In the rapidly evolving cryptocurrency landscape of 2025, stablecoins have transcended their original role as mere price-stable assets to become fundamental building blocks of the digital economy. The Steem Backed Dollar (SBD) stands at a pivotal moment in its evolution, facing both unprecedented challenges and extraordinary opportunities. As traditional finance increasingly intersects with blockchain technology, SBD's unique position as a content-creator-focused stablecoin offers fascinating possibilities for innovation and growth.

- Understanding SBD's Role as a Stablecoin: A Revolutionary Approach

SBD represents a groundbreaking hybrid model in the stablecoin ecosystem, combining elements of algorithmic stability with social consensus mechanisms. This unique architecture sets it apart from both traditional fiat-backed stablecoins and purely algorithmic alternatives.

Advanced Stability Mechanisms:

Multi-Layer Price Discovery:

- Primary Layer: Witness-driven price feeds

- Secondary Layer: Market-driven arbitrage

- Tertiary Layer: Social consensus mechanisms

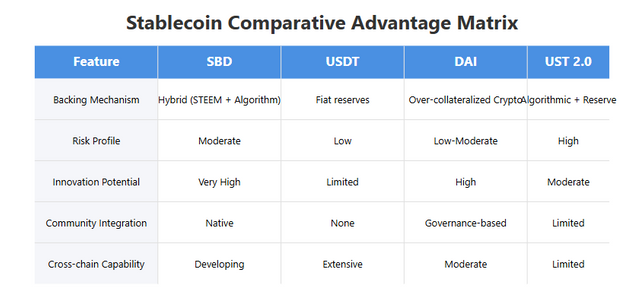

Comparative Advantage Matrix:

- Revolutionary Solutions to Stability Challenges

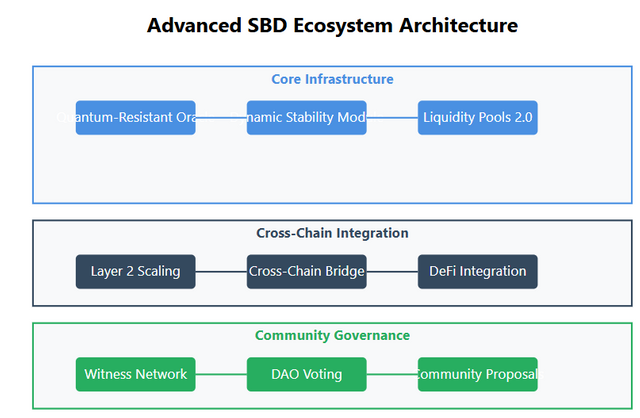

Next-Generation Stability Framework:

1- Quantum-Resistant Oracle Network

- Implementation of post-quantum cryptography for price feeds

- Decentralized validator networks with Byzantine fault tolerance

- AI-driven anomaly detection and correction

2- Dynamic Liquidity Pools 2.0

- Self-adjusting liquidity concentration curves

- Cross-chain liquidity aggregation

- Risk-segmented liquidity provision

3- Advanced Market Making Architecture

- Neural network-driven market making algorithms

- Predictive volatility management

- Cross-market arbitrage automation

- Revolutionary Utility Expansion

Web3 Integration Framework:

1- Metaverse Economics

- Virtual real estate transactions

- In-game currency bridging

- Digital content marketplace integration

2- DeFi 3.0 Integration

- Zero-knowledge proof-based lending protocols

- Cross-chain yield optimization

- Automated portfolio rebalancing

3- Social Finance Innovation

- Content monetization smart contracts

- Reputation-based credit scoring

- Collaborative content funding pools

- Strategic Response to Exchange Challenges

Innovative Trading Solutions:

1- Decentralized Exchange Network

- Layer 2 scaling implementation

- Cross-chain atomic swaps

- Automated market making pools with dynamic fees

2- Advanced Risk Management

- Real-time compliance monitoring

- Multi-signature custody solutions

- Insurance pool implementation

Revolutionary Infrastructure:

1- Hybrid Trading Protocol

- Centralized exchange integration bridges

- Decentralized liquidity aggregation

- Smart order routing optimization

2- Community-Driven Solutions

- Distributed validator networks

- Reputation-based trading systems

- Social trading integration

- Future Prospects: A Vision for 2030

Technological Evolution:

1- Quantum-Ready Infrastructure

- Post-quantum cryptographic security

- Quantum-resistant consensus mechanisms

- Advanced encryption protocols

2- AI Integration

- Machine learning price stabilization

- Predictive market analysis

- Automated risk management

3- Cross-Chain Interoperability

- Universal state channels

- Cross-chain atomic swaps

- Interchain security protocols

Market Evolution:

1- Global Adoption Strategies

- Integration with traditional payment systems

- Cross-border settlement solutions

- Institutional adoption frameworks

2- Regulatory Compliance Framework

- Dynamic compliance monitoring

- Automated reporting systems

- Cross-jurisdiction compatibility

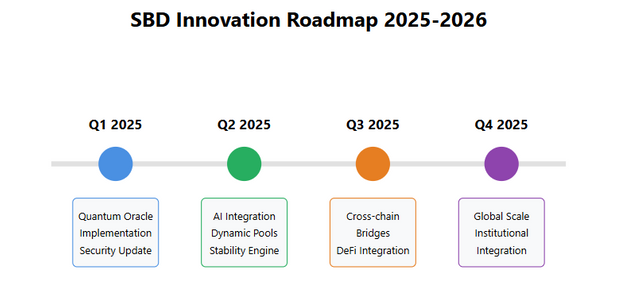

Revolutionary Implementation Strategy

Phase 1: Foundation Strengthening (2025 Q1-Q2)

- Implementation of quantum-resistant oracle network

- Launch of advanced market making system

- Development of cross-chain bridges

Phase 2: Expansion (2025 Q3-Q4)

- Integration with major DeFi protocols

- Launch of metaverse partnerships

- Implementation of AI-driven stability mechanisms

Phase 3: Global Scale (2026+)

- Full regulatory compliance framework

- Universal cross-chain operability

- Advanced institutional integration

Conclusion: Pioneering the Future of Digital Value

SBD stands poised to revolutionize the stablecoin landscape through its unique combination of social consensus, technological innovation, and community-driven development. The challenges facing SBD are not merely obstacles but opportunities for transformative innovation. By implementing these advanced solutions and maintaining focus on community-driven development, SBD can emerge as a leading force in the future of digital finance.

The path forward requires bold vision, technical excellence, and unwavering community support. Through the implementation of cutting-edge technology and strategic market positioning, SBD can not only overcome current challenges but establish new standards for stablecoin functionality and utility in the Web3 era.