Traders and Investors are always getting themselves trapped in holding losses, rug pulled. No matter how hard they try to analyze the Crypto they are investing into, you will see that out of 10 investments only 2 might get them into profits and the rest will be in reds due to the wrath of bears. There is one thing they tend to ignore when investing especially newbies, "Crypto Hyping walks hand in hand with FoMo". Lets first define these 2 terms Hype and FoMo and see how they move hand in hand.

What is Crypto Hyping?

Crypto Hyping is when a project is always trending in the spotlight and a lot will be said about that e.g things like this is gonna be in the top 3, this is gonna be used as a currency, this is gonna be better than Bitcoin, this is gonna be listed on Big Exchanges etc. Mostly when investing we always try and find crypto which is on the spotlight and we jump in and invest. There are good projects out there and most investors ignore them because they are looking for something trending.

What is FoMo?

FoMo is a term which is well known in the Crypto trading and investing and its the short abbreviation of "Fear Of Missing Out". This is when investors see a crypto currency about to explode and they quickly invest in that asset so that they enjoy the ride as it goes to the moon.

How does Hyping and FoMo relate?

As we defined, when a project is being marketed its is always hyped and a lot of positive stuff will be said and this will make the investors curious. Then due hyping you will see that the crypto asset will start showing bullish sign and making some spikes ready to explode and as it start going up the investors will jump in so that they don't get left out.

As it starts making its stride to the moon some fuel will be added to the fire and you will be told to buy more before its too late and that's when FoMo kicks in. As you add more positions you might just get into profit for some time and the asset slows down. The reason for this is, the smart money always buy value and sell at premium, so when they first buy they wont tell you to buy. When they are fully in holding their project they then start hyping and when you invest you will be providing liquidity for them and they offload their positions and you will be left holding some losses.

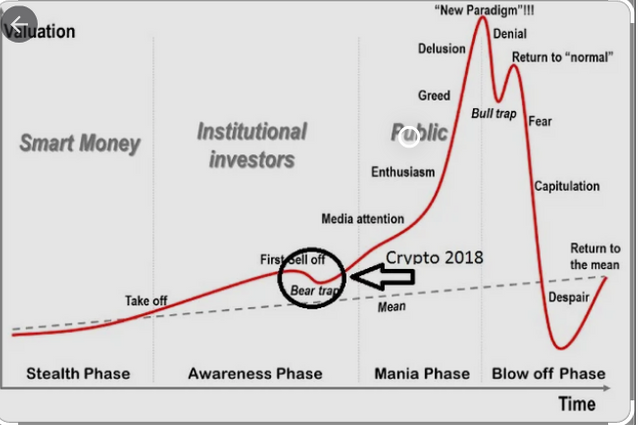

The above picture shows how it all happens from the start till the end. Smart money is always the first to invest in the asset and they then introduce the asset and the institutional investors jump in. Now that's when hyping starts as the assets is now on the public map and when it hits the peak the smart money and institutional investors will be out already and the rest will be trapped.

How an Investor should deal with Hype and FoMo?

Its so simple, the first thing a trader should do is to dig dipper before investing in that asset. Secondly make sure you buy because you find it worthy to invest in not because of hype and let FoMo take control of you investing instincts and mind. Always try and avoid hype by all means necessary before you decide.

Make sure you invest in something with a clear crafted whitepaper backed with implementation showing the future plans, buy the idea backed with actions not just buying an idea and Last but not least, don't be derailed by too much noise you hear.

Also Follow my Links for more of these article and earn Crypto for writing and reading on Publish0x and Read.cash and my Twitter.