Dear Steemit Friends,

This past weekend the overall cryptocurrency market has struggled to stay on a positive trajectory. My normal diaily routine is to wake up and check how the market is doing, and to my surprise (or not), today signaled a pretty good start recovering some of the losses over the weekend. Typically when this happens, it's because something positive happens or is projected to happen. Going through the typical Cryptocurrency news which seems to dominate most headlines these days, I came across the following article from Fortune:

This Big Cryptocurrency Acquisition Could Create a Wall Street-Style Financial Giant

Eager to learn more, I clicked on the link and read about Circles recent announcement...

Circle, the peer-to-peer payments technology company founded by Jeremy Allaire and Sean Neville in October 2013 just confirmed and announced that they will be acquiring Poloniex, a US-based digital asset exchange for around $400-million.

I have been mining and trading digital currencies for over 5 years now and like most people have used several Cryptocurrency exchanges. I happen to also have the Circle App installed on my Apple IPhone, however, I can't remember a time that I have ever used it.

Like most people who have ever traded, bought, and sold cryptocurrencies, I have used Poloniex. In fact, at one time it was the primary exchange up until a few years ago when I switched to Bittrex. Poloniex, like most exchanges, added a wealth of features to provide a fully immersive trading experience for its users. The site had analysis charts and a live chat feature that was unique from any other exchange that helped most people stay on top of news, updates, and analyses from other users on price trends realtime to help make better (and sometimes worse) trading decisions. For an exchange, there was a good amount of security, a decent number of users and trading volume, and supported probably the largest variety of digital currencies over any other exchange (over 100 when I was using it). It was the first exchange to list new digital currencies before any other exchange, which was both good and bad and it had the low deposit and withdrawal fees compared to any other exchange.

I left Poloniex almost a year ago when transaction issues and delays in withdrawals were starting to crop up. My last withdrawal took 2 weeks to process and a number of support tickets just to get it to move. They had also updated the interface and removed the chatbox (also known to be a huge trollbox) which to me was a helpful tool to stay on top of potential buy opportunities and trading advice. It was also a great way to notify or get updates from Admins on tickets and concerns that had been raised.

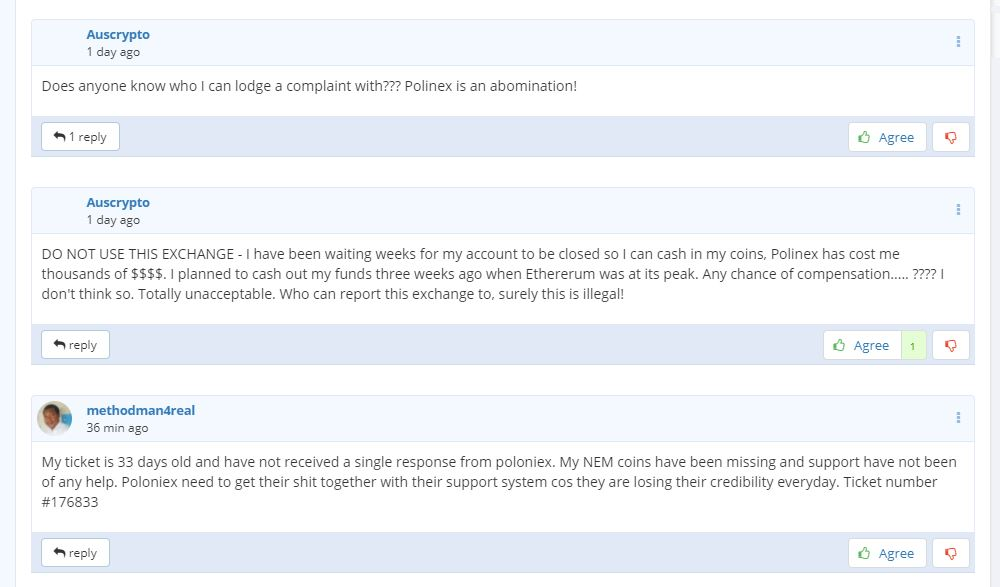

Sample Complaints - Image Source

I am personally glad I got out when I did because, for the longest time after I had left, a number of issues and complaints have plagued the exchange. The site was a victim of being hacked, although they did compensate all those impacted and has more recently been the center of attention as having the worst and slowest customer service response time. Aside from these issues, the platform has been plagued with slow approval and withdrawal times causing a lot of users to lose funds through the natural volatility of cryptocurrency prices. Since Poloniex does not deal with fiat, often times users would end up receiving their withdrawals at a value much lower than when they processed the withdrawal.

The acquisition by Circle, a more well-known and more respected company may signal better times ahead for the exchange. Because investment bank Goldman Sachs is also a strategic backer of the company, this could also help further legitimize the cryptocurrency space. This, of course, comes with an increased likelihood that Poloniex may follow other competitors like Coinbase and become a regulated exchange.

Circle Co-Founders - Image Source

Circle co-founders Jeremy Allaire and Sean Neville explained their vision for Poloniex in a statement saying:

that they plan to build on the work done previously by the Poloniex team, setting the goal of pushing it past being "an exchange for only crypto assets."

"We envision a robust multi-sided distributed marketplace that can host tokens which represent everything of value: physical goods, fundraising and equity, real estate, creative productions such as works of art, music and literature, service leases and time-based rentals, credit, futures, and more.

Using Circles existing technology and features, the company can also expand Poloniex's capabilities by integrating fiat-to-crypto (USD, EUR, and GBP) connectivity and transactions allowing the platform to scale and expand its user base. Circle also committed to continuing to run Poloniex as a separate entity and immediately focus on address customers support requests and technical issues by leveraging the operational and customer support resources from Circle.

In a statement by Poloniex, the company said:

"We recognize that our extraordinary growth these past few years has not come without some growing pains for our users. We look forward to bringing Circle's experience to increase the scalability and reliability of our platform and operations."

This is a great day for Poloniex users and may encourage users who left the platform to return and give the exchange a second chance. It's expected that during the transition, users should not see any disruption in services, however, I will probably only return once some updates and integrations have happened to improve the overall experience and capabilities of the platform.

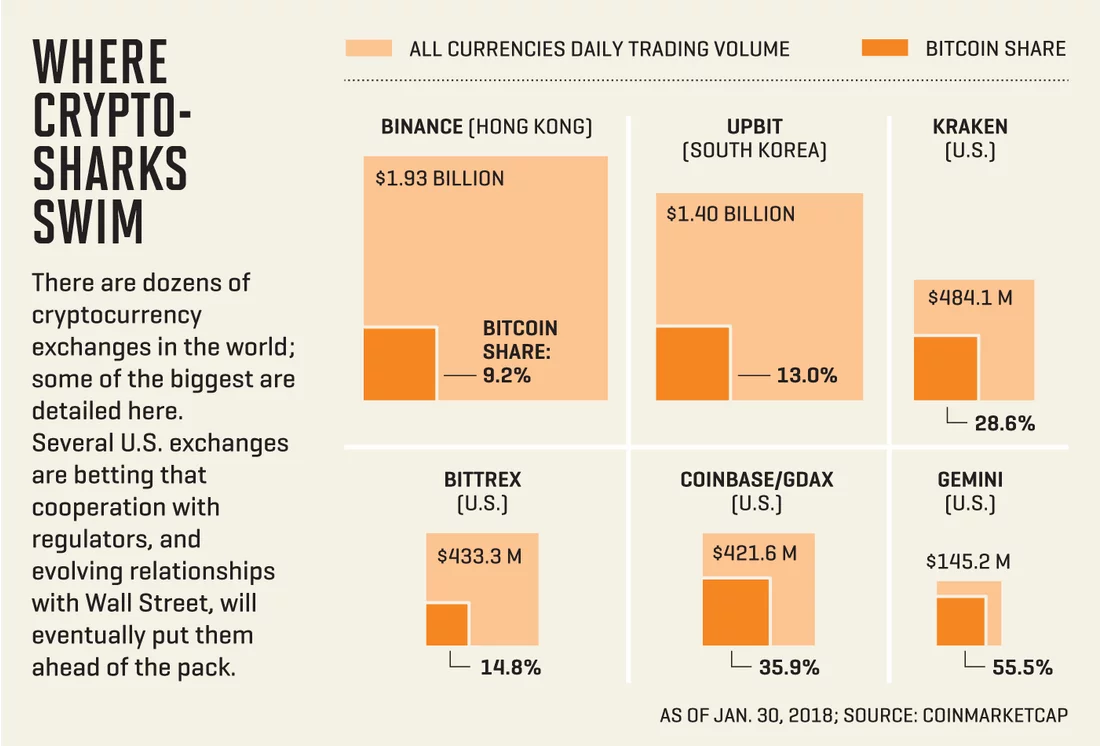

Trading Volume on other popular exchanges - Source

Circle has its work cut out for them. With the number of existing exchanges vying for customers business, integrating unique features and offerings that will make Poloniex standout is no easy task. Following on the heels of some of the other more established exchanges (not to say that Poloniex isn't itself established) the platform will be playing catch up and doing a lot of damage control when it comes to its current reputation.

