Market sentiment

source: canstar.com.au

As much as there are at this point thousands of ways to read the charts, filled with theories and numbers, I'm still holding strong to skepticism. For the year I've been accompanying cryptocurrencies, I know of nobody that has been correct more often than not, which shows me that real traders, if they actually exist, don't share anything to the public at least.

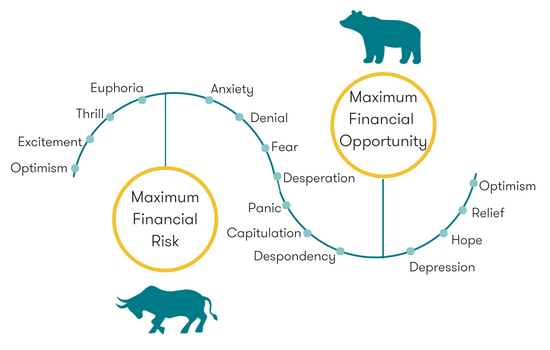

However one undeniable conclusion that I will carry to the grave, is that markets are driven by public sentiment. Things go up and down in value depending on how people feel about it, and possibly nothing more. Yes, of course I'm not oblivious to manipulation, but for the most part, what's being manipulated is precisely that, how people feel.

Knowing this both gives me peace of mind and also frustrates me. Why? Because I see people who are working against themselves almost every single day. Mind you, I'm not saying that there are no reasons to be critical, or to even be scared, but succumbing to those fears, spreading misinformation, etc, does little to nothing to help our case.

To put this bluntly: If sentiment is what drives markets, how can you affect in a positive way sentiment? Can you? Should you? Why or why not? Maybe these are questions that need asking, and if we refuse to contemplate them, then we should be able to predict how the game will unfold.

It echoes

I've been thinking about this particular truth in the past few weeks, mostly because it's always true, but within the context of my choices today, it's specially so. This is to say that the decisions I'm making today are sure to echo throughout my existence, and I'm under no illusion it works in any other way.

I also must remind myself and quite often, that I was one of those who had always complained about being late to the opportunity. I'm of those who would say "If I'd only had ....", as I would imagine a different present from the one I was living. So, it's understandable that when the markets were in all the hype and nobody believed the prices were ever coming down, I was experiencing regret yet again. "if I had only listened to my friend Amador".

There is even this meme out there that sums up precisely what was going through my mind last December; "Gosh... I wish Bitcoin would go down so I can get in" - Guess what? I got my wish, and yes I know it was not the universe answering my call either, don't worry.

Choices my friends, choices. If there is one thing that we need in order to play the game of life, is the ability to not be shutdown from choices. I didn't want much, not really, I just wanted a second chance and it seems like I got one, it seems like you did, we all did.

Facing reality

The day that I knew things were not turning around, the day when it became obvious that the second opportunity was well on it's way, I actually smiled a bit. Yes, I worried too, I won't lie, but I also knew what had to happen now, there was no way of delaying anything anymore.

You could say I came to grips with the real concept of what it means to be an early adopter of something. For a second, I thought I was not, I thought I had caught the second or third wave, and I was building my future on top of the structure others had built before me. This notion was comforting, but far from the truth.

All this to say, that now I know what I should be doing, and know it all too well. You see, I have dreams, big dreams. I've been called a dreamer my whole life and it has never felt as an insult, but I think I truly understand what they meant with their critiques. If I want to make it, if I want to truly fulfill all these crazy ideas in my head, I have to be prepared mentally, physically and yes economically. I can't think that focusing on one, will sort out the rest, just because I want it to, not anymore.

And yes, I know the markets will turn around, and I know that once again euphoria will take over, but I'll go into the madness armed with knowledge. I will know it's just another cycle, and the boom bust will repeat once more.

For now... we could use some stronger placebos, right?

Your statement above is precisely the foundation upon which the Elliott Wave Theory of market analysis is built! Buy the book and read it – it’s not filled with technical mumbo-jumbo but instead is replete with fascinating historical anecdotes and common sense examples of the type of psychology and logic quite similar to your own. You will love this book, Meno!

