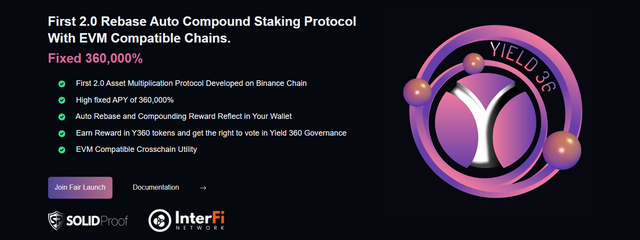

On this occasion, we will review a project that has shaken the crypto world, the project is Yield 360. What is Yield 360? The Yield360 is an automated reward generation and distribution protocol with an estimated interesr rate of 0.0206% in a time stamp of 13 minutes.

The protocol provides automation through is exclusive Yield360 automation protocol YALE, T360 treasury fund YIF, and deflationary tokenomics that functions simply through the phenomenon og buy-hold-earn.

What is the reason Yield360 exists?

The advent of DeFi 2.0 has taken the blockchain solutions by storm through completely revolutionizing the investment procedures. A major shift from DeFi 1.0 to DeFi 2.0 is the alteration of focus to low risks and higher yield solutions.

Yield360 has also taken its part through introducing a product that can provide a constant stream of returns throughout the day. The Y360 protocol offers a return on investment after every 13 minutes, which is 110.76 times in a day, and 39,433 time a year; totaling a fixed APY of whooping 360,000%

Through the use of its Y360 insurance fund YIF, Yield360 has made it possible for its users to earn these higher aforementioned returns simply through holding $Y360 in their wallets. The protocol fully comprises of following features

The $Y360 is a native token on the protocol which also serves as the network’s native currency. All rebase interests are paid in $Y360 token along with many other utilities of this token.

What are Yield360 exclusive features?

Safe simple staking

The Y360 tokens are always kept in your wallet and do not need to be staked in the high-risk staking contract. All you have to do is buy and hold it, and it will automatically multiply rewards in your wallet, eliminating the need to learn about the stake/unstake mechanism and avoiding an additional tax fee on staking operations.

Rebase tokenomics

Yield360.io rebase tokenomics Yield360.io uses a complex set of factors to support its price and rebase rewards. It includes the (YIF), which acts as an insurance fund to ensure the price stability and long-term viability of the Y360 Protocol by maintaining a consistent 0.0206 percent rebase rate paid to all $Y360 token holders every 13 minutes.

Auto-liquidity management protocol

Liquidity can be viewed as a large pool of money divided in half between $Y360 and $BNB tokens. There is a conversion ratio set to the amount of $Y360 available through BNB, for example: 1 BNB is equal to 36.44 Y360.

Insurance fund

The $Y360 Insurance Fund, acronym of YIF, is an independent wallet in the YAP system of Y360. The YIF is funded by a fraction of the buy and sell trading fees racked up in the YIF wallet and employs an algorithm that underpins the Rebase Rewards. Put simply, the YIF parameter endorses the staking rewards (rebase rewards) that are distributed every 13 minutes at a rate of 0.0206 percent, guaranteeing $Y360 token holders a high and stable interest rate.

Reduction of risk associated with downside: Ensuring long term growth continuity by maintaining constant growth levels Ensuring price stability through rebase strategy.

Yield 360 Treasury

The Treasury is critical to the Y360 YAP protocol. It serves three important components for Y360.io’s growth and long-term viability. The treasury is another source of funding for the YIF. This extra assistance could be useful if the price of the $Y360 token falls dramatically. It contributes to the formation of a $Y360 token floor price.

Fire pit

The fire pit consumes approximately 1.5 percent of all $Y360 traded. The quanity of burned token is directly proportional to the circulating supply, the more that is traded, the more that is added to the fire, having caused the fire pit to grow in size through self-fulfilling Auto-Compounding, reducing the circulating supply and keeping the Y360 protocol stable.

APY Formulation

The Y360.io protocol is based on a simple daily-interest compounding formulation. Where "A" represents the future value of your investment "P" denotes the primary investment. "R" is the decimal interest rate, and "N" is the number of times interest has been compounded in the given time. "T" denotes the total time required for investment maturity. It is important to note that rate "R" and time "T" must be expressed in the same time units, such as months or years.

Based on a 365-day year, time conversions are 30.4167 days per month and 91.2501 days per quarter. A year has 360 days, with 30 days per month and 90 days per quarter. In this case, suppose the user invests $1000 worth $Y360 for a year at 0.0206 percent compounding every 13 minutes, he will eventually have whooping $360,000,000 after the maturity of his investment.

Where can I get more information?

You can get more and complete information by visiting some of Yield360's official links

- Website: https://yield360.io/

- Whitepaper: https://yield360.io/whitepaper.pdf

- Medium: https://yield360.medium.com/

- Github: https://github.com/Yield360/

- Telegram: https://t.me/yield360

Telegram: https://discord.gg/w6utZfyUXr - Twitter: https://twitter.com/yield360

- Facebook: https://www.facebook.com/Yield360

- YouTube: https://www.youtube.com/channel/UCMDPz2BYaUqSXesPVW_HNwA

- Reddit: https://www.reddit.com/r/Yield_360/

Author identity

- Bitcointalk username: Bredd6767

- Bitcointalk profile url: https://bitcointalk.org/index.php?action=profile;u=1204015