Crypto20, The World's First Tokenized Cryptocurrency Index Fund

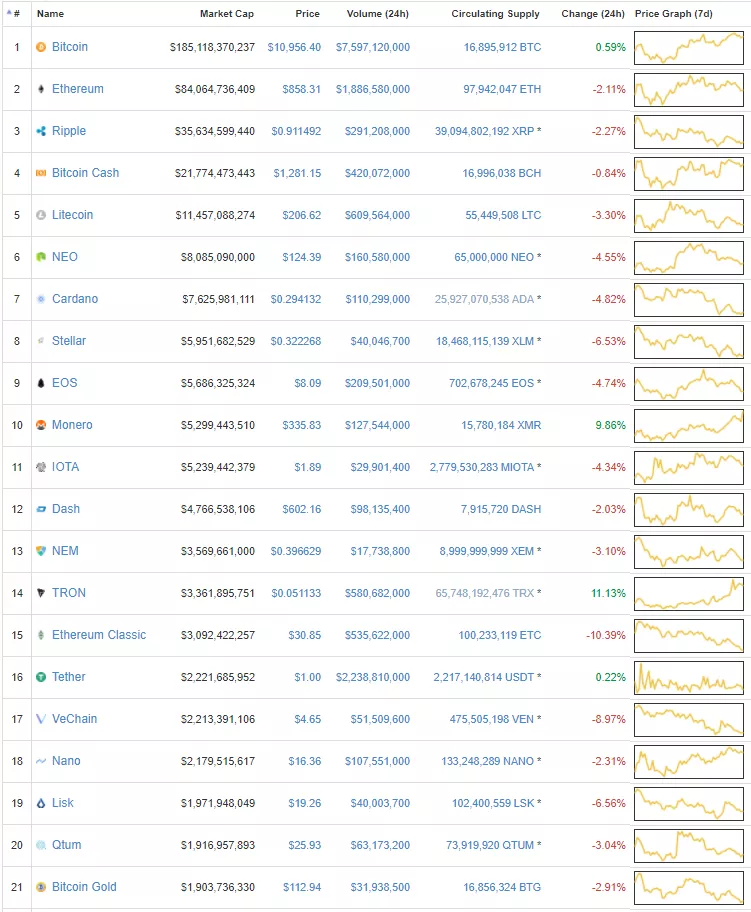

Crypto20 is a new index fund that that holds a portfolio of the top 20 cryptos by market cap in the same way as the Vanguard 500 maintains a portfolio based on the market cap of the S&P 500.

Top 20 Excluding Scam coins, Ponzis and Tether

Currently the top 20 coins capture >90% of the overall market cap.

As you can see, the market cap sizes start dropping off after the top ten or so, to below $5 Billion USD. Most coins outside of the top 20 are currently under $1 Billion in market capitalization.

Sorry Tether, you didn't make the cut.

USDT - faker than the real thing - hodl artist shop

How the CRYPTO20 Index Works

The Crypto20 asset portfolio is adjusted through weekly re-balancing to track the market over time.

As you can see by the Portfolio weights below, it is not weighted by market cap, but uses a scaled approach to weights based on the rank within the index. Bitcoin gets a modest 11.6% weight, and Ethereum gets 10.5%, scaling all the way down to Icon, which gets 1.1%.

https://hodlcrypto.org/2018/03/02/crypto20-launch-invictus-capital-passive-ico-investment-funds/crypto-20-portolio-weights-march-2nd-2018/

Crypto 20 Portolio Weights March 2nd, 2018

If Crypto20 were to weight their portfolio using a market-cap based weighting system, then portfolios would be weighted with roughly 41% Bitcoin and 19% Ethereum.

Coin Market Shares - March 2nd, 2018

The Crypto20 Index gives investors more exposure to the smaller cryptocurrencies within the top 20

Since the Crypto20 index only gives a combined weight of 22% to Bitcoin + Ethereum compared to the the 60% of Market Capitalization the two coins represent within the actual crypto market, the Crypto20 Index gives investors higher exposure to smaller altcoins.

*this may (or may not) result in higher upside potential.

Whether the method of weighting chosen for the Crypto20 index is a good strategy or not simply depends on how well the smaller coins in the index (i.e. $BCH, $LTC, $EOS, $XMR, $IOTA, $NEO) do in relation to larger coins (i.e. $BTC and $ETH).

CRYPTO20's Nov 2017 ICO and C20 Tokens

The Crypto20 ICO in Nov 2017 closed with $38m raised, making it the 22nd largest recorded ICO at the time.

C20 Tokens launched on exchanges Jan 22nd and are currently available on Bibox, HitBTC, and IDEX.

Crypto20's performance to date vs. BTC and the Total market

So far, the C20 has performed quite well since its launch. It's outperformed both BTC and the total Market Cap in % terms since December.

Invictus Capital Launching 2 New Funds Alongside Crypto20

Invictus Capital is the crypto investment management firm behind the Crypto20. They believe that data science, machine learning, etc. will outperform actively managed funds.

The team is aspiring no less than to become the Vanguard of blockchain investing.

