On April 17, Bitcoin prices fell more than $ 200 in less than 20 minutes, the result of a sale order that released a large amount of the currency.

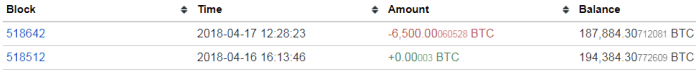

According to information from bitifochart.com, a $ 1.49 billion 3D2oetdNuZUqQHPJmcMDDHYoqkyNVsFk9r wallet - an anonymous digital account worth $ 1.49 billion - sold 6.500 Bitcoin on Tuesday, with an average selling price of 8,186.7 USD / BTC, whereby the total value of sales is just over $ 50 million.

The sale came after a day when the third largest purse - famous for having bought more than $ 400m in Bitcoin in February - sold 6,600 Bitcoins at an average price of $ 8,026. All showed that within two hours, the two Bitcoins shelled out a huge amount of Bitcoin worth over $ 100 million.

As expected, after the two big sell orders appeared, the online forums discussing coding had flickered, with constant speculation about what happened or who was behind the deal. This.

A Reddit user has commented:

It is unbelievable, I just checked the price of a few coin then back to see Bitcoin has seen it reduced by 200 dollars.

The initial market reaction was to criticize Eric Schneiderman - New York State Attorney General - when he announced that he would conduct an inspection of 13 major US securities exchanges, seeking information such as fees. trading, volume and procedures related to margin trading.

However, the fact that this news came out four hours before Bitcoin began to plummet.

Previous sales of Bitcoin started with a significant number of sellers, the most famous case being Mt. Gox on March 7, when the trusts of the floor announced liquidated a large amount of Bitcoin worth more than $ 400 million.