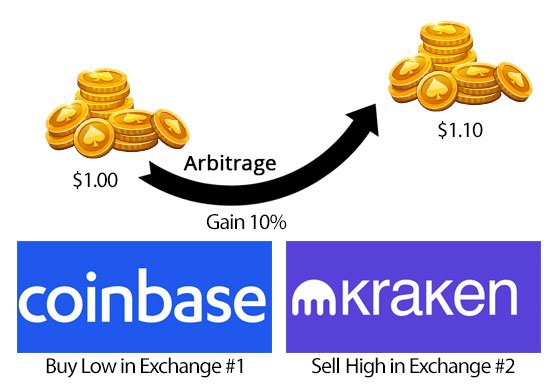

Figure 1: Arbitrage between two exchanges.

At the time of writing, there are an estimated over 500 cryptocurrency exchanges out there. That volume of exchange opens the door to arbitrage trading, as the prices of the same coins are different between these exchanges and there are plenty of opportunities out there.

When it comes to trading crypto arbitrage, many traders get excited about the possibility of making a decent return absent gambling on the coin’s price movement. However, before you rush and quit your day job, you should understand the risks and learn how to try and avoid them.

Just as other investment vehicles, crypto arbitrage is not risk-free and there is much to learn and master to be able to make a good return on a consistent basis.

There are many things that can go wrong along the way. To help investors understand the risks, we have compiled a list of 10 common arbitrage pitfalls that you may encounter, as well as ways you can try and avoid these mistakes. We hope you find this useful and informative.

1. Same name, two very different coins.

Figure 2: Can you tell the difference. Photo credit: animalslook.com

With over a thousand cryptocurrency coins available for purchase, many projects have similar or even the same symbol names.

For instance, there is a project called SIA, it's Decentralized storage, and the symbol is very similar to the Single Collateral DAI called SAI. If you confuse the two you can lose all your coins.

More troubling, is symbols with the same exact names. For example, Binance exchange has CMT symbol that is the CyberMiles currency, however, Cryptopia exchange has CMT ticker, but it's the Comet currency. Another example is the HNC symbol, which is named HellenicCoin on Livecoin exchange, but Huncoin is on Coinexchange with the same symbol name HNC.

Further, the problem with symbols and names inconsistency across different exchanges can be a serious problem and can get you broke in no time as exchanges will not refund you if you send the wrong coin to the wrong wallet address.

Here are a few more inconsistence name symbols to show you that this is a significant problem:

- AdCoin ACC, Accelerator ACC

- ArcticCoin ARC, Arcade Token ARC

- BetaCoin BET, DAO.Casino BET

- Bitcoin Scrypt BTCS, Bitcoin Silver BTCS

- Bitcoin Gold BTG, Bitgem BTG

- Bitmark BTM, Bytom BTM

- CanYaCoin CAN, Content and A... CAN

- Cashcoin CASH, Cash Poker Pro CASH

- Catcoin CAT, BitClave CAT, BlockCAT CAT

- COMSA [ETH] CMS, COMSA [XEM] CMS

- Comet CMT, CyberMiles CMT

- EncryptoTel ETT, EncryptoTel ETT

- FairCoin FAIR, FairGame FAIR

- TheGCCcoin GCC, GuccioneCoin GCC

- Global Tour Coin GTC, Game GTC

- Helleniccoin HNC, Huncoin HNC

- iCoin ICN, Iconomi ICN

- KingN Coin KNC, Kyber Network KNC

- LiteBitcoin LBTC, Lightning Bit LBTC

- NetCoin NET, Nimiq NET

- Propy PRO, ProChain PRO

- Cubits QBT, Qbao QBT

- Rcoin RCN, Ripio Credit RCN

- Russian Miner RMC, Remicoin RMC

- SmartCash SMART, SmartBillions SMART

- International XID, Sphre AIR XID

- and many more

SOLUTION

- Compare prices and volumes

A good way to ensure you are dealing with the same coin is to check volume and price. If the price seems too good to be true, then it probably is. You should filter any results of arbitrage difference that is too significant. We cannot seriously expect to do arbitrage of 50% profit from one exchange to another. Keep in mind that price and volume is not a guarantee either. For instance, Binance's exchange symbol KEY which stands for Key Coin. However, there is another symbol with the same symbol: SelfKey. SelfKey is ranked much higher on the "CoinMarketCap" website than Key Coin. This can get you confused if you rely on price volume only.

- Check the logo of each exchange

Which leads us to another check. The other way to ensure the symbol and name match on both exchanges you are doing arbitrage is to look at the actual coin symbol logo. Many exchanges provide a logo for each coin being traded, so a quick check ensuring it's the same logo can help avoid dealing with different coins that have the same name.

