Source of info: CryptoBridge Dex Review

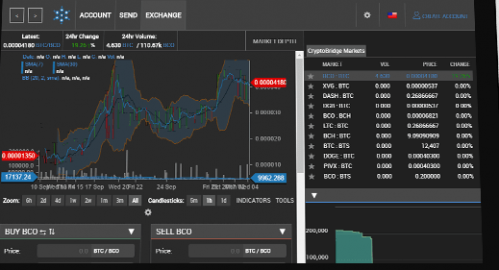

CryptoBridge is one of the new entrants in the market, also running on the BitShares Network. However, it is doing quite well with $1,582,838 in volume.

The platform allows users to deposit, withdraw and trade all popular altcoins without points of failure if you know what that means.The company also runs its own token — BridgeCoin or BCO. With this token, you can stake and own shares.

Publishing a transaction on the network requires a super majority running federated network of gateways to agree. These gateways are issuing the same multi-signature proxy assets. Each of the gateway independently verifies the transactions of the other nodes to ensure each gateway stays honest.

How it works and benefits

It works in a very simple way, with a quick sign up that allows easy and quick generation of username and a cryptographic password that you must store safely.

The platform uses Graphene, which can process up to 100.000 transactions per second for very quick transactions. The fact that it runs on BitShares/Graphene does not mean it is a fork of BitShares/Graphene. It also differs from other BitShares Exchanges in a number of ways. First, unlike a BTS Gateway which is a central point of failure because the user depends on the gateway run by the company to deposit/withdraw funds, CriptoBridge uses a federated distributed network of gateways that communicate to each other.

Second, the BridgeCoin Profit Staking Coin ensures that 50% of the exchange profits are shared with holders of the coin. They did their eleventh staking payout last month, distributing about $73,275 to users.

The average confirmation time on the platform is just 3 seconds. Additionally, it is possible for third parties to build applications that can run on the DEX thanks to the API.

Trust-reduced issuing and withdrawing of the supported coins is possible with the company’s multi-signature federated gateway software. A dozen trusted gateways use the software, which runs in multiple continents. And with your private keys, you can access coins even if the company goes out of business.

Trading runs on decentral blockchain and users create and access orders on the orderbooks. You can do that using a web wallet or a Windows or Mac OS X client. Thus the software acts as a wallet and exchange at the same time. You also need to download and safe it to a good place to avoid losses.

For the market makers, the company is running a program that allows you to get back the order fees. This also cuts into 50% profit share for the stakers. The company dedicates the 25% of profits to market makers and 75% to BCO staking. Market makers create liquidity by creating sell or buy orders thus reducing the spread. Adding a market adds value to all existing and potential participants.

You can access information about staking here.

When a maker creates a limit order, they get their fees back or actually receive 50% of the market taker’s trading fee. At the end of the day, they earn 0.05% per filled order.

Other information

The company plans to add Omni protocol support for Tether coin this June, in addition to doing Blockfolio integration. ERC20 token support, Android and iOS apps and bitUSD and bitCNY support are coming this July while Cryptonote protocol support will be on August this year and Graphene protocol support in October.

The project was created in 2017 and 50 percent of all profits go to BridgeCoin owners.

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit