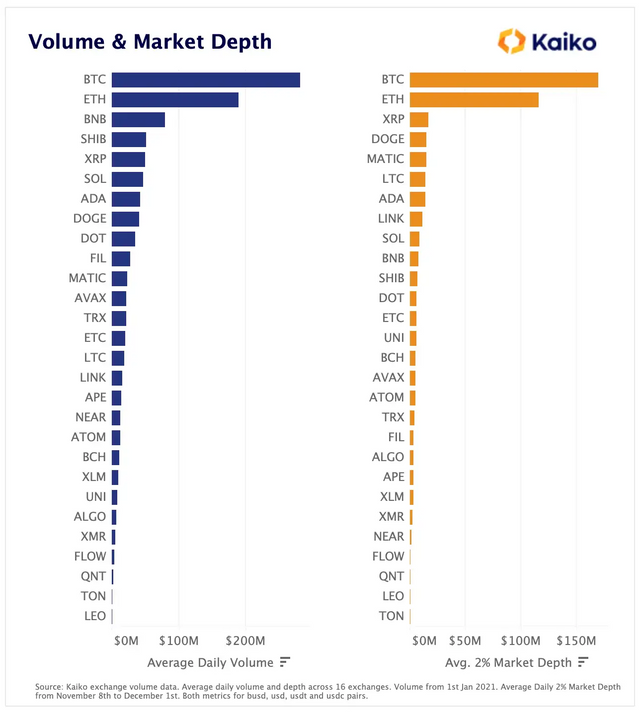

Below is a summary of the top instruments ranked by volume and market depth. A clear discrepancy can be seen between BNB and SHIB. In terms of trading volume, the coins rank 3rd and 4th, but they only rank 9th and 10th, respectively, by market depth. Litecoin, on the other hand, looks undervalued given its good level of trading activity and shortage in mass.

Image source: blog.kaiko.com

Spreads

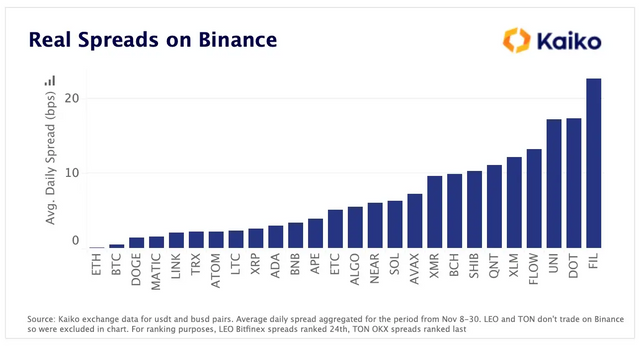

Spreads are also a valid measure of liquidity. They taper as the number of participants and trading volume increase. Notably, BNB loses out to some coins in market depth and spreads on parent cryptocurrency exchange Binance. Dogecoin, on the other hand, ranks third, just behind Ethereum and Bitcoin.

Image source: blog.kaiko.com

Overall liquidity ranking

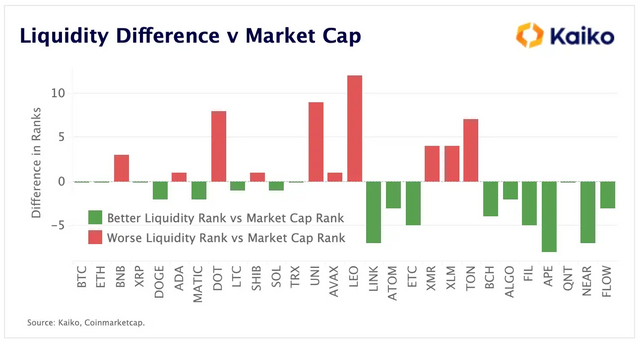

By combining the three liquidity indicators above with market capitalisation, we get the following chart:

Image source: blog.kaiko.com

Bitcoin and Ethereum are in line with their liquidity levels, BNB and DOT (Polkadot) are overvalued, while Dogecoin, on the other hand, is undervalued.

Image source: StormGain.com

The overall results don't suggest that Dogecoin is destined for inevitable growth. However, this methodology gives a better assessment of the potential risks of owning an asset. This is especially applicable to centralised coins emitted by one person or organisation.

StormGain Analytics Team

(a cryptocurrency trading, exchange and storage platform)