For instance, take a look of the logo of KEY, it is similar but not exact:

Figure 3: Self Key (KEY) logo

Figure 4: KEY logo

Confusing? Yes, very. You need to pay close attention, and don't trade absent food, sleep or in a rush.

2. Check exchanges wallets are online

Figure 5: Exchange wallet online or offline. Photo credit: globalnews.ca

A coin wallet may be disabled, inactive, offline, or even running off different Blockchains between two exchanges. It is not unusual that even large exchange closes all deposit and withdrawal for certain coins or even for all coins.

SOLUTION

- Ensure the wallets are online

Many exchanges offer a way to ensure the wallet is online or offline. This can be found on the deposit, withdrawal pages, through their application program interface (API) or some even have a dedicated page that provide information about the platform and wallets.

- Ensure the wallet is based on the same Blockchain.

If you compare Bitcoin (BTC) and Ethereum (ETH) it's simple to find which one is what. Most BTC addresses are 34 characters. ETH addresses are often represented as 40-character or if you count the hex prefix ( "0x" ) it's 42 characters. However, LTC and BCH are a BTC fork so they have same/similar addresses as Bitcoin and the various altcoins can have similar addresses so you won't be able to disguise and neither will the exchanges.

Additionally, USDT is using both the USDT-Omni (Omni layer protocol built on the BTC blockchain network) and ERC20 (based on the ETH network) so you need to ensure you are using the same Blockchain when sending coins. Furthermore, pay close attention as many coins have moved from one Blockchain to another. For instance, In 2018, the EOS platform moved from ERC20 token on the Ethereum blockchain to EOS Mainnet, which is its own blockchain with a separate set of coins. Normally, exchanges will tell you which Blockchain the wallet is based on, but you cannot rely 100% on the exchange do your own check.

3. High Deposit/withdrawal fees

Figure 6: High Deposit/withdrawal fees. Photo: forum.bitcoin.com

Many traders are aware of the withdrawal fees that exchanges charge. However, although unusual some exchanges also charge deposit fees. These fees can be significant. For instance, at the time of writing Hitbtc exchange charges $17.11 (11.172 XTZ) in fees to withdrawal. Additionally, USDT Tether costs a whooping flat fee of 20 USDT to withdrawal.

SOLUTION

- Check Deposit/withdrawal fee on each exchange and calculate your total expenses before doing an arbitrage. Our site (https://tradingwatcher.com) offers a tool to help quickly calculate these fees but this can be done in excel or any other method you like, be aware. A useful resource to figure out each exchange withdrawal fee can be found here: https://withdrawalfees.com/exchanges. However, as you can see they don't take into account deposit fees only withdrawal fees.

4. Volume

Figure 7: Volume. Photo credit: shutterstock.com

It's important to check prior to commencing arbitrage that the coin you want to trade has volume. Many coins have been delisted due to lack of volume, if the coin has no volume, you won't be able to sell your coins and potentially get stuck with these coins for a long time, or lose most of your money.

You can have many successful trades and all it takes is one trade to set you back to where you started or worst. Additionally, the coin may have volume, however, there is no volume for selling or buying at the price you like. The last price is not as important as the ask, bid price or the depth. We have noticed that some exchanges hype their exchange depth by showing transactions in very low volume, which may not be legit.

SOLUTION

- Ensure the depth volume of a specific transaction

Watch the exchange order book, see if you see transactions moving or it's a standstill. Also pay attention, that exchanges may hype the order book in order to look "busy" and you may see tiny coin dust moving around with tiny volume.

- Ensure the total depth volume of a coin on the daily and live

Look at the coin's volume per day as well as per the transaction you are trying to execute. If you don't see volume in either it's a bad sign and you should avoid the transaction altogether.

5. Avoid pump & dump schemes

Figure 8: Pump and dump. Photo credit: sarahmichellerupert.com

Unfortunately, many crypto coins are associated with pump and dump (P&D) schemes.

Note: P&D scheme is a form of fraud by artificially inflating the price of an owned asset through false and misleading positive statements or price action, in order to sell the cheaply purchased asset at a higher price.

There are many groups dedicated to crypto P&D schemes and each time they pick a coin and inflate the price only to have the last buyers "holding the bag" and can't sell at the price they bought for a long time or for good.

SOLUTION

- Check technical analysis for pump & dump schemes

To be a successful arbitrage trader, you need to have some basic knowledge of technical analysis (TA). It's beyond the scope of this article but what needs to be done is check volume, price especially on the 1-minute chart and other TA indicators.

6. Deposit needs manual process

Figure 9: Manual process. Photo credit: chatbotslife.com

This happens on exchanges that deposits are not being processed electronically and you need to get in touch with the exchange to figure out where is your funds. Just to hear that the exchange needs to do a "manual" process. It's not clear why this is happening, as the exchange may not offer any explanation. That's why the best advice dealing with Crypto is a trade only what you can lose is so common.

SOLUTION

- Break transaction to small than large transactions

There is no way to really predict what exchange can do and what and when with anyone's coins, however, it is a good advise to send a small transaction first before committing a larger transaction. This can help minimize your risk, however, it will be at the expense of your profit, as you will have to pay a deposit and withdrawal fees twice.

7. Exchange holds your funds

Figure 10: Exchange holds your funds. Photo credit: betanews.com

Crypto exchanges are not regulated and it's good in some way while bad in other ways. Exchanges can basically take all your funds and "runaway" ignoring your emails for days or forever. There are plenty of horror stories on crypto forms, where exchanges just decided to hold funds for good without explanation or with the pretense that they need more information from you to release these funds. There are also cases where exchanges just shut down holding all investors money.

For instance, in 2019 U.S. customers are blocked from trading on Binance.com and many exchange block certain countries. It feels like a moving target, just keeping up with what exchange limit what customers and which exchange is still open.

SOLUTION

- Send a small transaction first.

Just as was advised previously, sending a small transaction before committing to a larger transaction can help minimize your risk.

- Know Your Customer (KYC) and Anti-Money Laundering (AML)

Many exchanges start to comply with KYC and AML or limit the account's transaction when the user is not complying with requests for more information. Some people are alleging that the exchanges are using that as an excuse to hold customers funs, whatever it may be, you need to take that into account every time you trade.

- Don't keep your coin on exchanges

Exchanges lost billions to hackers through the years. It's beyond the scope of this article to go into details, but as a rule of thumb, we would recommend keeping your coins away from "hot" wallets into "hard" wallets.

8. Timed opportunity

Figure 11: Timed opportunity. Photo credit: humanresourcesonline.net

Although there is an abundance of opportunities on many of the exchanges out there, it is still a scarcity timed opportunity per the transaction itself and you need to move fast to ensure you can commit your trade on time and exit with profit as the market conditions can change in seconds in the crypto world.

SOLUTION

- Use arbitrage tools

In order to ensure you can achieve your checks and commit your transaction, you need to have tools and an exact plan to scan for an opportunity as well as check profit and commit the transaction. This can be done by using online tools and apps, such as the ones we offer or using an excel sheet with links, or even a notebook, whatever works for you. It just needs to be done quickly and efficiently.

9. Problem with transaction

Figure 12: Commit a small transaction first. Photo credit: pixcove.com.

There are times that the transaction would not execute due to all kind of issues on the exchange such as:

- Exchange “overload”

- The transaction could not execute

- Wallet issues

- Withdrawal issues

- Exchange down

- and many others

SOLUTION

- Break a transaction into a small transaction than your large transaction

Just as we pointed out before, breaking a transaction into a small than a large transaction or multiple transactions will decrease your profits, but will also help risk reduction as well as mitigate your risk.

10. Exchange charges high trading fees

Figure 13: High trading fees. Photo credit: theatlantic.com

Last but not least, some exchanges charge high and unreasonable trading fees and these fees can change overnight. For instance, Coinbase Pro's decided in 2019 to increase their fees by 233% for 'Lower-Volume' traders (traders trading $10,000 and below). Makers' fees changed from 0.15% to 0.50% and takers' fees changed from 0.25% to 0.5%.

SOLUTION

- Check takers and maker fees

Check both takers and makers fees and add these to your expenses calculations, before committing to a transaction.

- Find a way to reduce fees

Some exchanges offer large discounts in case you pay using their coin. This may be worth your while if you work with the same exchange consistently.

Let's recap

We gave you a deep dive into the ten common crypto arbitrage pitfalls and how to avoid them. We covered common problems as well as a potential solution and what you can do in order to be successful in crypto arbitrage trading. After reviewing this post you may be wondering if it is still worth it to do arbitrage. Many traders have been successful in completing arbitrage trades with reduced risk and nice exit profit, however, there are also many stories of issues with exchanges, so the bottom line is only trading what you can lose and just like any other trading, try to gather the most information possible before entering a trade.

Feel free to list anything we have forgotten, fix any error you find, or list any problem you have encountered with specific exchange and how you solved it (if at all). Our hope is that this will be a work in progress post to help traders identify and solve problems associated with crypto arbitrage.

Where to go from here

You can find arbitrage trading opportunities we listed daily on Twitter. Sign up for our free service, as well as watch for new articles. Lastly, signup for our newsletter.