In the wake of neglecting to stem the rising prominence of cryptographic forms of money through their notices, the national banks have stooped down to subsidizing hostile to crypto battles. This move will just diminish the trust in the national banks and urge new financial specialists to enter the crypto world.

In the meantime, the Venezuelan government is intending to dispatch another cryptographic money called the petro. Each new coin will as far as anyone knows be sponsored by one barrel of oil. In any case, there is an unavoidable issue on the national bank's validity that is issuing the petro. Experts trust that the petro is well on the way to wind up not bringing the normal outcomes.

Then again, Bitcoin keeps on drawing in first-class ventures. After the current fall, there are reports of a merchant purchasing about $400 million worth of Bitcoin between Feb. 09 to Feb. 12.

Individuals are continuously turning positive on Bitcoin by and by. Shark Tank's Robert Herjavec trusts that Bitcoin will top its 2017 mid-December high of about $20,000 for the time being.

We should perceive what does the outline design gauge?

BTC/USD

Merchants who tail us are conveying long positions that activated on Feb. 15. We had suggested booking 50 percent benefits at the 50-day SMA, and most brokers ought to have sold when Bitcoin aroused to an intraday high of $11,348.99, yesterday, Feb.18.

We had likewise suggested trailing the rest of the positions with a reasonable stop misfortune. As each broker has an alternate exchanging technique, we didn't give a particular trailing stop misfortune.

The BTC/USD combine is exchanging inside a rising channel. For whatever length of time that it exchanges over the help line of the channel, it can reach $12,000 levels.

In the event of a fall, the help line of the rising channel and the 20-day EMA will go about as solid help. In the event that these two levels break, the cost may tumble to $8,400. In this manner, merchants who are still left with 50 percent positions should keep the stop misfortune at $9,800.

We didn't suggest shutting the total position on the grounds that Bitcoin will wind up positive once it manages over the dropping channel.

ETH/USD

Ethereum mobilized near the 50-day SMA yesterday, Feb. 18, coming to an intraday high of $979, near our objective target of $1,000. Expectation merchants would have book benefits on half positions.

For as far back as four days, the ETH/USD combine has been taking help at $900 levels. Accordingly, we prescribe raising the stop misfortune on the rest of the position from $775 to $900. The objective target is a move to the protection line of the diving channel.

In the event that the bulls prevail with regards to breaking out of the channel, a move to $1,200 is likely. Then again, if the bears separate underneath $900, there may be a tumble to $780 levels.

BCH/USD

Our objective target on Bitcoin Money was a rally to the 50-day SMA, near $1,800 levels, be that as it may, yesterday, Feb.18, it diverted down from $1,639.251 levels.

Our underlying stop misfortune was set at $1,100. We need to raise this stop misfortune to $1,400 on the grounds that if most digital forms of money divert down from their protections, the BCH/USD match may go with the same pattern.

So we should not lose cash on it.

On the upside, please book fractional benefits above $1,750 and hold the rest with a trailing stop misfortune for an objective goal of $2,000.

XRP/USD

As opposed to our desire, Swell keeps on exchanging a tight range. It has not taken part in the pullback like the other best cryptographic forms of money. The main comfort is that it is maintaining over the 20-day EMA for as far back as four days.

We had proposed an underlying stop loss of $0.86, however we should raise this stop higher in light of the fact that if the best monetary forms turn down, the XRP/USD match will likewise fall pointedly. If it's not too much trouble raise the stops on the entire position to $0.95.

On the off chance that the tight range settle on the upside, please book benefits on 50 percent position at $1.45. Trail the rest of the position for a moment target goal of $1.74.

XLM/USD

Stellar additionally has been stuck in a tight range for as far back as four days. It is exchanging near our proposed purchase levels of $0.45.

We foresee a move to the upper end of the range at $0.63. Yet, for that, the XLM/USD combine should break out of the 50-day SMA.

On the drawback, bolsters lie at the 20-day EMA, the flat line at $0.41, and the channel line at $0.38.

For the time being, please keep up the stop misfortune at $0.30 on a day by day shutting premise (according to UTC). We have to think about bringing it up in two or three days.

LTC/USD

In our past examination, we had prescribed to book benefits on 50 percent positions at $240, and Litecoin came to an intraday high of $239.5 on Feb. 16. We trust that the merchants would have sold portion of their positions set up at $180.

For as long as four days, the LTC/USD combine has been exchanging a scope of about $208 to $240. A breakout of this range will be a positive move, and we expect a rally to $270 and after that to $307.

Our stop misfortune is right now at breakeven. We need to lessen our hazard and pocket a portion of the paper benefits. That is the reason we should raise the stops on the rest of the 50 percent long positions to $200.

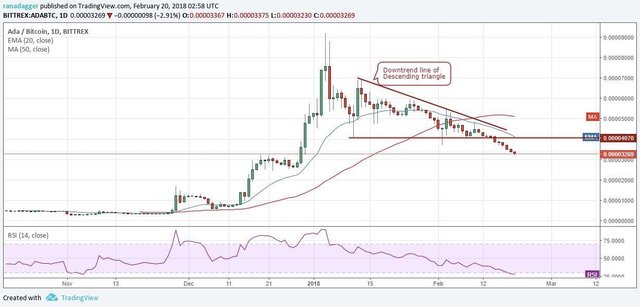

ADA/BTC

We have been bearish on Cardano for as long as few days since it has separated of the bearish diving triangle design. In spite of the fact that a pullback to the breakdown levels of 0.00004070 is conceivable, the digital money stays negative as long as it exchanges underneath the downtrend line of the slipping triangle.

The ADA/BTC combine is probably going to slide to the following help level of 0.0000246. Our bearish view will be negated if the computerized money breaks out of the downtrend line, in light of the fact that a disappointment of a bearish example is a bullish sign.

NEO/USD

As NEO is exchanging inside a dropping triangle design, we had suggested a fast exchange with a long at $121 and an objective target of a rally to the downtrend line of the diving triangle design.

The NEO/USD combine achieved our objective target on Feb. 17, achieving a high of $138.35, where the brokers more likely than not shut their positions.

An endeavor by the bears to sink the cryptographic money fizzled Feb. 18. It is as of now endeavoring to break out of the downtrend line of the plummeting triangle, which will refute the bearish example. In the event that the bulls support the breakout, we may see a rally to $169.

On the drawback, the moving midpoints and the flat line at $120.33 may go about as solid help.

EOS/USD

Of course, EOS diverted down from the downtrend line yesterday, Feb. 18. The 20-day EMA is at $9.76, and the 50-day SMA is at $10.8.

We trust that the bulls will confront hardened protection in the zone of $9.76 to $10.8. Along these lines, merchants can start long positions above $11, if the EOS/USD combine manages the level for four hours. The objective goal on the upside is a rally to $15 levels.

The stop misfortune can be set at $8.8.