The US Commodity Futures Trading Commission (CFTC) published a two-page newsletter on the so-called "pump and dump" schemes. In it, in addition to a brief digression into the history of such frauds, there is an announcement of potential rewards for individuals who are ready to act as informants about such activities.

"Pump and dump schemes in the field of virtual currencies and digital tokens continue to exist largely due to their anonymity. If you have exclusive information that may become the basis for imposing a fine of $ 1 million or more, then you will be able to claim 10-30% as a reward, "the report said

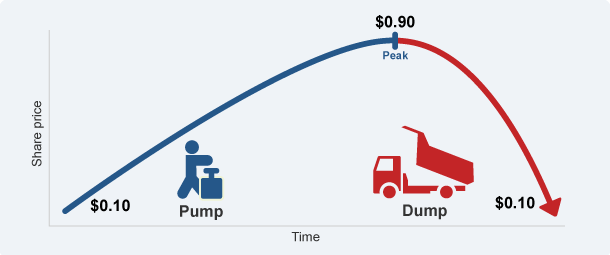

Note that "pump and dump" is a kind of market speculation tactic in which a group of people intentionally manipulates prices for an asset (in this case, a cryptocurrency) in order to artificially inflate its value and then sell it quickly. According to the CFTC, this kind of illegal activity is far from new.

"Pump and dump schemes appeared much earlier than virtual currencies and digital tokens. Historically, this was the prerogative of the so-called "boiler rooms", which aggressively promoted joint-stock companies through false promises of an early breakthrough, the release of a revolutionary product or merger with major competitors. Along with the demand for securities of these companies, stock prices also grew. When they reached a certain point, the "boiler rooms" sold all their papers sharply, after which the exchange collapsed, and investors remained with the depreciated assets, "the report says.

According to the CFTC, today this process has become much simpler and more destructive. For example, social networks and online chats allow you to convey the message and coordinate the actions of thousands of people. The document also notes that speculators have a lot of new tools, including "fake news" that large corporations or investment firms are allegedly going to make a deal with a small company.