Invictus Capital - The Umbrella Company

Yesterday, March 1st, the team announced the launch of Invictus Capital, "a global company defining the leading edge of the cryptocurrency financial services industry."

A few of the Invictus Capital team members at work in their offices

Invictus provides end-users direct access to funds in the form of tokens. This eliminates all third-party fees that take a share of investor profits, such as broker or platform fees.

They are very much pushing the data-based approach, which many investors, myself included are quite big fans of.

“Transparency and the scientific method are core tenets of our philosophy at Invictus. We believe that all funds should be developed and justified with a data-backed approach. We do not rely on guesswork and intuition.”

2 New Funds: Kinetic (Passive) and Hyperion (ICO's)

With the launch of the umbrella company, two new funds join the ranks alongside CRYPTO20 — namely, the Invictus Kinetic fund (passive) & the Invictus Hyperion fund (pre-ICO/ICO).

The Invictus Kinetic Fund

The first open, passively managed tokenized fund to be launched by Invictus Capital. The Kinetic fund leverages our expertise in machine learning in the creation of a dynamic, algorithmically rebalanced fund designed to navigate the constantly changing cryptocurrency market.

At the heart of this fund is the Kinetic function that strictly defines its governing rules, enabling it to increase positions in tokens exhibiting growth, while closing positions in tokens in decline, all without being subject to human bias, emotion and interference.

Many independent investors find themselves exhausted and emotionally depleted from trying to manage a portfolio of cryptocurrencies in a market that never sleeps.

Some of us have seriously become "Crypto Zombies" waiting for those juicy 3AM-4AM trades on US Eastern time when there is action in the Asian markets.

Invictus Capital seeks to help with this.

As a passively managed fund, use of the Kinetic function allows the fund to navigate the shortcomings common to more basic funds, while still benefiting from the low fee structures characteristic of passive funds.

The Kinetic function continuously processes a stream of market data. The seven parameters and three hyper-parameters of the Kinetic function have been optimized by machine learning and back-tested over past market data.

The full function, underlying mathematical model and backtest results will be described in detail in the whitepaper release on March 16th, 2018.

The fund utilizes a variety of kinetic indicators characteristic of a given cryptocurrency’s performance relative to the rest of the market to assign it a score.

Ranking the 100 largest cryptocurrencies by their Kinetic score results in a Kinetic Rank.

This rank is used to create the Invictus Kinetic fund by selecting the top cryptocurrencies in the Kinetic Rank weighted by their Kinetic score.

The fund is rebalanced at fixed periods.

Over the coming years, we can expect there to be considerable changes within the market cap rankings of the 100 largest cryptocurrencies.

Smaller market cap cryptocurrencies will likely rise steadily up through these rankings — naturally an investor would want to be able to identify these rising stars and capitalize on their growth by investing in them early on.

Similarly, over time we expect to see some of the historic top performers, those cryptocurrencies that have exhibited meaningful, even meteoric, growth in their market capitalization to date begin to exhibit decline relative to the growth of the rest of the market.

Even more, some of the cryptocurrencies with the largest capitalizations may be displaced by the rising stars who disrupt their business model or use cases, possibly causing them to plummet into obscurity.

In these scenarios, it would be favorable to divest from these assets early in their decline to realize the returns from their previous growth, and to avoid the loss associated with holding a declining asset.

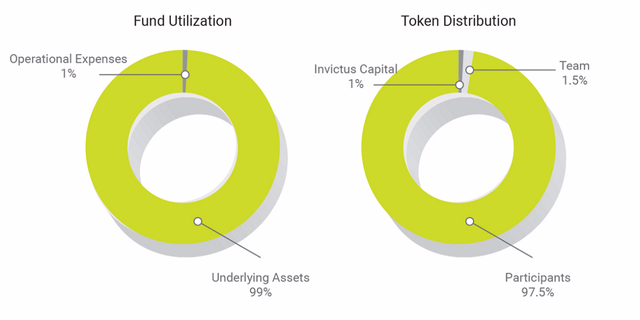

Kinetic Fund Token Structure and Fund Utilization

The token structure is very lean in terms of fund utilization (only 1% to operational expenses) and token distribution (97.5% to ICO investors).

Annual Management Fee: 0.75 %

• Token Structure: 1.5% of tokens for team, 1% for Invictus Capital, vesting over two years. 97.5% to ICO participants

• Fund Utilization: 1% of funds raised for operational expenses, 99% for purchasing underlying assets

• Token Price: $0.10 per token at live exchange rate from BTC/ETH/LTC

• Hard Cap: None — open-ended fund

• Soft Cap: $2M

Invictus Hyperion Fund

The Invictus Hyperion fund is a closed, tokenized venture capital fund designed to function as a syndicate for investors looking to gain exposure to the earliest stage of blockchain investing.

The Hyperion fund will focus on early-stage investments in blockchain technology. The fund will not invest or trade in projects that already have a listed token.

The fund will operate with Invictus’s typical data-driven investment methodology. Predictive models and tools will be utilized to determine the potential of investment opportunities.

The blockchain revolution has ushered in a new era in the financial sector, but it has also left many feeling overwhelmed.

With over a thousand coins to choose from and so much information, FUD, and shameless coin shilling to dig through to get the right information, it's no wonder some investors just resort to the top currencies that seem to have the lowest risk.

Independent investors are simply unable to allocate the time, energy and mental bandwidth required to understand and navigate all of the new investment opportunities — and traps.

Development of new investment protocols like Initial Coin Offerings (ICOs), token pre-sales and Simple Agreements for Future Tokens (SAFTs) have redefined and democratized early stage investing. Independent investors now have the opportunity to invest in projects across the globe while they are in their infancy — investment opportunities that historically were only available to wealthy accredited investors and first-world venture capitalists.

While these changes, enabled by blockchain technology, have provided people with access to a wide array of new investment opportunities, they have also exposed people to the significant risk of early stage investing. The undertaking to perform the necessary due diligence to make informed investments has become onerous.

Hyperion seeks to break down barriers to early-stage crypto investing

Even though blockchain technology has transformed the early stage investment landscape, the independent investor still faces barriers. Large bonuses or discounts are often offered exclusively to very early investors or partners with significant capital and connections to the project.

Through the power of syndication, the Invictus Hyperion fund has been designed to break down these barriers facing the independent investor.

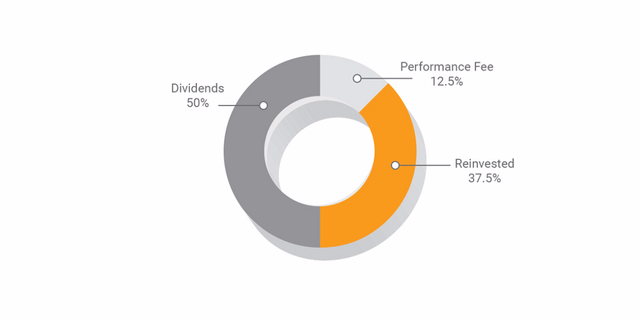

A portion of the returns from the sale of tokens will be paid out to token holders as dividends and the rest will be reinvested in new blockchain projects, repeating the cycle.

Hyperion - Distributions of quarterly returns

The analysts at Invictus will actively solicit and evaluate funding applications from entrepreneurs, performing extensive due diligence in the vetting process.

The Titan AI tool will be used to evaluate proposals and gain additional insights into factors influencing the success of early-stage blockchain investing.

The Hyperion fund will offer simplified access to early stage investing in a broad, vetted portfolio of promising blockchain projects. Entrepreneurs in need of pre-ICO support in the range of $0.25M to $1M can already apply through the funding application portal at InvictusCapital.com.

The fund utilization and token distribution structure is identical to that of the Kinetic fund.

Dividend Phase Activation: Dividend payments will be activated once the fund has grown to an invested portfolio of $30M.

In the Dividend Phase: 50% of returns realized within each quarter will be paid to token holders, a 12.5% performance fee will be leveraged by Invictus and the remainder of 37.5% will be re-invested into the fund.

Titan AI Tool — Making Crypto Investing Safer

1st Stage

The tool analyzes ICO white papers and is capable of identifying plagiarized content — Titan is even capable of detecting cases where plagiarized content has been restructured and synonym substitutions have been made.

They have already indexed thousands of ICO white papers for comparing white papers against — but as users upload papers, this corpus will grow automatically. With this tool, we aim to empower users to make more informed investment decisions and help to form a community driven watchdog service.

2nd Stage

The second stage of the Titan tool will provide users with a visual representation of the degree to which an ICO is related to others in terms of their business model and sector.

The tool empowers users and Invictus analysts with the ability to evaluate the originality and legitimacy of early-stage investment opportunities within the ICO space and specific sectors thereof. The second stage will be released in the first week of March (this week).

Titan is an example of the company’s commitment to legitimizing the broader cryptocurrency community, in this case, by rooting out frauds and copycat projects.

For those interested in the ICOs for the new Invictus Funds, there is no date announced yet, but they have indicated it will be announced with the whitepaper releases on March 16th.

Whitelist for the ICOs of New Tokenized Funds

The funds will begin to raise in April — the exact dates will be announced when the whitepapers are released on the 16th of March 2018 at 18h00 GMT.

The funds will open to the public after a short initial phase dedicated to the below two groups. For priority access to our new funds you will need:

A.) To be an investor in the CRYPTO20 ICO.

OR

B.) Prove ownership of more than 500 C20 tokens using our verification tool. The justification for this amount is that it is approximately the median investment in the CRYPTO20 ICO.

Justification for this amount is that it is approximately the median investment in the CRYPTO20 ICO.

Conclusion

The Crypto20, Kinetic, and Hyperion funds offered by Invictus Capital are all potentially strong options for those interested in index style (passive) and pre-ICO investing.

Disclaimer: I do not hold C20 and but plan to invest in Kinetic and Hyperion based on a final assessment once the whitepapers are released. This is not financial advice.

Always Do Your Own Research. Hold on for dear life.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hodlcrypto.org/2018/03/02/crypto20-launch-invictus-capital-passive-ico-investment-funds/

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit