Crypto arbitrage is simple to grasp, however, to be profitable consistently requires efforts and time, as well as employing a strategy. In this series of articles, I will be covering crypto arbitrage strategies and how to employ them using real-world examples.

Here are a few crypto arbitrage strategies:

- Simple arbitrage

- Spatial

- Cross-border

- Statistical

- Oscillator

- Convergence arbitrage

- Triangular arbitrage

- Arbitrage Hodl

In this article, we will be covering a two-fold strategy solution and how to employ the strategy using real-life examples. I broke the process into five-step actionable steps that you can follow.

- Scanning for opportunities

- Calculating spread & fees

- Check Coins in depth

- Check wallets

- Execute Arbitrage

What is two-fold arbitrage

Two-Fold arbitrage profits from the simultaneous sale and purchase of an asset to exploit differences in prices across markets. A good example would be the exchanges at the airports. On average, travelers exchange foreign currency at about 6-8% of the going rate and sometimes even up to 12-15% of the amount. That significant enough to see many exchanges at international airports.

Figure 1. Photo credit Change Group.

To employ this strategy in cryptocurrency, you would buy coins on an exchange where the price is lower and then selling the same coins on a different exchange where the price is higher.

The arbitrage profit from the difference (also known as "spread") between the buy and sell prices between these two exchanges.

Step 1: Scanning for opportunities

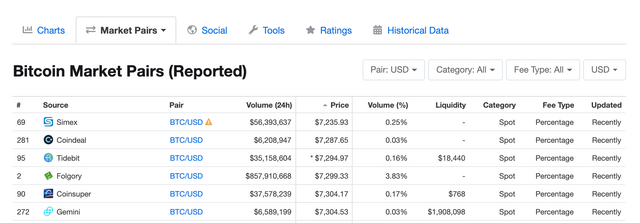

The first step is to scan for opportunities across multiple exchanges. A good resource is coinmarketcap, which allows you to click on the "market pair" tab and scan coin pairs on multiple exchanges and filter the results. For instance, we can take Bitcoin against USD as an example https://coinmarketcap.com/currencies/bitcoin/markets/ and check price differences on multiple exchanges.

This process can be done manually, by using sites that allow comparing different coins;

Figure 2. Photo credit "coinmarketcap".

We filter the prices from high to low so we can see the lowest price at the bottom;

Figure 3. Photo credit Coinmarketcap.com

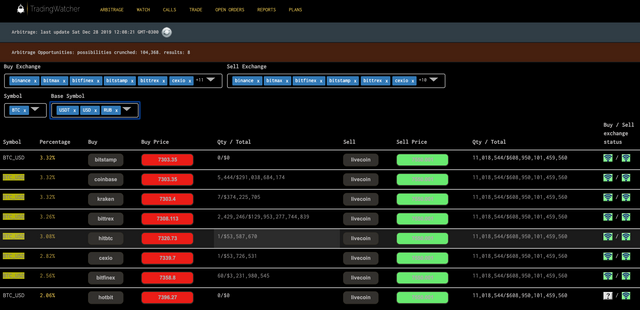

Additionally, this process can be done by tools like the one we are offering that uses an algorithm to scan the market constantly using the exchanges API and filter the results to give the best opportunities.

Figure 4. Photo credit TradingWatcher.com

For instance, if we look at Coinbase and Livecoin for BTC USD pairs, it looks like there is a difference in price;

| Compare | Coinbase | Livecoin |

|---|---|---|

| Price | 7359.80 | 7550.00 |

Step 2: Calculating spread & fees

Once you find an opportunity, the next step to calculate the fees associated with completing the transaction. This can be done by calculating the fees as well as the spread between the exchange you buy against the exchange you sell. The fees can be broken to the following fees;

- Trading fees

- Deposit fees

- Withdrawal fees

You need to find these fees as well as calculate the spread difference. Once again this can be done using simple algebra or by using tools that help calculate.

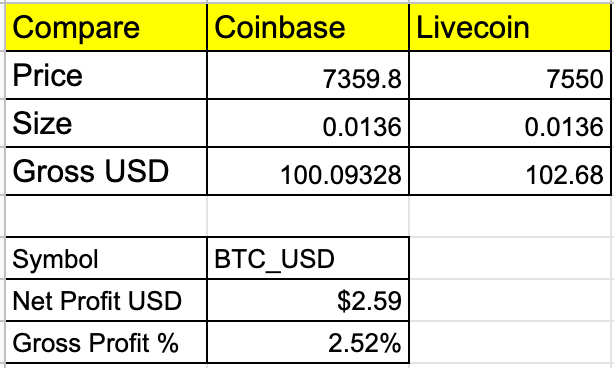

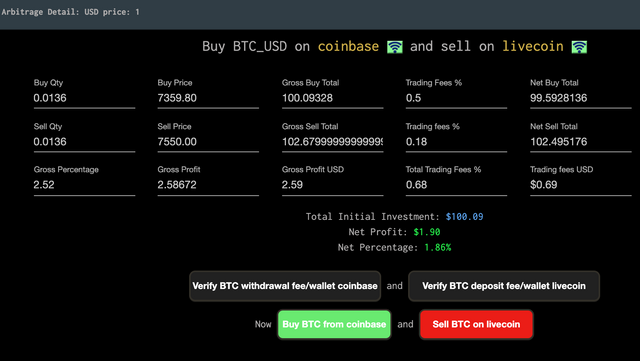

Checking Coinbase against Livecoin there is a 2.52% spread, so for a transaction of 0.0136 BTC (about $100 at time of writing).

| Compare | Coinbase | Livecoin |

|---|---|---|

| Price | 7359.80 | 7550.00 |

| Size | 0.0136 | 0.0136 |

| Gross USD | 100.09328 | 102.68 |

| Spread | 0% | 2.52% |

Gross Profit USD: $2.586

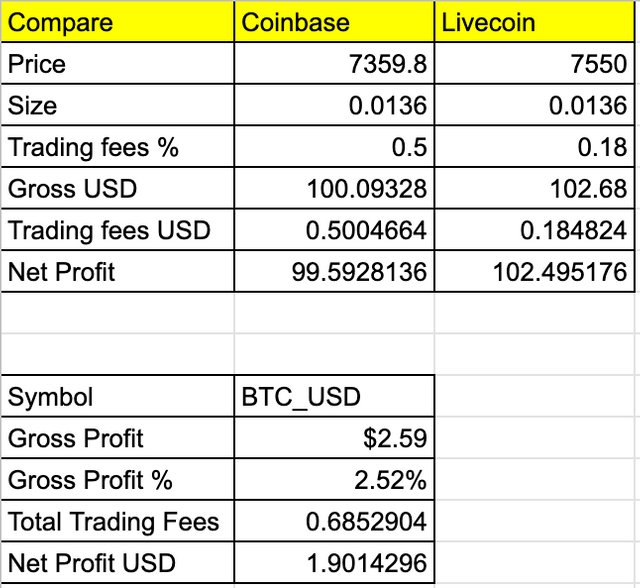

To do these calculations manually, you can use an excel sheet and with simple algebra calculate these numbers;

Figure 5. Google excel sheet calculate profit.

You can download our Google excel to help you calculate;

https://docs.google.com/spreadsheets/d/19r4UYrq7EXmqZk3b77oPMiICebTbVHYPEPdkke911mI/edit?usp=sharing

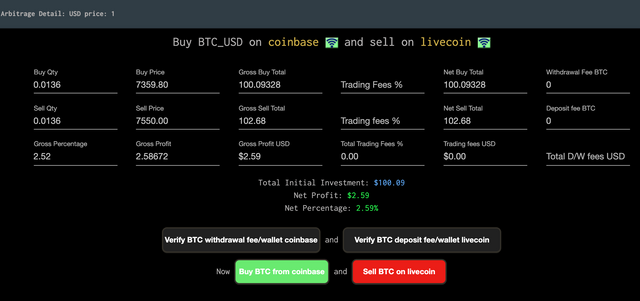

If we plug that information into TradingWatcher platform, we can get help calculating these numbers;

Figure 6. Photo credit TradingWatcher.com trading calculations before fees.

You can navigate to view these calculations yourself:

However, once we fill the fees our profit drops from $2.59 to $1.90. Notice that Coinbase charges a hefty 0.50% trading fee for takers, however, Coinbase charges no withdrawal fees, so for small transactions such as ours, that's more worth it than exchanges that charge low trading fees with high withdrawal fees.

Figure 7. Photo credit TradingWatcher.com trading calculations after fees.

You can also do these calculations manually;

Figure 8. Google excel manual calculations.

Step 3: Check Coins in depth

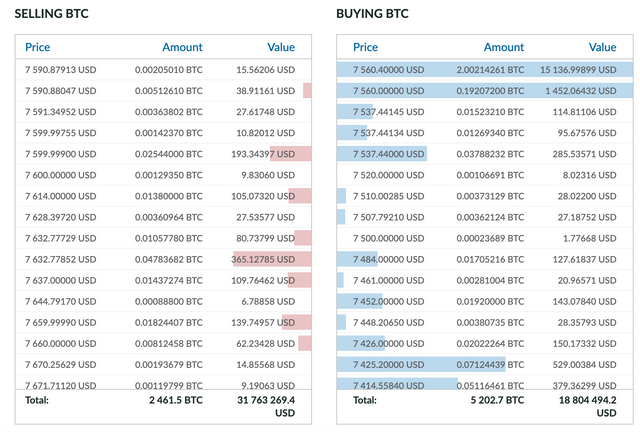

In terms of profitability, we established that this transaction is worth executing. However, we are not done. Our next step is to check the coins in-depth. What we want to know is volume and actual transactions pending at the prices we want to sell and buy. The process is to go to the order book of the exchanges and check not the "last" price but the selling price on the exchange we are buying from as well as the asking price at the exchange we want to sell at and the volume.

Figure 9. Coinbase BTC USD order book

Figure 10. Livecoin BTC USD order book

The second important aspect we want to check is to ensure these are the same coins on each exchange. We point out in our article about 10 Common Crypto Arbitrage Pitfalls And How To Avoid Them, how there are coins with the same symbol, that are two very different coins. The best check is to look at the picture of the coin, volume and ensure the spread is not too much of a difference.

At TradingWatcher we dig into the order book to find actual transactions with volume instead of relying on the last price or daily volume. We also provide links to verify, however, this can be done manually by keeping the URL of the exchange order book. In our example, we are trading BTC so the volume is there without worry, however, this becomes significant when you deal with smaller coins with low volume.

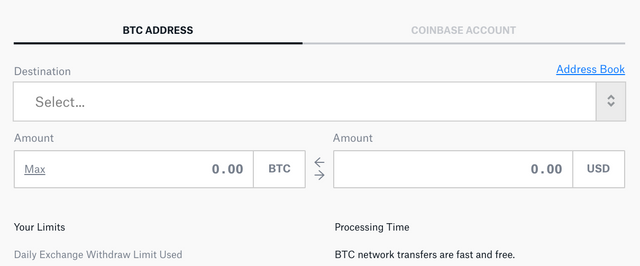

Step 4: Check wallets

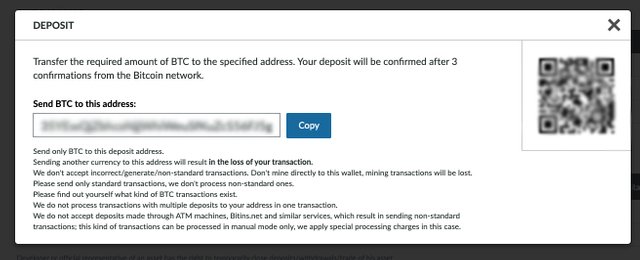

Our arbitrage transaction passed the calculating of spread & fees and the in-depth check. The next step is to ensure that both exchange wallets where we sell are online and our account is able to perform withdrawal and deposit. This can be performed by going to the deposit and withdrawal pages on both exchanges.

The other check is the processing time. Checking both exchanges we can find the processing time as well as the fees;

Figure 11. Coinbase Pro BTC wallet

Figure 12. Livecoin BTC wallet

Livecoin indicates that it would take 3 confirmation for the deposit to be confirmed;

"Your deposit will be confirmed after 3 confirmations from the Bitcoin network."

Each BTC confirmation takes about 10 minutes, so that's about 30 minutes. In the crypto world, 30 minutes is a long time and the market can swing up or down significantly during the time the transaction is being confirmed.

Arbitrage of crypto holds risks such as a missed opportunity, technical analysis (TA) check and it's recommended to try a small transaction first before risking a larger amount. We recommend you read our article about 10 Common Crypto Arbitrage Pitfalls And How To Avoid Them to avoid falling into one of the common pitfalls and losing your hard-earned money.

Step 5: Execute Arbitrage

This step involved buying the coin, watch, withdraw, wait for confirmation of deposit, and sell. Once all went well rinse and repeat if possible.

Let's recap

We broke down the arbitrage two-fold strategy into a five-step actionable solution.

Step 1: Scanning for opportunities

Step 2: Calculating spread & fees

Step 3: Check Coins in depth

Step 4: Check wallets

Step 5: Execute Arbitrage

These steps can be either done manually, automated or using tools to help. Just like any trading, information is the key. The more information you have before executing the trade, the more chance you have to complete the transaction in the money.

Where to go from here

Signup with exchanges Coinbase and Livecoin to check prices, wallets and order book;

Find arbitrage trading opportunities we list daily on Twitter. Sign up for our free service, as well as watch for new articles. Lastly, signup for our newsletter.