Mine Your Own Business

@bunchubets

"Go big or go home!" We shouted as my business partner and I hung up the phone on a late January evening. Excited, wide eyed, and maybe just a little naive, we were finally ready to begin our journey in cryptocurrency mining.

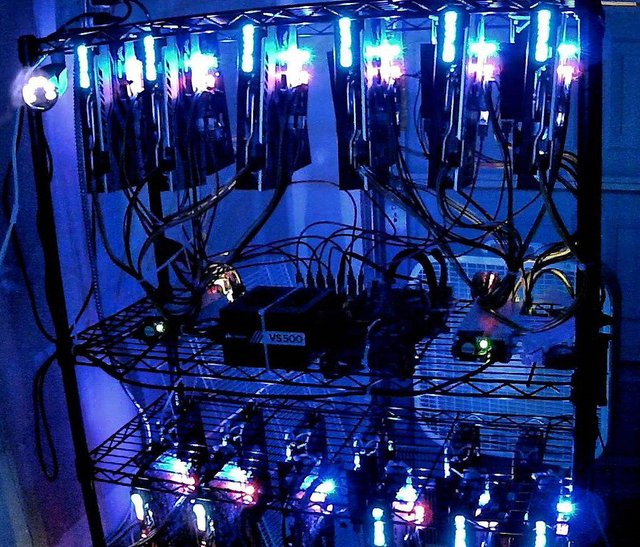

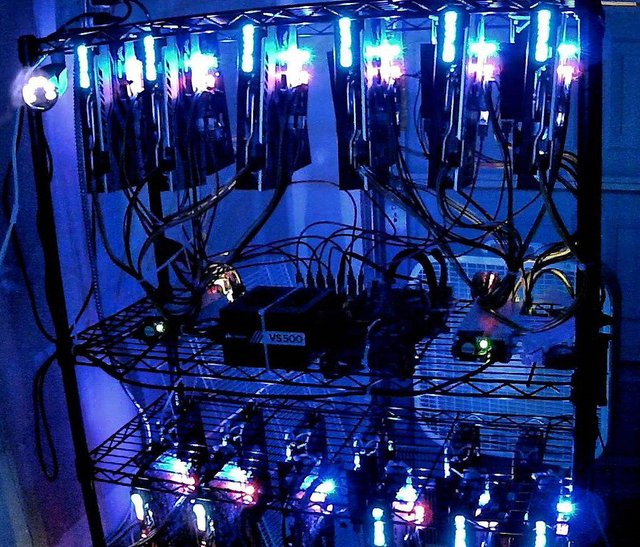

After a couple months of planning, forecasting, and calculations, Bitstorm LLC was born and thus so was our beautiful baby 54 GPU mining rig. If you find yourself interested in diving into the world of cryptocurrency mining, this post may serve as the dos and don'ts guide to help you get started and avoid some of the same mistakes we have made on our mining journey thus far.

So Easy A Caveman Could Do It - Kind of

Disclaimer: I am in NO way an expert. There are many great expert miners out in the crypto twitterverse that have been doing this far longer and with much more expertise than myself. I'm merely a noob with a big rig (*winks) that is here to share some of my experiences.

Here's some background on myself. I came into crypto as a complete noob in early 2017 with no technical background. Basically, I'm a finance guy. My background was in business and economics prior. I stumbled onto Bitcoin and crypto on accident, became fascinated with it from a market perspective and by the fact that "holy shit I could make a ton of money from this stuff." I knew NOTHING about cryptocurrency mining. I had no idea what a GPU even was, let alone that I could potentially make profit off of magic internet coins with them.

Since that time, I have spent countless hours researching and learning the ins and outs of mining and will aim to at least give some technical perspective as well in this post.

Plan It Damn It!

I think it goes without saying, but I will say it anyway. A solid plan is the most important thing you can have when tackling an endeavor like this.

Some questions you may need to ask yourself (not an extensive list).

How many GPUs will your rig be?

What is your strategy? Will you be mining with the goal of profit, or will you be mostly spec mining? Maybe some combination of the two.

What type of GPUs will give you the best hash power for your buck?

What are your power costs?

Will you pay the power costs out of pocket, or out of mined coin inventory?

What is your break even?

Are you willing to mine at a loss?

What's your plan for expansion if any?

When will you upgrade cards?

Choosing GPUs

One of the most important things I learned in the early stages is that choosing your GPUS is super important. GPUs are expensive and scarce and getting more so by the day. You want to make sure you are getting not only the best bang for your buck and a solid ROI on your investment, but also that what you are buying matches your overall mining strategy.

If you were to go on Whattomine.com you would see that different coins will be most profitable if you put in specs with 580s vs 1080TI. The list of coins will be vastly different. When choosing our strategy we decided that it was a priority to us to get the quickest ROI. That lead us down the road to choosing Nitro Sapphire + 570s and mining Ethereum. These GPUs are very effective at mining ETH because the ETH algorithm is very memory and bandwidth processing intensive. These work great for any ETH based coins. If your goal is straight hash power and less amount of GPUs than you might be better off looking at Nvidia cards.

What it came down to for us was, half the cost (of a 1080TI), for equal performance on Ethereum.

Shop Around

Buying 54 GPUs was NOT an easy task. Quite honestly we had no idea where to start when we began the project. Places like Newegg and Amazon were sold out for days and weeks. Nowinstock.net was a great resource for us to set alerts on when cards would become available and it allowed for us to quickly scoop up some cards at reasonable prices. The other route we went was buying in bulk from CDW. We were able to get an order of 30 cards filled in just a few weeks at a great price. If you are looking to really snipe some deals, consider EBay as well.

Our Strategy

For a rig our size, we use a lot of power. We average about 200 watts per card at any given point in time. Our power is 13 cents per kw/h. In our first month of being fully operational our power bill was a whopping $864! This means for a rig our size we are always thinking about covering the power bill first. This may not be the strategy of most, especially smaller sized rigs where it is easy to pay the power out of pocket, but for us it is always the first thing we think about. So how do we diversify?

Since power is pretty much always a constant once you know what it costs, we are able to calculate how many GPUs we always need to dedicate to mining the MOST profitable coin. We are then free to spec mine any new projects or our favorite coins looking for that 10x with the remaining rig capacity. This is all dependent on the market and what we think will provide the best chance to make money. There are times when all we are mining is ETH and we are ok with that as well. The name of the game for us at this point is ROI. It’s also a pretty cool feeling to make money while you sleep!

What I’ve Learned

- The most important thing that has helped us survive since starting a 54 GPU mining rig at the start of the bear market was having a plan. We know where our break even point is and it helps us minimize the risk of having such a huge power bill.

- Join groups! Learn as much as you can from people who have been there. The Crypto Aquarium (Shout out @coinyeezy and @icebergy) has a mining specific channel full of great people and resources to bounce ideas off of.

- While sites like Whattomine.com are great tools to use for forecasting profitability and researching coins to mine, just beware that their calculations are a little skewed. They assume highest achievable hash power per card and severely underestimate the power cost by almost half. Keep that in mind as you are planning your rig!

- This shit gets hot!!! Have a plan for cooling. 54 GPUs in a garage is basically like having 100 hair dryers running on full blast 24 hours a day. I break a sweat just walking into the room. That doesn’t say too much though because I sweat peeling an orange.

- If you’re going to set up in your garage and leave the door cracked every day, know how your homeowner’s association will react. We just recently got warned that we need to do something about our aesthetics. Now we need to figure out how to cool more efficiently which has been our biggest challenge and will be as the summer months approach.

- Be cost conscious, but don’t skimp on the important stuff. Every few dollars you spend can add days to your ROI. Be conscious but not cheap.

- Keep records. Mining is taxable and everything we mine needs to be recorded. It is absolutely the worst part of the project.

Wrapping Up

Mining is an awesome way to supplement and diversify your crypto investment. If done correctly it can be very profitable as well. It is also an integral part in keeping the decentralized ecosystem alive. Take the time do DYOR and really put a plan and forecast together before jumping into something too big.If anyone has made it this far and would like to see what we have for components for reference purposes, or a template of how we have been tracking our coin mining, please feel free to reach out to me on Twitter @bunchubets.

Good luck and mine the good fight my friends!

- Bunchu

You have forgot to mention that signing up in binance and buying Crypto will pay you 20% referral bonus. Here is my referral link if anyone wants to sign up and then they can forward it as well.

https://www.binance.com/?ref=16105300

It is so simple...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit