We all appreciate the role technology has played in revolutionizing the financial services industry; however, what some might not be aware of, is the endgame. Initially, ‘FinTech’ (financial technology) referred to the application of new technologies to the back-end of established financial institutions. Today, FinTech encompasses any new technological innovation in the financial sector, with peer-to-peer lending sites, automated financial advisors, and all-in-one money management apps, topping the list of 21st century FinTech innovations.

To place the FinTech market in perspective, here are some figures from Statista:

The segment with the largest transaction value is digital payments, which encompasses mobile payments processed via smart devices at the point of sale, cross-border peer-to-peer payments, and digital consumer commerce transactions. It is within the digital payments space that we find bitcoin and a number of other cryptocurrencies. These blockchain assets are growing so quickly in both number and value that the corporate establishment can’t seem to produce an accurate way of describing them. They’ve tried, “scam,” “tulips,” “bubble,” “pyramid scheme,” “fraud,” and people just keep buying, investing and HODLing.

Bitcoin is a term many have heard, and few fully understand. We can loosely trace its genesis in the records of the cypherpunk movement of the early 1990s. A Cypherpunk’s Manifesto, written in 1993, by Eric Hughes, declares, “We the Cypherpunks are dedicated to building anonymous systems. We are defending our privacy with cryptography, with anonymous mail forwarding systems, with digital signatures, and with electronic money.” The ‘electronic money’ referenced in the excerpt, foreshadows the arrival of bitcoin fifteen years later. The manifesto was a culmination of conversations and ideas that can be traced back to at least David Chaum and his writings in the late 1980s. Cypherpunks believe in securing privacy through code and mathematics. The manifesto specified, “Cypherpunks write code. We know that someone has to write software to defend privacy, and since we can’t get privacy unless we all do, we’re going to write it. We publish our code so that our fellow Cypherpunks may practice and play with it. Our code is free for all to use, worldwide. We don’t much care if you don’t approve of the software we write. We know that software can’t be destroyed and that a widely dispersed system can’t be shut down.”

The cypherpunk spirit gave birth to the movement that forced the U.S. government to relax the rules prohibiting the publishing and export of cryptographic source code. This victory allowed for developers to publish projects involving cryptography online, which is a vital step of an immeasurable number of open-source projects today. Hopefully, by now, you can clearly see the connections between bitcoin, an open source, electronic money, based in cryptography, and the cypherpunk movement and their manifesto. The current ICO mania, with everyone and their dog creating tokens for everything, and major corporations putting blockchains everywhere, is at the very least, a sign of the gradual increase in mainstream adoption of cypherpunk ideals. In order for any of us to have privacy, we all must have privacy, and one of the first steps for increasing privacy is becoming familiar and comfortable with encryption and decentralization. Blockchain technology, bitcoin, and other cryptocurrencies are the perfect mechanisms to bring this knowledge into the general public’s realm.

The growth of FinTech is primarily the growth of automated systems for wealth management and the removal of unnecessary middlemen in payment systems. The more FinTech develops, the more we develop systems for peer-to-peer lending, and mobile apps that allow us to send money globally with low fees, the more likely we are to recognize that with greater freedom comes greater responsibility. We have the power to manage our own investments using an app, to stop paying banks exuberant amounts for poor service and low interest rates, to finally cut out the corporate leeches who stand between our money and new projects worth funding, and with all these abilities comes the need to secure our personal information, communications, and devices.

You can no longer relegate your security to third parties or ‘trust’ that your email is safe because you have a long password and have enabled two-factor authorization via sms. Anyone in the crypto field will tell you, as you gain control over your financial assets, you also attract attention from a wide array of bad actors who wish to scam and defraud you. Encrypted email, hardware wallets, virtual private networks, tor browsers, and physical 2FA devices, are all essential to preserving your capital. What better way to get people to start taking privacy and security seriously then by putting them in charge of their own money?

The advancement of FinTech will lead to the widespread adoption of blockchain technology, which in turn results in the embrace of the cypherpunk ideals of privacy via code and freedom from widespread surveillance. It shocks me every day how little the average person knows about maintaining their security online, or identifying and closing vulnerabilities within their private networks and devices. Every month we have another major hack, another ‘leak.’ It has been years since mobile phones, personal computers, and wifi have been invented so why are we still sitting ducks to any mildly educated hacker? People complain that keeping private keys safe is a hassle, or wonder why there aren’t systems in place to help gain access to accounts if you do lose your private keys and/or backup mnemonic? They can either learn the nice way about taking security seriously, or they can wait until their accounts are drained and identities stolen. If you have spent any time in the crypto space, then you know exactly how easy it is to get scammed, and the lengths that a motivated hacker will go to in order to get your assets. The crypto space isn’t special, it is merely an exciting target, if any of those hackers wanted to target you, how easy would it be to turn your life upside down?

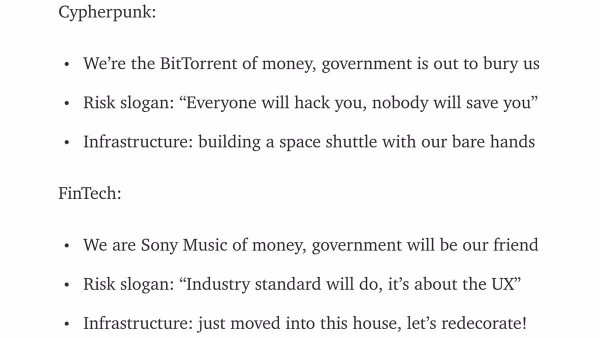

In conclusion, I want to leave you with a funny comparison from Tuur Demeester’s twitter feed:

…Stay tuned for a blueprint of the future of crypto in social media, courtesy of Shokone. Own your online presence, protect your identity and personal information, get paid for the original thoughts and content you post on social media…

If you enjoyed this article, or think someone else might, please share. If you want to talk more, or debate my points, leave a comment below, or contact me on linkedin

Sources:

https://www.statista.com/outlook/295/109/fintech/united-states#

https://www.activism.net/cypherpunk/manifesto.html

https://www.britannica.com/event/Bernstein-vs-the-US-Department-of-State

https://twitter.com/TuurDemeester/status/766047240871743488

Original Post: https://medium.com/shokone/the-spread-of-fintech-is-just-a-pitstop-on-the-road-to-embracing-cypherpunk-ideals-13ee434295b6

Fintech is unstoppable and it is a movement towards mainstream adoption that will be used by the wealthy first while restricting the user as much as possible while they build competing ecosystems.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @zvnowman! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit