AxenS is an upcoming ICO project that wants to establish a marketplace to enable small and medium size business to trade globally. Will it beat competitors like Venchain, Originchain or Eximchain? I did some research and want to share my findings from now on in my brand new cryptocheck series with you.

Preface & important info

If you look at the current crypto market you can find some ICO’s to go with everyday. Some are sold out in seconds, some won’t reach their goals and others are SCAM. As an investor it’s crucial to get as many information about the project as possible to decide if it will be worth investing in. I spent hours after hours to deep dive into those projects to cut through the marketing buzzword horsecrap (the best, highest, world’s first, decentral…) to get everything I need to now. I have time for that because I’m lucky to be able to work outside the 5–7 schedule by consulting brands in terms of digital communications & content globally. But time es limited for most of you because of work and private life. That’s where I want to help and share my findings in a neutral way in the future. Don’t take it as a financial advisory — read it, understand it and decide on your own please. Thanks!

This is AXenS

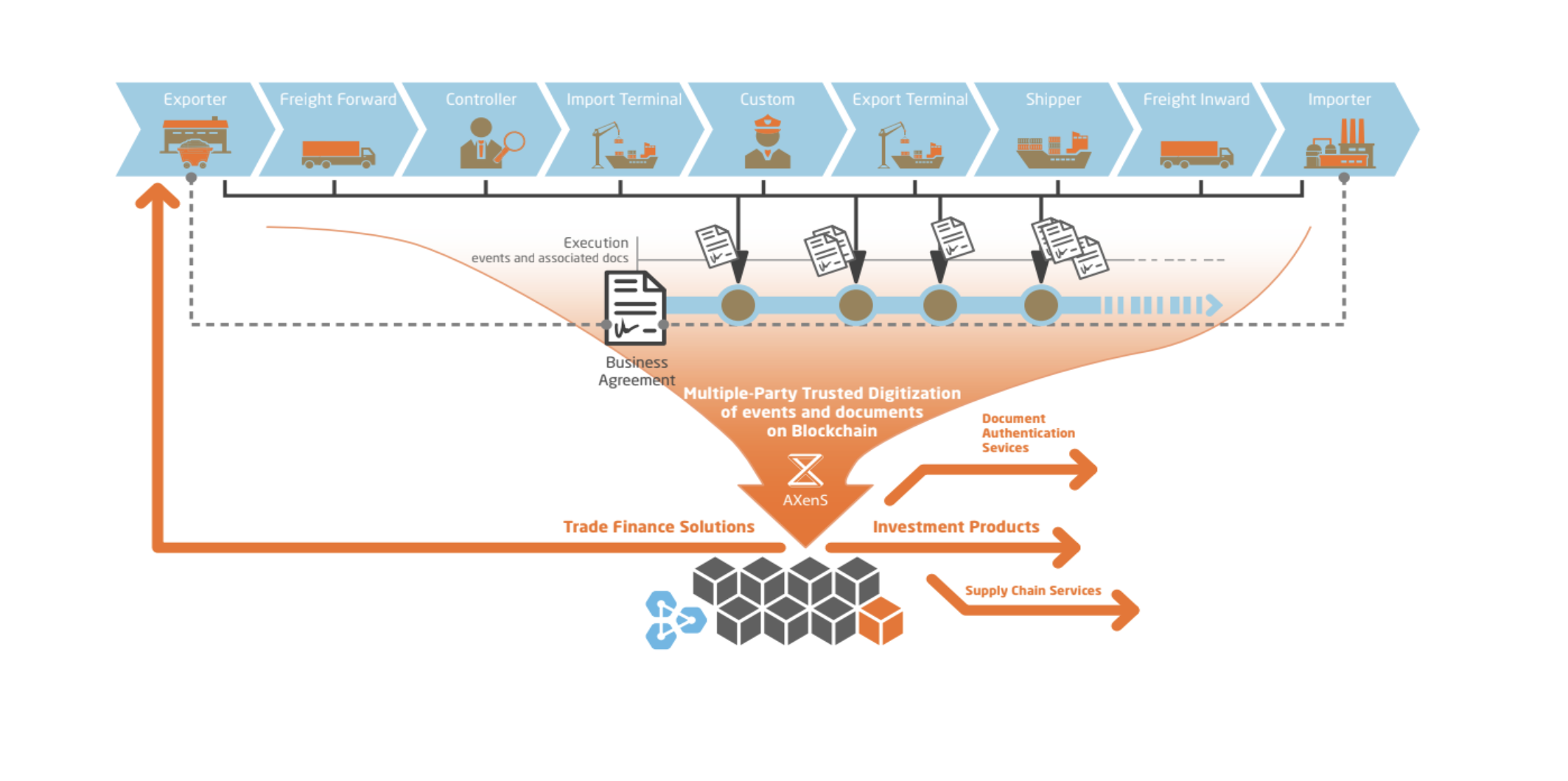

AXenS is a market place in which both lenders and borrowers can be matched. Borrowers will generally be small and medium enterprises who export goods and have a hard time getting credit from banks and other similar institutions for the export process. The export process includes things like transport, tariffs, storage, insurance, etc… to get the goods to the end buyer. Using the possibilities of the Blockchain, AXenS wants to keep track of the exported goods from when they leave the seller to when they reach the buyer. This comes with a high level of safety allowing AXenS and its partners to understand a trade deal fully and be able to lend money where banks would be scared to lend.

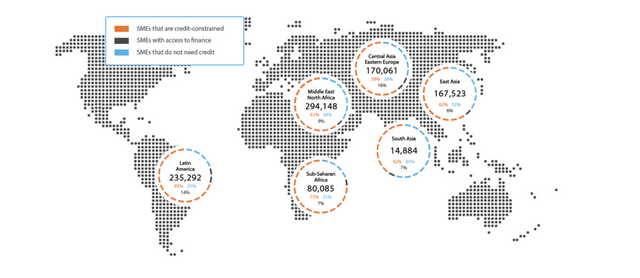

The chart below shows the number of Small and Medium Enterprises which are underserved by banks in the different regions. In most cases it is above 50% of the total. This is the target AXenS wants to work with.

Along with lending for export (trade finance), they want to provide or facilitate services which are needed to transport goods from point A to B (i.e. Supply Chain Management).

In short, AXenS wants to offer one central place where all services (lending, trade services) and stakeholders (importers, exporters, transport companies like shippers, trucking, air travel and warehouses, insurance companies, etc.) will be able to interact in a transparent, cost-efficient, prompt and safe manner.

Example

To understand it even better let’s say I am a medium size coffee plantation in Puerto Rico and I would love to export my goods to Germany. What now? I asked this question Samson Assefa, the CEO of AXenS (you see, I do my research ;)) via LinkedIn. Here’s his answer:

“We would use the buyer’s purchase order (or letter of credit), and the coffee itself as a collateral to lend to the coffee exporter. Furthermore, since most small businesses do not have the wherewithal and knowledge of logistics, etc.. (i.e. supply chain management part) to take the coffee to Germany, we would be able to book the ship, warehousing at the port, etc.. By digitizing all docs required for this transaction and placing them in one central place, AXenS provides a secure environment (tamper proof against fraud) and allows the process to be efficient (review and approvals of docs are quicker). By providing real time tracking afterwards, we will add transparency across all segments of the supply chain . All this translates into providing fuel for growth to the global trade business.”

Market Problem & Blockchain need

Whenever I make my research I also look if the problem they are going to solve is a real problem and if yes — does a Blockhain based solution make sense?

Market Fit

Well, regarding the market the world bank estimates an additional need of $1.3trn a year that small and medium enterprise require in lending. No, I’m not talking about TRN, I talk about a Trillion (1,000,000,000,000). But those banks and other similar institutions only use traditional parameters to see if they can lend. Thats harming those small and medium businesses. AXenS wants to get rid of that by eliminating the need for cumbersome documentation (digitization) and notary services and handles topics like Fraud, Costs, transparency in the process of lending and speed of transactions.

Blockchain Fit

After reading though everything I can say — yes, it makes sense to use the blockchain technology. Why?

By eliminating the need for cumbersome documentation (digitization) and automatic notary services; this handles topics like Fraud, Cost and Transparency in the process of lending and allows speed in the execution of transactions.

It enables the platform to digitally timestamp various parts of the supply chain process to have a proof of when goods or raw materials are shipped and received.

With the Blockchain, the automation of payments to the supplier can be triggered upon pre-programmed conditions. This should overall positively impact payment terms in the long term.

There is less risk for fraud since the truth is held by a single real-time source that is shared simultaneously across the Blockchain network.

And its cost efficiency through tokenization of trade credit.

Better then the rest?

As I said at the beginning there are already competitors like Originchain, Eximchain and of course the big one Venchain. It’s price is at 4.6 dollars since going public in August 2017.

What speaks for AXenS is a pretty good team.

The Team

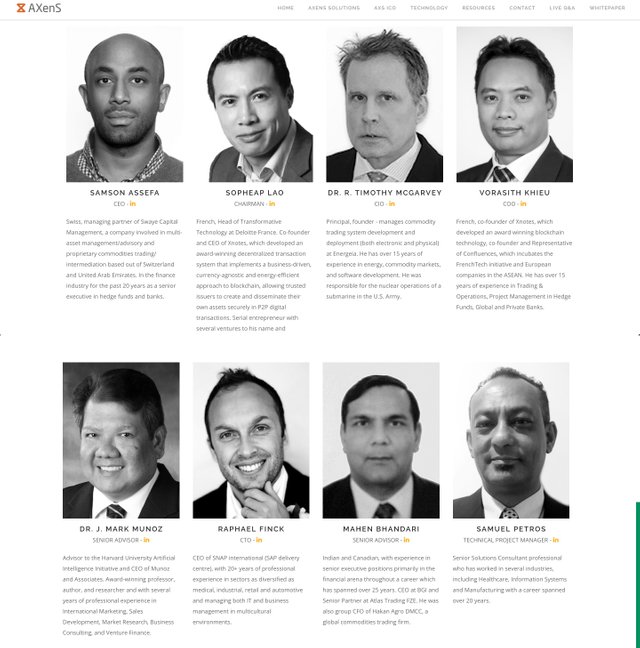

The AXenS initiative is led by a consortium of commodities trading companies. So they are primary participants in the business, who have been in the business already for years, and know what their customers want.

Also the personal experience level is quite interesting:

- Founder #1: 20 years of Financial experience in senior executive positions: hedge funds and banks. Currently a managing partner at Swaye Capital for global physical commodities.

- Founder #2: AXenS Co-founder and CIO has a PhD in physics from Caltech and was formerly responsible of nuclear operations for nuclear submarine in the US army, now principal of his own trading firm.

- Founder #3: Award winning blockchain technologist (Xnotes) and currently Head of Transformative Technology for Deloitte France.

- Advisor: A PhD in management from San Jose University. Advisor to the Harvard University Artificial Intelligence initiative. Award winning author, multiple published books, CEO of international finance firm.

Partnerships

Besides the team they have already formed strong partnerships both on the business and the tech side.

Business side:

- Energia Associates

- African Procurement Group

- JC International Trading

- DPI digital packaging

Tech side:

- XNotes: Award winning blockchain technologist

- Conure; Award winning HMI, UI and UX developers. Clients include Jaguar, McLaren, Ford GT and Thales

- SNAP: Silver member of SAP

- DIROX: global developer in 4 continents with 75 programmers

Based on Stellar instead of Ethereum

What I find quite interesting is that AXenS will run on the Stellar blockchain instead of Ethereum. After deep diving into the whitepaper the reasons make sense:

Stellar offers built-in token capabilities that can support multi-signature authorizations, generate dividends, limit who can hold tokens, and more.

There is a built-in token issuance system.

Stellar features a decentralized exchange where any token issued through Stellar can be instantly traded without relying on a third party exchange to list the token. This means newly issued tokens can be traded on day one.

Stellar has gained stature: IBM, and other notable institutions have Stellar Blockchain for its payment technology, it has its own token Lumens (XLM), which is in the top ten in Market Capitalization and there were several successful ICOs on its platform already (Why a $39 Million ICO Chose Stellar Over Ethereum).

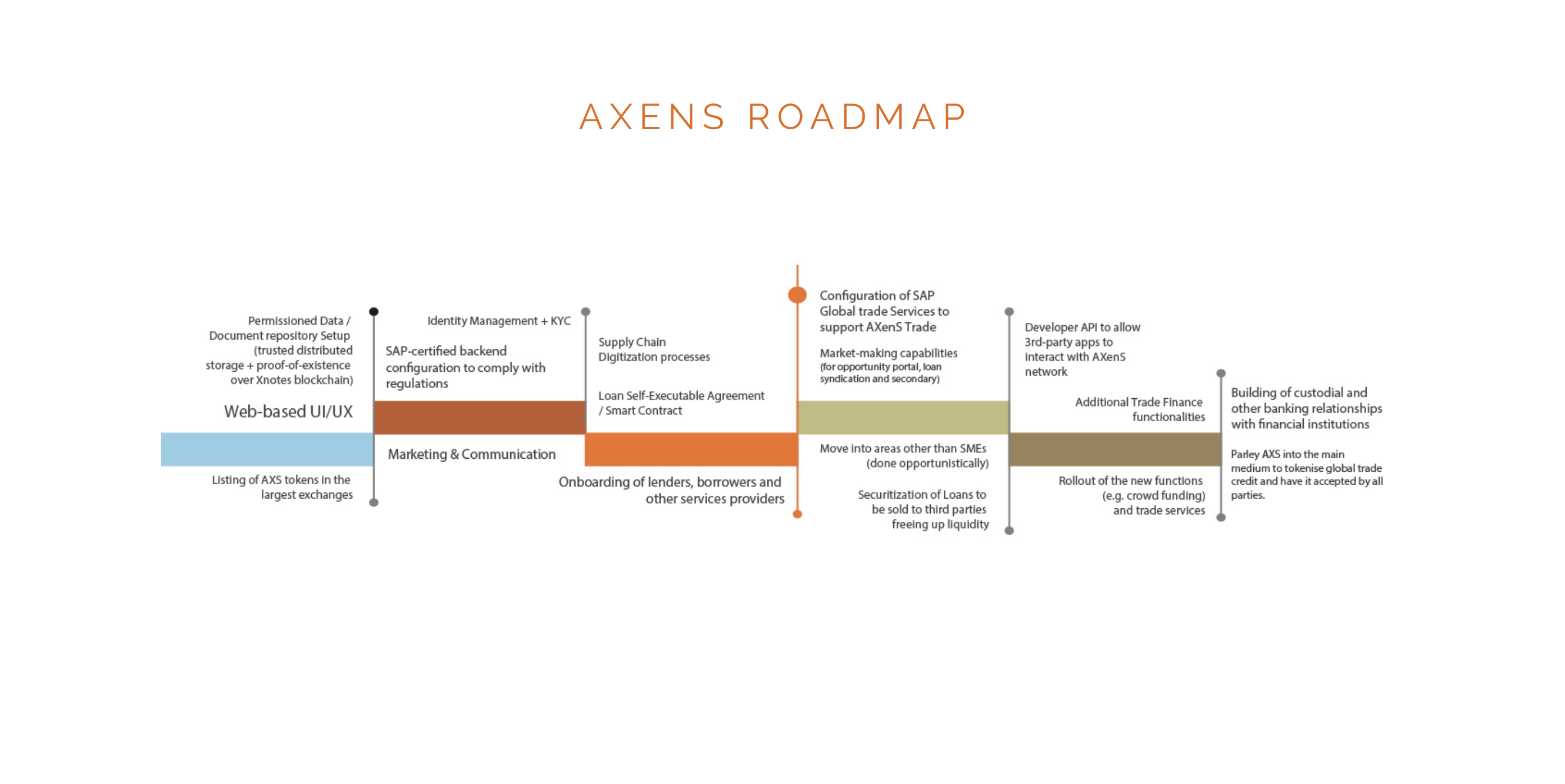

Roadmap

Everything I found out doing my research sounds pretty good. But just ideas are shit, execution matters. I asked the CEO what the status of the product is on a scale from 1 (idea) to 10 (working and accessible). His answer:

Five. The blockchain technology is nearly done through Xnotes; customized for Supply Management. Needs to be plugged into the backend SAP ERM system, and Front end user interface on Web.

Regarding the roadmap, AXenS communicates the following steps in its whitepaper:

ICO

The ICO Pre-sale will be held from April 1st to April 15th. Public sale starts at April 16th to end of May. CEO Sam told me that they are seeing quite a bit of interest at investment levels of $75k+ which might be locked in earlier. The token will be distributed within 1 week of the end of the ICO period or hard cap being reached, which ever comes first.

You can also get a bonus in the presale period that depends on the level of you investment. You’ll find the excact info in the whitepaper. The lock up period for tokens will apply to bounty rewards (1 months) and longer for team members.

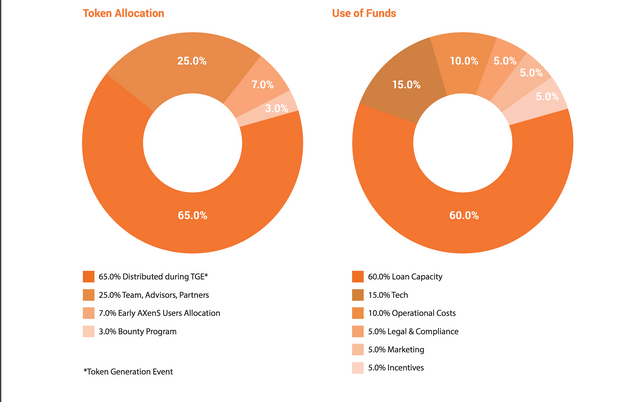

The allocation and the use of the funds look like this:

Pretty straight forward in my eyes and I really like the fact that 60% of the allocation will be used for loans.

Summary

To be honest I don’t have a lot of knowledge about the global trading market. But what AXenS wants to archive is massive. They have a good team, a good tech and a good understanding of the market and are generating revenue already. Swaye Capital has been around the last 6 years, and some its partners on the platform for even longer. They are active in physical metals trading, coffee, wheat, cement, bitumen and mainly sourcing from emerging market countries to sell to the developed world.

I also want to highlight there awesome whitepaper. Seriously. Look at it. That’s how a whitepaper should look like!

BUT $50M aren’t easy to raise at the current state of the ICO market. TE-FOOD did very well in raising there $19M pretty fast and it’s comparable to AXenS, but of course AXenS has a lot more to offer. And they need the money to have enough capacities in granting loans to the small and medium sizes businesses.

In the end this could play out IF they can create a hype around it. They already started a bounty program to get more people on Telegram. But they need to speed up in terms of community building because their main topic and strenghts aren’t something that the bride mass of investors can understand within seconds.

Overall I’m bullish on AXenS if they do their community & communication homework to create a hype. If that happens, the crypto market will have another stellar best usecase of the blockchain technology and a upscaling platform that can help small und medium sizes businesses to trade on the global market successfully.

Additional info:

- Website: axens.io

- Whitepaper

- Telegram