Circle's statement demonstrates that they understand the pain points of the existing users and has a vision for where they want to take the exchange. Circle is valued at over $480-million and possibly close to $1-billion or more after this deal and although entering a volatile business, says they "are very stubborn about the overall vision, but really flexible about how to get there."

According to Fortune:

The company was the first startup to be awarded a BitLicense, a certification for virtual currency businesses issued by the New York State Department of Financial Services. It was the first Bitcoin outfit to earn an electronic money license from the UK’s Financial Conduct Authority. And Allaire, since last year, has advised the International Monetary Fund on fintech policy.

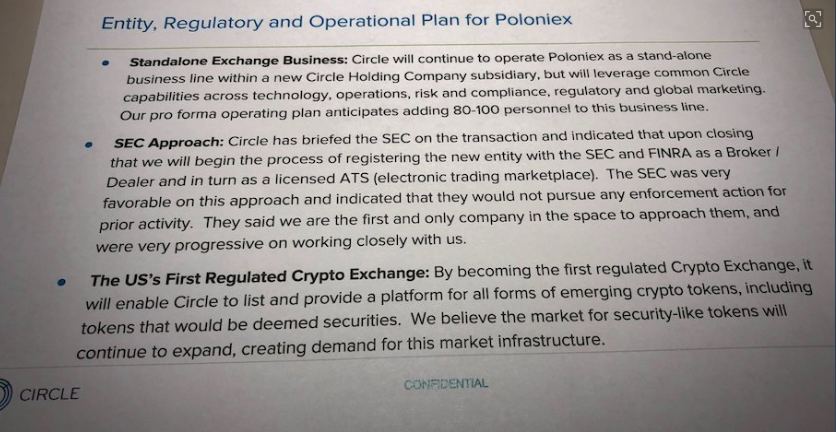

Regulation is coming - Image Source

All of the wins above and their close relationship with regulators will be expeience and tools that Circle will leverage to modernize and expand the Poloniex platform. In fact, The SEC did indicate that regulators would treat Poloniex as a new entity and "not pursue any enforcement action for prior activity" at the exchane as long as Circle cleans up Poloniex and turns it into a regulated exchange. They are willing to overlook any rules that were broken in the past and move forward building a well-regulated marketplace.

Leaked Document from Circle presentation - Image Source

I'm not for centralization and banks taking control of cryptocurrencies, but this does help to legitimize and open the possibility for financial markets to take digital currencies more seriously. Only time will tell how the market reacts and if Poloniex will be better now that it is in the hands of Circle. I am excited to see where this goes and I hope this will kick off a bullish trend igniting a move back to the moon for most currencies.

Thanks for taking the time to read. Let me know what your thoughts are about the acquisition and the future of Poloniex. If you have any questions, inputs, or feedback, please feel free to post a comment below. I would also appreciate support in the form of Upvoting, Following, and Re-steeming my post if you found it informative.

If you want to read more about the acquisition, you can refer to the following articles

Business Insider - A Goldman Sachs-backed tech company just bought a major crypto exchange for a reported $400 million

Coindesk - Circle Buys Crypto Exchange Poloniex

Poloniex - POLONIEX JOINS CIRCLE

Smart move on their part. If you can't beat them, buy them! Here come the big banksters to the crypto party!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

The government is going to find a way to get their share of the pie no matter what.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I never really liked Poloniex. The chat was always filled with people trying to pump-and-dump coins and there was never really anything special about the interface for me. The only positive about them is probably the low fees, but I never really used it to benefit from that.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It was good in the beginning. I learned a lot about trading. I agree with the chat box. You cant always trust the advice you get there. Just need to make an educated decision on the information you have. If Poloniex can get back to where it once was when it first launched, I may consider checking it out and maybe eventually return. It won't be my sole exchange though...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

are you serieus !!! 1 SBD to speedvoter !!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This comment has received a 0.23 % upvote from @speedvoter thanks to: @laefboy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This comment has received a 0.03 % upvote from @speedvoter thanks to: @laefboy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thanks lot

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This comment has received a 0.05 % upvote from @speedvoter thanks to: @laefboy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received a 3.04 % upvote from @speedvoter thanks to: @cloh76.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This post has received gratitude of 2.77% from @appreciator courtesy of @cloh76!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit