https://300cubits.tech/ My TL;DR: A crypto deposit solution for ensuring container shipping agreements are executed as booked, thus drastically reducing No Show / Rolling costs on both shipper’s and carrier’send. I will be avoiding the TEU 300cubits ICO.

<figure class="graf graf--figure">

</figure>

<figure class="graf graf--figure"> TEU — Bitcoin for the shipping industry

</figure>

<figure class="graf graf--figure"><figcaption class="imageCaption"></figcaption></figure>

The container-shipping industry is the backbone of globalization, allowing you to wear US-imported jeans, that were made in Bangladesh, in Europe, eat kiwi in Russia and, conversely, drink vodka in New Zealand. The industry is so developed and competitive that it is usually operating at minor profit or sometimes even at loss, and the space is yet to see some meaningful innovation.

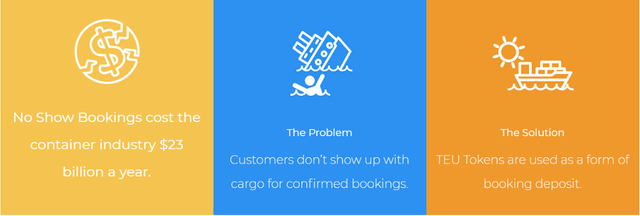

A multi-billion dollar problem is the inefficiency created by No Shows / Rolling, where a shipper (that sends a container) and a carrier (that ships it) fail to uphold their end of a booking agreement. For the shipper, not being able to send their cargo as agreed results in containers not getting shipped in time, thus contained product is not sold in time. For the carriers, shippers not bringing their containers to be delivered and therefore not paying for their booking, results in empty space aboard, which means wasted costs for freighting air instead of cargo. There usually are provisions in the contracts for penalties, but they rarely get executed, so liners simply overbook to make sure they don’t lose money. This rolling problem costs the industry some $23bn per year.

<figure class="graf graf--figure">

</figure>

<figure class="graf graf--figure"> Qbits Megaprofit System inception

</figure>

300cubits, which is also the size God told Noah to build his ark, wants to solve this problem with their TEU token. TEU comes from Twenty-foot Equivalent Unit, the size of a standard shipping container, and is used for measurement in the shipping industry. What they propose is that, when booking a transport, both the shipper and the carrier make a deposit in a smart contract, that gets released back to both parties if the shipping is successful, or that gets transferred away from the party that failed to uphold their end of the bargain to the one that stands to lose from this situation.

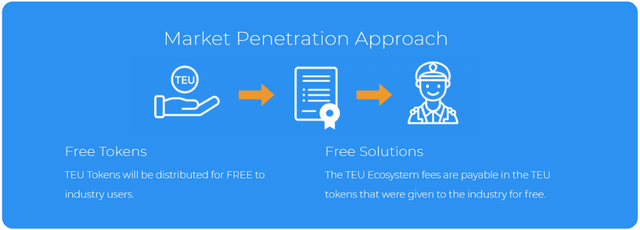

This is an excellent use-case of blockchain technology, and I personally see this model as one of the most important solutions for the described problem. However, I see a number of problems with the project. First and foremost, the project’s plan for adoption is to sell some of the tokens to the general public, and give some other tokens for free to the carriers and other eligible companies in the field. Their thinking is that when these companies see those free tokens to be worth something, they’ll start using them as deposits for guaranteeing shipment agreements execution.

<figure class="graf graf--figure">

</figure>

<figure class="graf graf--figure"> The best penetrations are free

</figure>

Basically 300cubits plans to raise money from investors, create some value out of thin air by setting a portion of the tokens aside, and give that portion for free to companies. That’s a super aggressive approach where the only ones holding the risk are the investors who have paid for buying TEU tokens, hoping they will be valuable for something. That wouldn’t be the first ICO that sells this hope, most of them do this, actually. But what they usually do is first create a product, an ecosystem for it, announce partners that will pay to use it, and then bring this as an opportunity for investors.

300cubits is going about this the wrong way, which is extremely off-putting. Their whitepaper is not detailed enough, their hype is artificial — huge numbers on Twitter and Telegram, but no Reddit and only a few shallow articles and cringe worthy interviews. Some of the team members claim to have held Vice President positions at reputable companies such as RBS or Morgan Stanley, which is dubious, as the description of the job says “managing team of 7 analysts” — that’s more Team Lead than Vice President.

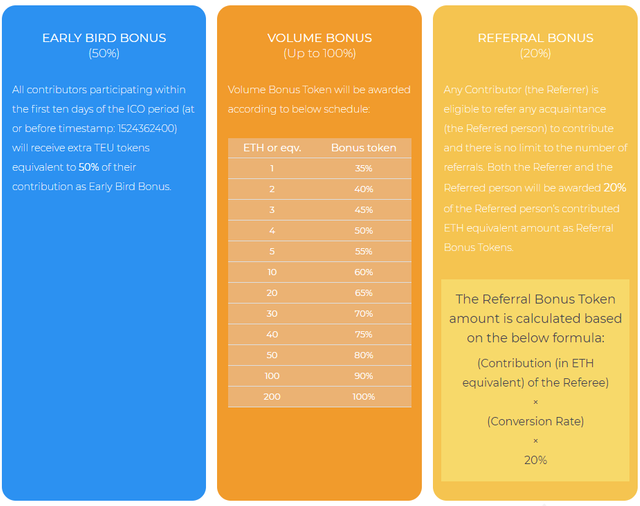

They sold 2% of the tokens in a presale that raised 1.588ETH. They will do a first ICO to sell 18% of the tokens for 45.000 ETH, and then another to sell 20% more tokens, or burn them. I have trouble following their metrics, they claim $12mn hardcap on their Telegram, but looking at the token prices they list, they are looking for anything in between $9mn — $18mn today, and would be valued at roughly $45mn — $90mn. Maybe because of the complex bonus scheme.

<figure class="graf graf--figure">

</figure>

<figure class="graf graf--figure"> Bonus is “good”

</figure>

I love the use case for blockchain to solve this problem, but I doubt it needs its own token, and even if one will eventually be adopted by the shipping industry, that would come from a bigger, better team, with a better product proposal. Furthermore, the penetration tactic of giving away free tokens with investors holding bags hoping for the “free” scheme to generate adoption is not attractive to me. I will be avoiding this project.