In the fast-paced world of cryptocurrencies, the year 2017 stands out as a rollercoaster ride of euphoric highs and sobering lows. It was during this year that the crypto market experienced an unprecedented boom followed by a significant crash. While the events of 2017 have now become a part of cryptocurrency history, the lessons learned from that tumultuous period continue to offer valuable insights for investors and enthusiasts alike.

- FOMO (Fear of Missing Out) Can Drive Irrational Behavior, The crypto market of 2017 was fueled by the fear of missing out on potential profits. As prices of various cryptocurrencies soared to astronomical levels, investors rushed to buy in without conducting thorough research. This FOMO-driven behavior led to inflated prices that were detached from the underlying technology and fundamentals of many projects. The subsequent crash taught us the importance of making informed decisions based on sound research rather than being swayed by market hype.

- Diversification is Key, The 2017 crypto crash highlighted the perils of overconcentration. Many investors had placed their entire portfolios into a handful of cryptocurrencies, hoping for massive gains. However, when the market corrected, these portfolios suffered disproportionately. Diversification across different types of assets, industries, and even investment strategies can help mitigate risks and provide a buffer during times of extreme volatility.

- Due Diligence Matters, During the crypto boom of 2017, countless projects emerged, each promising groundbreaking solutions and potential riches. However, a significant number of these projects lacked substance and were driven solely by marketing hype. Investors who failed to perform thorough due diligence often found themselves holding onto worthless tokens when the market eventually corrected. This experience reinforced the importance of scrutinizing projects, understanding their technology, team, and real-world applications before investing.

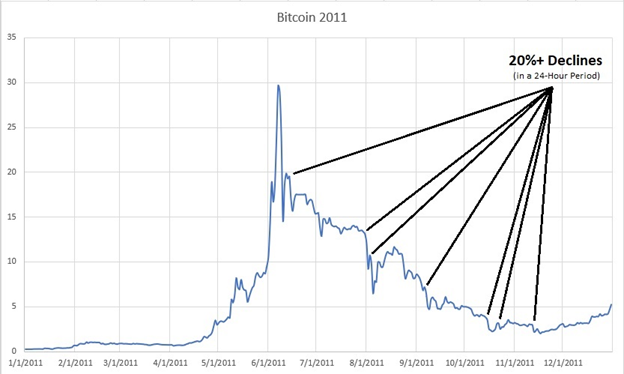

- Volatility is Inherent, Cryptocurrencies are notorious for their price volatility, and 2017 was a stark reminder of this fact. Prices of various coins and tokens skyrocketed to astonishing levels only to plummet shortly thereafter. This extreme price volatility is inherent to the cryptocurrency market and serves as a reminder that potential rewards come with substantial risks. Being prepared for sharp price fluctuations and having a long-term perspective can help investors weather the storm.

- Regulatory Uncertainty Can Trigger Panic, The 2017 crypto crash was partly triggered by regulatory crackdowns in various parts of the world. News of potential bans, strict regulations, and government interventions led to panic selling among investors. This experience underscored the significance of staying informed about the regulatory landscape and understanding the potential impact of regulations on the cryptocurrency market.

Conclusion :

The 2017 crypto crash was a pivotal moment in the history of cryptocurrencies, serving as a reality check for investors who were caught up in the frenzy. While the market has evolved since then, the lessons learned from that period remain relevant. In today's crypto landscape, investors can benefit from these lessons by conducting proper research, diversifying their portfolios, and maintaining a rational approach to risk and reward. As the market continues to mature, the experiences of the past can guide us toward a more sustainable and informed approach to cryptocurrency investing.