The Elliott Wave Principle: A Key to Market Behavior

In my view, the “Theory/Principle” does not necessarily “predict” price movement, but instead, provides a framework with which to follow, track, and at best, “anticipate” at what stage and degree of “euphoria” or “despair” a given market is displaying at any moment in time – and across all time horizons.

The larger the time-frame one observes, the clearer the picture becomes. Monthly charts that span several decades, render the most reliable footprints in accurately uncloaking the stages of mass human psychology behind past price behavior leading to the present – which in turn, gives the seasoned analyst a far better chance of anticipating future price paths and duration's vs. not having any knowledge as to how human emotion is currently affecting a present valuation metric.

Here is a working example reflecting upon my work in such endeavors.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

i do read your analysis Passion, every time you post them, i check them out

;)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

In truth, Meno - I'm more or less finished with my former obsession/passion for financial markets and analysis. The only thing I'm doing market-wise, (and I can do it while being several steps removed from day-to-day engagement), is monitoring the S&P 500 for long-term buy and sell signals for a small group of loyal subscribers who have been with me since 2005.

After 30-years of getting caught up in this hope - that hope, and the next hope... Waiting for a crash, a collapse, or a skyrocketing of the price of Gold, Silver, or Crypto's - I just got tired of waiting.

The more things change, the more they stay the same - but with a slightly different twist. I got tired of beating dead horses and saying the same things over and over and over again - only to listen to the sound of the underlying songs forever remaining the same.

Thankfully, I played a lot of my cards right, and for now anyway, I don't have to worry or obsess about any of this shit. My passions and focus have reverted to those of my youth. If check you my latest post, you'll completely understand exactly what I'm talking about.

If I sound a bit harsh or authoritative at times, it's only because I hope to relay what I know now vs. what I knew 20 or 30 years ago, and share what I've experienced to date. It is my aim to impart that perspective to help others balance their own perspectives in the most healthy and prosperous way.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I agree with so much of what you're saying here @meno.

I think there is a big case for manipulation in the crypto market, the whales can turn the market from the downside to the up when it suits their strategy. But having said that, sentiment is king in determining a strong bull... or bear market.

I also see this current market as an opportunity rather than a crash. I made a dtube video yesterday about why I plan to invest in (buy) steem for the first time. One of the main reasons for my choice was all the development and projects I witnessed at steemfest 3. There is a lot going on with the steem blockchain which isn't necessarily reflected in the current price. I'm looking at boosting myself up to dolphin in the next few days. 🙂

Fck black Friday... It's steem sale time 😉

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hell yeah .. we need more dolphins in the pod

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well you're going to be right and I hope that a lot of people can join the new wave and among all live this new madness. And that as the one who enjoys almost as much of the trip while preparing it as on the trip so enjoy people like I am doing now. Thanks for the push @meno !!!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hmmm, after reading half of your post I was like where do I sign, where do I buy, I think you are on to something... This would be a good time to make a small investment at least... Problem is I only got "Scared Money"... Im resteeming this!

/FF

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

the swings in crypto are bonkers.... exciting time though, peace

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@memo if the market is affected by people's feeling then I am going to be extra positive knowing that cryptocurrency is going up big time. My intuition tells me this and I trust this wholeheartedly.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for sharing. Cycles alright! But who created these cycles?! Could some people interfere with these cycles?!

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I suspect the current bear markets are institutional money shaking off weak hands

Posted using Partiko Android

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A lot of the shitcoins will die off along the way as people find out there is nothing behind them but hot air. If we can get behind the right ones at the bottom however then we have the opportunities that we all want to see. All we can really do is try to get behind the right coins and make our profit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I remember thinking about the genius of many who bought STEEM below $1 when I started in January and now I see many regret that decision. However, I still see it as visionary and brilliant as it the current markets are driven by manipulation, fear, and regret which are emotional decisions and do not take any fundamental thought process into consideration. Most are just following the trend that bitcoin is setting which leads to inefficient prices… and opportunity!

Posted using Partiko iOS

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations!

This post has been granted a 100% upvote, courtesy to @wokeprincess, from BlissFish!

Enjoy the Bliss!

Join us on Discord!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

🏆 Hi @meno! You have received 0.1 STEEM reward for this post from the following subscribers: @cardboard

Subscribe: automatically support your favourite steem authors :) | For investors.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit