Want to start new after the crypto crash? Here is a widespread guide on how to invest and prosper over the long term.

Well its happened, the crypto market just practiced the worst crash since 2014, the bubble has burst. The idiocy of newbies FOMO-ing into anything with low nominal value lead to endless twitter timelines like this, and now nobody has any idea where the market relaxes. What do you do now?

In the following weeks it will be a good time to reconsideration your investment approach and how you arrive at your decisions. Just buying whatever is shilled on Twitter or Reddit and jumping from one crypto to another isn't going to work like it did these last two months.

The good news is that we're finally back closer and closer to our long term moving average which is much more healthy for contestants, the bad news is that the fear might continue compounding if outstanding issues are not dealt with. Tether is the big concern for me personally for reasons I've stated many times, but some relief in the short term may come if the SEC and CFTC meeting on February 6th goes well. Nobody really knows where the bottom is but I think we're now past the "irrational exhuberance" stage and we're entering a period of more serious inspection where cryptos will essentially have to prove themselves as useful. I suspect hype artists like CryptoNick and John McAfee will fall out of kindness.

BACKGROUND

As I completely expected, the 2X movement from the New York Agreement that was supposed to happen during the middle of my holiday flopped on its face because Jeff Garzik was driving the clown car with passengers willfully inside like Coinbase, Blockchain.info, Bitgo and Xapo and there were here massive bugS and in the code and miners like Bitmain did not want to allocate $150-350m to get it over the difficulty modifications.

I am very disenchanted in their lack of integrity with putting their money where their mouths are; myself and many others wanted to sell a lot of B2X for BTC!

On 9 December 2015, with Bitcoin trading at US$388.40, I wrote The Rise of the Fourth Great Bitcoin Bubble. On 4 December 2016, with Bitcoin trading at US$762.97, I did this conference:

FUNDAMENTALS

Bitcoin is the decentralized censorship-resistant Internet Protocol for transferring value over a communications channel.

The Bitcoin network can use traditional Internet infrastructure. However, it is even more resilient because it has custom infrastructure including, thanks to Bitcoin Core developer Matt Corrallo, the FIBRE network and, thanks to Blockstream, satellites which reduce the cost of running a full-node anywhere in the world to essentially unknown in terms of money or privacy. Transactions can be cheaply broadcast via SMS messages.

But perhaps most prominently use this as a learning experience, don't try to point fingers now. The type of dumb behavior that people were engaging in that was rewarded in a bull market (chasing pumps, going all in on a shillcoin, following hype..etc) could only ever chief to what we are experiencing now. Just like so many people jumped on the crypto bandwagon during the bull run, they will just as quickly jump on whatever trend is to be used to blame for the deflation of the bubble. Nobody who pumped money into garbage without any use case will accept that they themselves with their own investing comportment were the real reason for the gross overvaluation of most cryptocurrencies, and the inevitable crash.

So if you're looking for a additional start after the massacre (or just want to get in now), here is a guide:

Part A: Making a Investment Approach

This is your money, put some exertion into investing it with an actual strategy. Some simple yet critical advice that should apply to everyone, regardless of individual strategy:

- Slow down and research each crypto that you're procurement for at least a week.

- Don't buy something just because it has increased.

- Don't exit a position just because it has dropped.

- Invest single as much as you can afford to lose.

- Prepare enter and exit policies in advance.

First take some time to think about your ROI target, set your hold periods for each spot and how much you are actually ready to risk losing.

ROI goals

A lot of young investors who are in crypto have unrealistic opportunities about returns and risk. A lot of them have never invested in any other type of financial asset, and hence many seem to consider a 5-10% ROI in a month to be unexciting.

But its important to temper your hype and apprehend why we had this exponential growth in the last year and how unlikely it is that we see 10x returns in the next year. What we saw recently was Greater Fool Theory in action. Those insipid returns of 5-10% a month are much more of the norm, and much more healthy for an alternative investment class.

You can think about setting a target in terms of the market ROI over a relevant holding period and then add or diminution based on your own risk profile.

Example: Calculating a 2 year ROI goals

Lets say you want to hold for 2 years now, how could you set a accurate target to strive for? You could look at a historical 2 year return as a base, preferably during a period similar to what we're facing now. Now that we had a major amendment, I think we can look at the two year period starting in 2015 after we had the 2014 crash. To calculate a 2 year CAGR starting in 2015:

Year Total Crypto Market Cap

Jan 1, 2015: $5.5 billion

Jan 1, 2017: $18 billion

Compounded annual development return (CAGR): [(18/5.5)1/2]-1 = 80%

This annual return rate of 80% comes out to about 4.8% compounded monthly. This may not sound exciting to the lambo moon crowd, but it will keep you grounded in authenticity. You can aim for a higher return (say 2x of that 80% rate) if you choose to take on more risky propositions. I can't tell you what return target you should set for yourself, but just make sure its not depended on you needing to achieve continual near perpendicular parabolic price action in small cap shillcoins because that isn't sustainable.

Once you have a target you can construct your risk profile (low risk vs. high risk category coins) in your portfolio based on your target.

Risk Supervision

Everything you buy in crypto is risky, but it still benefits to think of these 3 risk categories:

• Core properties - This is the exchange pairing cryptos and those that are well customary. These are almost sure to be around in 5 years, and will recover after any bear market. The Coinbase pairs (Bitcoin, Litecoin and Ethereum) are in this class of risk, and I would also argue Monero.

• Medium Risk Hypothetical - These would be cryptos which commonly have a working product and niche, but higher risk than Core. Things like ZCash and Ripple, relatively established history but still uncertainty over long term viability.

• High Risk Hypothetical - This is anything produced within the last few months, ICOs, low caps, shillcoins...etc. Most cryptos are in this category.

How much risk should you take on? That depends on your own life condition for one, but also it should be proportional to how much expertise you have in both financial analysis and technology.

The general starting point I would recommend is:

• 50-70% for newbies in Low Risk Core, then you can go depressed to 30% as you gains confidence and experience

• Always try to keep at least a 1/3rd in safe core points

• Don't go all in on hypothetical picks.

Some more core moralities on risk management to cogitate:

• Diversify across sectors and rebalance your allocations periodically.

• Consider using dollar cost averaging to enter a position. This generally means investing a X amount over several periods, instead of at once. You can also use downward biased dollar cost averaging to mitigate against downward risk. For example instead of investing $1000 at once in a position at market price, you can buy $500 at the market price today then set several limit orders at somewhat lower intervals (for example $250 at 5% lower than market price, $250 at 10% lower than market price). This way your average cost of acquisition will be lower if the crypto happens to decline over the short term.

• Don't have more than 5-10% of your net worth in crypto.

• Have the majority of your holdings in things you feel good holding for at least 2 years. Don't use the majority of your investment for day trading or short term investing.

• Remember you didn't actually make any money until you take some profits, so take do some profits when everyone else is at peak FOMO-ing mode.

• Have some fiat in reserve at a FDIC-insured exchange (ex. Gemini), and be ready to add to your winning positions on a pullback. This should be part of your entry strategy.

• Consider what level of loss you can't accept in a position with a high risk factor, and use stop-limit orders to hedge against sudden crashes. Set you stop price at about 5-10% above your lowest limit. Stop-limit orders aren't perfect but they're better than having no hedging strategy for a risky microcap in case of some meltdown. Only you can determine what bags you are unwilling to hold.

You can think of each crypto having a risk factor that is the outline of the general crypto market risk (Rm), but also its own inherent risk specific to its own goals (Ri).

Rt = Rm +Ri

The market risk is something you cannot avoid, it is essentially the risk that is carried by the entire market over things like regulations. What you can diminish though the Ri, the specific risks with your crypto. That will depend on the team composition, geographic risks (for example Chinese coins like NEO carry regulatory risks specific to China), competition within the space and likelihood of adoption and other factors, which I'll describe in Part 2: Crypto Picking Methodology.

Portfolio Allocation

Along with thinking about your group in terms of risk categories described above, I really find it helpful to think about the segments you are in. OnChainFX has some segment categorization but I generally like to bring it down to:

• Core holdings - BTC, Ethereum, LTC...etc

• Platform segment - Ethereum, NEO, Ark...etc

• Privacy segment - Monero, Zcash, PivX..etc

• Finance/Bank settlement segment - Ripple, Stellar...etc

• Enterprise Blockchain solutions segment - VeChain, Walton, Factom...etc

• Promising Tech segment - NANO/Raiblock, Cardano...etc

Think about your "Circle of Competence", your body of knowledge that allows you to evaluate an investment. Your ability to properly judge risk and potential is going to largely correlated to your understanding of the subject matter. If you don't know anything about how supply chains functions, how can you competently judge whether VeChain or WaltonChain will achieve adoption? If you don't appreciate anything about the tech when you read the Cardano paper, are you really able to determine how likely it is to be adopted?

Consider the historic correlations between your holdings. Generally when Bitcoin pumps, altcoins dump but at what rate be contingent on the coin. When Bitcoin goes sideways we tend to see pumping in altcoins, while when Bitcoin goes down, everything goes down.

You should diversify but really shouldn't be in much more than around 12 cryptos, because you simply don't have enough competency to accurately access the risk across every segment and for every type of crypto you come across. If you have over 20 different cryptos in your group you should probably think about consolidating to a few sectors you understand well.

Part B: Crypto Preference Methodology (Due Dilligence)

Do you struggle on how to fundamentally evaluate cryptocurrencies? Here is a 3-step methodology to follow to perform your due dilligence:

Step 1: Clarifying and Research

There is so much out there that you can get overwhelmed. The best way to start is to think back to your own portfolio allocation approach and what you would like to get more off. For example in my view enterprise-focused blockchain solutions will be important in the next few years, and so I look to create a list of various cryptos that are in that segment.

Upfolio has brief descriptions of the top 100 cryptos and is filterable by categories, for example you can click the "Enterprise" category and you have a neat list of VEN, FCT, WTC...etc.

Once you have a list of potential candidates, its time to read about them:

• Critically evaluate the website. If it's a cocktail of nonsensical buzzwords, if its unprofessional and poorly made, stay away. Always look for a roadmap, compare to what was actually delivered so far. Always check the team, try to find them on LinkedIn and what they did in the past.

• Read the whitepaper or business development plan. You should fully apprehend how this crypto functions and how its trying to create value. If there is no use case or if the use case does not require or benefit from a blockchain, move on.

• Check the blockchain explorer. How is the token distribution across accounts? Are the big accounts selling? Try to figure out who the whales are (not always easy!) and what the foundation/founder account is based on the initial allocation.

• Look at the Github repos, does it look empty or is there plenty of activity?

• Search out the subreddit and look at a few Medium or Steem blogs about the coin. How "shilly" is the community, and how much engagement is there between developer and the community?

• I would also go through the BitcoinTalk thread and Twitter allusions, judge both the length and quality of the discussion.

You can actually filter out a lot of scams and bad stashes by simply keeping your eye out on the following red flags:

• allocations that give way too much to the founder

• guaranteed promises of returns (Bitcooonnneeeect!)

• vague whitepapers filled with buzzwords

• vague timelines and no clear use case

• Github with no useful code and sparse activity

• a team that is difficult to find material on

Step 2: Transitory a latent pick through a checklist

Once you feel fairly confident that a pick is worth analyzing further, run them through a standardized checklist of questions. This is one I use, you can add other questions yourself:

Crypto Analysis Checklist

What is the problem or transactional inefficiency the coin is trying to solve?

What is the Dev Team like? What is their track record? How are they funded, organized?

How big is the market they're targeting?

Who is their competition and what does it do better?

What is the roadmap they created and how well have they kept to it?

What current product exists?

How does the token/coin actually derive value for the holder? Is there a staking mechanism or is it transactional?

Is there any new tech, and is it informational or governance based?

Can it be easily copied?

What are the weaknesses or problems with this crypto?

The last question is the most important.

This is where the riskiness of your crypto is gaged, the Ri I talked about above. Here you should be able to accurate place the crypto into one of the three risk categories. I also like to run through this checklist of blockchain benefits and consider which specific chattels of the blockchain are being used by the specific crypto to provide some increased utility over the current transactional method:

Benefits of Cryptocurrency

Decentralization - no need for a third party to agree or validate transactions.

Transparency and trust - As blockchain are shared, everyone can see what transactions occur. Useful for something like an online casino.

Immutability - It is extremely difficult to change a transaction once its been put onto a blockchain

Distributed availability - The system is spread on thousands of nodes on a P2P network, so its difficult to take the system down.

Quicker Settlement - In the financial industry when we're dealing with post-trade settlement, a blockchain can drastically increase the speed of verification

Simplification and consolidation - a blockchain can serve as a shared ledger in industries where multiple entities previously kept their own data sources

Cost - in some cases avoiding a third party verification would drastically reduce costs.

Step 3: Create a assessment model

You don't need to get into full modeling or have a financial background. Even a unpretentious model that just tries to derive a valuation through relative terms will put you above most crypto investors. Some simple valuation methods that anyone can do:

Probablistic Situation Valuation

This is all about thinking of scenarios and probability, a helpful exercise in itself. For example: Bill Miller, a prominent value investor, wrote a probabilistic valuation case for Bitcoin in 2015. He looked at two possible scenarios for probabalistic valuation:

- becoming a store-of-value equal to gold (a $6.4 trillion value), with a .25% probability of occurring

- replacing payment processors like VISA, MasterCard, etc. (a $350 million dollar value) with a 2.5% probability

Combining those scenarios would give you the total expected market cap: (0.25% x 6.4 trillion) + (2.5% x 350 million). Divide this by the outstanding hoard and you have your valuation.

Metcalfe's Regulation

Metcalfe's Law which states that the value of a network is proportional to the square of the number of connected users of the system (n2). So you can compare several monies based on their market cap and square of active users or traffic. We can alter this to crypto by thinking about it in terms of both users and transactions:

For example, associate the Coinbase pairs:

Metric Bitoin Ethereum Litecoin

Market Cap $152 Billion $93 Billion $7.3 Billion

Daily Transactions (last 24hrs) 249,851 1,051,427 70,397

Active Addresses (Peak 1Yr) 1,132,000 1,035,000 514,000

Metcalfe Ratio (Transactions Based) 2.43 0.08 1.47

Metcalfe Ratio (Address Based) 0.12 0.09 0.03

Generally the higher the ratio, the higher the valuation given for each address/transaction.

Market Cap to Industry judgments

Another easy one is simply looking at the total market for the industry that the coin is apparently targeting and comparing it to the market cap of the coin. Think of the market cap not only with circulating supply like its shown on CMC but including total supply. For example the total supply for Dentacoin is 1,841,395,638,392, and when multiplied by its price in early January we get a market cap that is actually higher than the entire industry it aims to disrupt: Dentistry.

More complex estimation models

If you would like to get into more fleshed out models with Excel, I highly indorse Chris Burniske's blog about using Quantity Theory of Money to build an equivalent of a DCF analysis for crypto.

Here is an Excel file example of OMG done by Nodar Janashia using Chris' model .

You should create multiple setups with multiple assumptions, both positive and negative. Have a base scenario and then moderately optimistic/pessimistic and highly positive/pessimistic scenario.

Personally I like to see at least a 50% upward potential before investing from my discreetly pessimistic scenario, but you can set your own safety brim.

The real beneficial thing about modelling isn't even the price or estimation comparisons it spits out, but that it forces you to think about why the coin has value and what your own assumption about the future are. For example the discount rate you apply to the net present utility formula drastically affects the valuation, and it reflects your own assumptions of how risky the crypto is. What exactly would be a reasonable discount rate? What about the digital economy you are assuming for the coin, what levers affects its size and adoption and how likely are your assumptions to come true? You'll be a drastically more intelligent investor if you think about the essential variables that give your coin the market cap you think it should hold.

Summing it awake

The time for lambo psychosis is over. But that's no reason to feel down, this is a new day and what many were waiting for. I've put together in one place here how to construct a portfolio allocation (taking into consideration risk and return targets), and how to go through a efficient crypto picking method. I'm won't tell you what to buy, you should always decide that for yourself and DYOR. But as long as you follow a rational and thorough methodology (feel free to modify anything I said above to suit your own needs) you will feel pretty good about your investments, even in times like these.

Edit: Also get a crypto prediction ferret. You won't regret it.

The Bitcoin network has a difficulty of 1,347,001,430,559 which proposes about 9,642,211 TH/s of custom ASIC hardware deployed.

At a retail price of approximately US$105/THs that implies about $650m of custom ASIC hardware deployed (35% discount applied).

This custom hardware consumes approximately 30 TWh per year. That could power about 2.8m US households or the entire country of Morocco which has a populace of 33.85m.

This Bitcoin mining generates approximately 12.5 bitcoins every 10 minutes or approximately 1,800 per day worth approximately US$16,650,000.

Bitcoin currently has a market capitalization greater than $150B which puts it solidly in the top-30 of M1 money stock countries and a 200 day heartrending average of about $65B which is increasing about $500m per day.

Average daily volumes for Bitcoin is around US$5B. That means multi-million dollar points can be moved into and out of very easily with nominal slippage.

When my friend Andreas Antonopolous was unable to give his talk at a CRYPSA event I was invited to fill in and delivered this presentation, spontaneous, on the Seven Network Effects of Bitcoin.

These seven network effects of Bitcoin are (1) Assumption, (2) Merchants, (3) Consumers, (4) Security [miners], (5) Developers, (6) Financialization and (7) Settlement Currency are all taking root at the same time and in an incredibly intertwined way.

With only the first network effect starting to take significant root; Bitcoin is no longer a little experiment of magic Internet money anymore. Bitcoin is monster growing at a tremendous rate!!

)

(

)

( )

And forks like BCash (BCH) should not be scary but instead be looked upon as an opportunity to take more territory on the Bitcoin blockchain by trading the forks for real bitcoins which dries up more salable supply by moving it, likely, into deep cold storage.

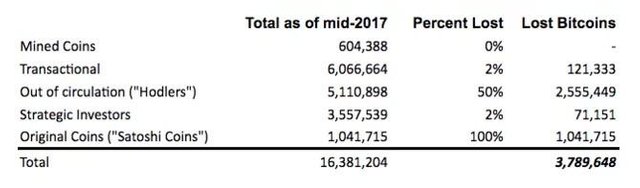

According to Wikipedia, there are approximately 15.4m millionaires in the United States and about 12m HNWIs ($30m+ net worth) in the world. In other words, if every HNWI in the world wanted to own an entire bitcoin as a 'risk-free asset' that cannot be impounded, seized or have the balance other wise altered then they could not.

For wise portfolio management, these HNWIs should have at least about 2-5% in gold and 0.5-1% in bitcoin.

Why? Perhaps some of the 60+ Saudis with 1,700 frozen bank accounts and about $800B of assets being targetted might be able to elucidate it to you.

In other words, everyone loves to chase the rabbit and once they catch it then know that it will not get away.

SELLING

There are approximately 150+ significant Bitcoin exchanges worldwide. Kraken, affording to the CEO, was adding about 6,000 new funded accounts per day in July 2017.

Apparently, Coinbase is currently adding about 75,000 new accounts per day. Based on some trade secret analytics I have access to; I would estimate Coinbase is adding approximately 17,500 new accounts per day that purchase at least US$100 of Bitcoin.

If we assume Coinbase accounts for 8% of new global Bitcoin users who acquisitions at least $100 of bitcoins (just pulled out of thin error and likely very conservative as the actual number is perhaps around 2%) then that is approximately $21,875,000 of new capital coming into Bitcoin every single day just from retail demand from 218,750 total new books.

What I have found is that most new users start off buying US$100-500 and then after 3-4 months months they ramp up their capital allocation to $5,000+ if they have the funds accessible.

After all, it takes some time and applied experience to learn how to safely secure one's private keys.

To do so, I highly recommend Bitcoin Core (network harmony and full validation of the blockchain), Armory (private key management), Glacier Protocol (operational procedures) and a Puri.sm laptop (secure non-specialized hardware).

WALL BOULEVARD

There has been no explanation for large financial fiduciaries to invest in Bitcoin. This changed November 2017.

LedgerX, whose CEO I interviewed 23 March 2013, began trading as a CFTC regulated Swap Execution Facility and Derivatives Clearing Organization.

The CME Group proclaimed they will begin trading in Q4 2017 Bitcoin futures.

The CBOE announced they will begin trading Bitcoin futures rapidly.

By analogy, these established products are like connecting a major metropolis's water system (US$90.4T and US$2 quadrillion) via a nanoscopic diversion to a tiny blueberry ($150B) that is infinitely elastic.

This price unearthing could be the most wild thing anyone has ever experienced in financial markets.

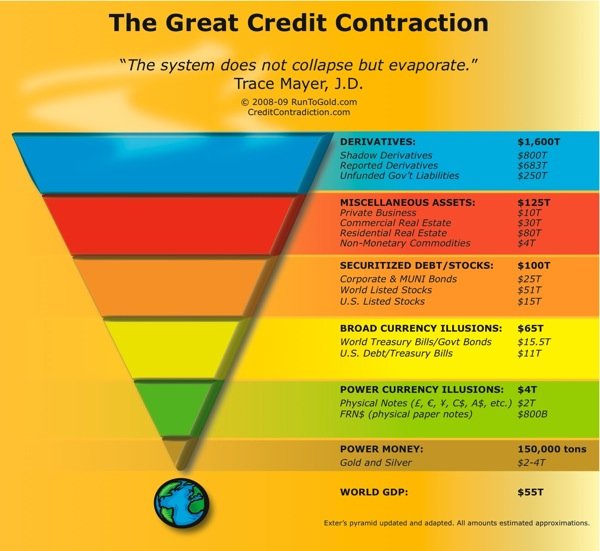

THE GREAT CREDIT SHRINKAGE

The same week Bitcoin was released I published my book The Great Credit Contraction and asserted it had now begun and capital would warren down the liquidness pyramid into safer and more liquid assets.

(

)

And forks like BCash (BCH) should not be scary but instead be looked upon as an opportunity to take more territory on the Bitcoin blockchain by trading the forks for real bitcoins which dries up more salable supply by moving it, likely, into deep cold storage.

According to Wikipedia, there are approximately 15.4m millionaires in the United States and about 12m HNWIs ($30m+ net worth) in the world. In other words, if every HNWI in the world wanted to own an entire bitcoin as a 'risk-free asset' that cannot be impounded, seized or have the balance other wise altered then they could not.

For wise portfolio management, these HNWIs should have at least about 2-5% in gold and 0.5-1% in bitcoin.

Why? Perhaps some of the 60+ Saudis with 1,700 frozen bank accounts and about $800B of assets being targetted might be able to elucidate it to you.

In other words, everyone loves to chase the rabbit and once they catch it then know that it will not get away.

SELLING

There are approximately 150+ significant Bitcoin exchanges worldwide. Kraken, affording to the CEO, was adding about 6,000 new funded accounts per day in July 2017.

Apparently, Coinbase is currently adding about 75,000 new accounts per day. Based on some trade secret analytics I have access to; I would estimate Coinbase is adding approximately 17,500 new accounts per day that purchase at least US$100 of Bitcoin.

If we assume Coinbase accounts for 8% of new global Bitcoin users who acquisitions at least $100 of bitcoins (just pulled out of thin error and likely very conservative as the actual number is perhaps around 2%) then that is approximately $21,875,000 of new capital coming into Bitcoin every single day just from retail demand from 218,750 total new books.

What I have found is that most new users start off buying US$100-500 and then after 3-4 months months they ramp up their capital allocation to $5,000+ if they have the funds accessible.

After all, it takes some time and applied experience to learn how to safely secure one's private keys.

To do so, I highly recommend Bitcoin Core (network harmony and full validation of the blockchain), Armory (private key management), Glacier Protocol (operational procedures) and a Puri.sm laptop (secure non-specialized hardware).

WALL BOULEVARD

There has been no explanation for large financial fiduciaries to invest in Bitcoin. This changed November 2017.

LedgerX, whose CEO I interviewed 23 March 2013, began trading as a CFTC regulated Swap Execution Facility and Derivatives Clearing Organization.

The CME Group proclaimed they will begin trading in Q4 2017 Bitcoin futures.

The CBOE announced they will begin trading Bitcoin futures rapidly.

By analogy, these established products are like connecting a major metropolis's water system (US$90.4T and US$2 quadrillion) via a nanoscopic diversion to a tiny blueberry ($150B) that is infinitely elastic.

This price unearthing could be the most wild thing anyone has ever experienced in financial markets.

THE GREAT CREDIT SHRINKAGE

The same week Bitcoin was released I published my book The Great Credit Contraction and asserted it had now begun and capital would warren down the liquidness pyramid into safer and more liquid assets.

( )

Thus, the critical question becomes: Is Bitcoin a possible solution to the Great Credit Contraction by becoming the safest and most liquid asset?

BITCOIN'S RISK SHAPE

At all times and in all settings gold remains money but, of course, there is always exchange rate risk due to price ratios continuously fluctuating. If the metal is held with a third-party in allocated-allocated storage (safest possible) then there is performance risk (Morgan Stanley gold storage lawsuit).

But, if correctly held then, there should be no counter-party risk which requires the financial ability of a third-party to perform like with a bank account payment. And, since gold exists at a single point in space and time therefore it is subject to confiscation or seizure risk.

Bitcoin is a completely new asset type. As such, the storage bottle is nearly empty with only $150B.

And every Bitcoin transaction excellently melts down every BTC and recasts it; thus ensuring with 100% accuracy the quantity and quality of the bitcoins. If the transaction is not on the blockchain then it did not happen. This is the sternest regulation thinkable; by math and cryptography!

This new absolute asset, if properly secured, is subject only to exchange rate risk. There does exist the possibility that a software bug may exist that could shut down the system, like what has happened with Ethereum, but the probability is almost nil and accomplishment lower everyday it does not happen.

Thus, Bitcoin questionably has a lower risk profile than even gold and is the only blockchain to achieve security, scalability and fluidity.

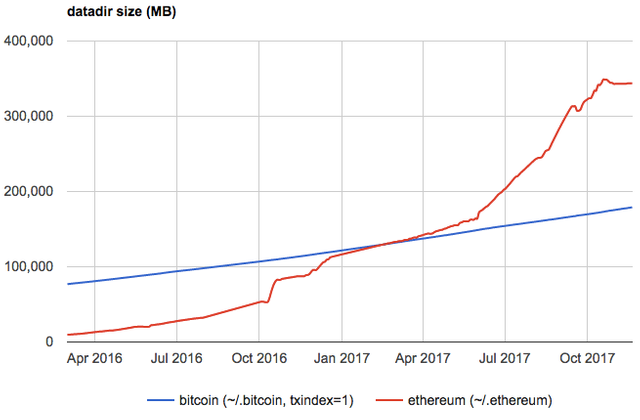

To remain decentralized, censorship-resistant and immutable requires scalability so as many users as conceivable can run full-nodes.

(

)

Thus, the critical question becomes: Is Bitcoin a possible solution to the Great Credit Contraction by becoming the safest and most liquid asset?

BITCOIN'S RISK SHAPE

At all times and in all settings gold remains money but, of course, there is always exchange rate risk due to price ratios continuously fluctuating. If the metal is held with a third-party in allocated-allocated storage (safest possible) then there is performance risk (Morgan Stanley gold storage lawsuit).

But, if correctly held then, there should be no counter-party risk which requires the financial ability of a third-party to perform like with a bank account payment. And, since gold exists at a single point in space and time therefore it is subject to confiscation or seizure risk.

Bitcoin is a completely new asset type. As such, the storage bottle is nearly empty with only $150B.

And every Bitcoin transaction excellently melts down every BTC and recasts it; thus ensuring with 100% accuracy the quantity and quality of the bitcoins. If the transaction is not on the blockchain then it did not happen. This is the sternest regulation thinkable; by math and cryptography!

This new absolute asset, if properly secured, is subject only to exchange rate risk. There does exist the possibility that a software bug may exist that could shut down the system, like what has happened with Ethereum, but the probability is almost nil and accomplishment lower everyday it does not happen.

Thus, Bitcoin questionably has a lower risk profile than even gold and is the only blockchain to achieve security, scalability and fluidity.

To remain decentralized, censorship-resistant and immutable requires scalability so as many users as conceivable can run full-nodes.

( )

COMMUNICATIONS

Some people, probably mostly those shilling alt-coins, think Bitcoin has a scalability problem that is so serious it requires a simple hard fork to solve.

On the other side of the debate, the Internet protocol and blockchain geniuses assert the scalability issues can, like other Internet Protocols have done, be solved in different layers which are now imaginable because of Segregated Witness which was activated in August 2017.

Whose code do you want to lane: the JV benchwarmers or the championship Chicago Bulls?

As deal fees rise, certain use cases of the Bitcoin blockchain are priced out of the market. And as the fees fall then they are economical again.

Additionally, as transaction fees rise, certain UTXOs are no longer economically usable thus destroying part of the money supply until fees decline and UTXOs become economical to move.

There are approximately 275,000-350,000 transactions per day with business fees currently about $2m/day and the 200 DMA is around $1.08m/day.

(

)

COMMUNICATIONS

Some people, probably mostly those shilling alt-coins, think Bitcoin has a scalability problem that is so serious it requires a simple hard fork to solve.

On the other side of the debate, the Internet protocol and blockchain geniuses assert the scalability issues can, like other Internet Protocols have done, be solved in different layers which are now imaginable because of Segregated Witness which was activated in August 2017.

Whose code do you want to lane: the JV benchwarmers or the championship Chicago Bulls?

As deal fees rise, certain use cases of the Bitcoin blockchain are priced out of the market. And as the fees fall then they are economical again.

Additionally, as transaction fees rise, certain UTXOs are no longer economically usable thus destroying part of the money supply until fees decline and UTXOs become economical to move.

There are approximately 275,000-350,000 transactions per day with business fees currently about $2m/day and the 200 DMA is around $1.08m/day.

( )

What I like about business fees is that they somewhat reveal the financial health of the network.

The security of the Bitcoin network results from the miners creating explanations to proof of work problems in the Bitcoin protocol and being rewarded from the (1) coinbase reward which is a form of inflation and (2) transaction fees which is a form of usage fee.

The higher the transaction fees then the greater disguised value the Bitcoin network provides because users are willing to pay more for it.

I am highly skeptical of blockchains which have very low business fees. By Internet bubble analogy, Pets.com may have millions of page views but I am more concerned in EBITDA.

DESIGNERS

Bitcoin and blockchain programming is not an easy skill to gain and master. Most developers who have the skill are also financially autonomous now and can work on whatever they want.

The best of the best work through the Bitcoin Core method. After all, if you are a world class mountain mountaineer then you do not hang out in the MacDonalds play pen but instead scramble Mount Everest because that is where the challenge is.

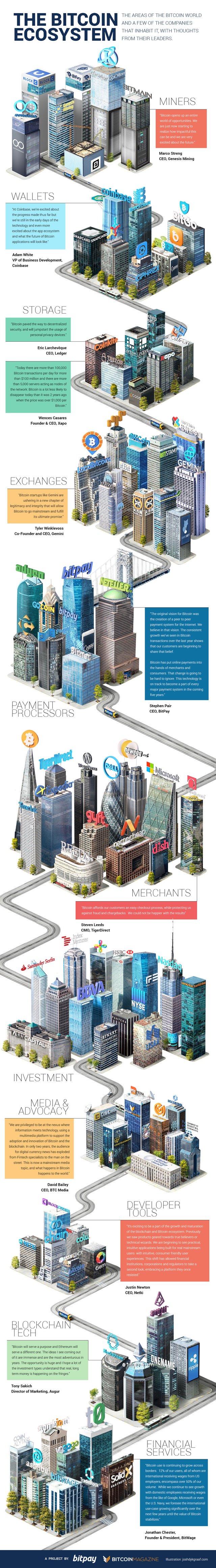

However, there are many talented creators who work in other areas besides the etiquette. Wallet maintainers, exchange operators, payment mainframes, etc. all need competent developers to help build their productions.

Accordingly, there is a huge shortage of competent developers. This is probably the largest single scalability limitation for the ecosystem.

However, the Bitcoin ecosystem is healthier than ever before.

(

)

What I like about business fees is that they somewhat reveal the financial health of the network.

The security of the Bitcoin network results from the miners creating explanations to proof of work problems in the Bitcoin protocol and being rewarded from the (1) coinbase reward which is a form of inflation and (2) transaction fees which is a form of usage fee.

The higher the transaction fees then the greater disguised value the Bitcoin network provides because users are willing to pay more for it.

I am highly skeptical of blockchains which have very low business fees. By Internet bubble analogy, Pets.com may have millions of page views but I am more concerned in EBITDA.

DESIGNERS

Bitcoin and blockchain programming is not an easy skill to gain and master. Most developers who have the skill are also financially autonomous now and can work on whatever they want.

The best of the best work through the Bitcoin Core method. After all, if you are a world class mountain mountaineer then you do not hang out in the MacDonalds play pen but instead scramble Mount Everest because that is where the challenge is.

However, there are many talented creators who work in other areas besides the etiquette. Wallet maintainers, exchange operators, payment mainframes, etc. all need competent developers to help build their productions.

Accordingly, there is a huge shortage of competent developers. This is probably the largest single scalability limitation for the ecosystem.

However, the Bitcoin ecosystem is healthier than ever before.

( )(/images/bitcoin-ecosystem-small.jpg)

DEFRAYAL CURRENCY

There are no significant global reserve defrayal currency use cases for Bitcoin yet.

Conceivably the closest is Blockstream's Strong Federations via Liquid.

VALUE

There is a wonderful amount of disagreement in the marketplace about the value intention of Bitcoin. Price discovery for this asset will be intense and likely take many cycles of which this is the fourth.

Since the supply is known the exchange rate of Bitcoins is composed of (1) transactional demand and (2) hypothetical demand.

Interestingly, the price elasticity of demand for the transactional demand component is irrelevant to the price. This makes for very interesting subtleties!

(

)(/images/bitcoin-ecosystem-small.jpg)

DEFRAYAL CURRENCY

There are no significant global reserve defrayal currency use cases for Bitcoin yet.

Conceivably the closest is Blockstream's Strong Federations via Liquid.

VALUE

There is a wonderful amount of disagreement in the marketplace about the value intention of Bitcoin. Price discovery for this asset will be intense and likely take many cycles of which this is the fourth.

Since the supply is known the exchange rate of Bitcoins is composed of (1) transactional demand and (2) hypothetical demand.

Interestingly, the price elasticity of demand for the transactional demand component is irrelevant to the price. This makes for very interesting subtleties!

( )

On 5 May 2017, Lightspeed Venture Partners partner Jeremy Liew who was among the early Facebook investors and the first Snapchat investor laid out their case for bitcoin exploding to $500,000 by 2030.

On 3 November 2017, Goldman Sachs CEO Lloyd Blankfein (https://www.bloomberg.com/news/articles/2017-11-02/blankfein-says-don-t-dismiss-bitcoin-while-still-pondering-value)said, "Now we have paper that is just backed by fiat...Maybe in the new world, something gets backed by agreement."

On 12 Sep 2017, JP Morgan CEO called Bitcoin a 'fraud' but conceded that "(http://fortune.com/2017/09/12/jamie-dimon-bitcoin-cryptocurrency-fraud-buy/)Bitcoin could reach $100,000".

Thus, it is no amazement that the Bitcoin chart looks like a ferret on meth when there are such widely varying opinions on its value scheme.

I have been around this space for a long time. In my judgment, those who scoffed at the thought of $1 BTC, $10 BTC (Professor Bitcorn!), $100 BTC, $1,000 BTC are scoffing at $10,000 BTC and will scoff at $100,000 BTC, $1,000,000 BTC and even $10,000,000 BTC.

Interestingly, the people who recognize it the best seem to think its financial governance is destiny.

Meanwhile, those who understand it the least make emotionally charged, logically incoherent bearish arguments. A tremendous example of worldwide cognitive dissonance with regards to sound money, technology and the role or power of the State.

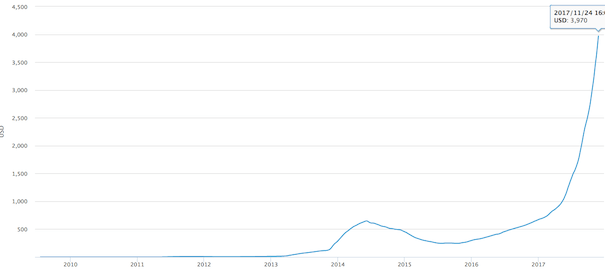

Consequently, I like looking at the 200 day moving average to filter out the daily noise and see the long-term trend.

(

)

On 5 May 2017, Lightspeed Venture Partners partner Jeremy Liew who was among the early Facebook investors and the first Snapchat investor laid out their case for bitcoin exploding to $500,000 by 2030.

On 3 November 2017, Goldman Sachs CEO Lloyd Blankfein (https://www.bloomberg.com/news/articles/2017-11-02/blankfein-says-don-t-dismiss-bitcoin-while-still-pondering-value)said, "Now we have paper that is just backed by fiat...Maybe in the new world, something gets backed by agreement."

On 12 Sep 2017, JP Morgan CEO called Bitcoin a 'fraud' but conceded that "(http://fortune.com/2017/09/12/jamie-dimon-bitcoin-cryptocurrency-fraud-buy/)Bitcoin could reach $100,000".

Thus, it is no amazement that the Bitcoin chart looks like a ferret on meth when there are such widely varying opinions on its value scheme.

I have been around this space for a long time. In my judgment, those who scoffed at the thought of $1 BTC, $10 BTC (Professor Bitcorn!), $100 BTC, $1,000 BTC are scoffing at $10,000 BTC and will scoff at $100,000 BTC, $1,000,000 BTC and even $10,000,000 BTC.

Interestingly, the people who recognize it the best seem to think its financial governance is destiny.

Meanwhile, those who understand it the least make emotionally charged, logically incoherent bearish arguments. A tremendous example of worldwide cognitive dissonance with regards to sound money, technology and the role or power of the State.

Consequently, I like looking at the 200 day moving average to filter out the daily noise and see the long-term trend.

( )

Well, that chart of the long-term trend is pretty understandable and hard to dispute. Bitcoin is in a massive secular bull market.

The 250 day moving average is around $4,011 and rising about $35 per day.

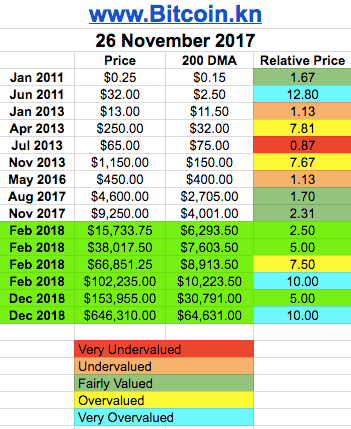

So, what do some proforma situations look like where Bitcoin may be unappreciated, average valued and overvalued? No, these are not prognostications.

(

)

Well, that chart of the long-term trend is pretty understandable and hard to dispute. Bitcoin is in a massive secular bull market.

The 250 day moving average is around $4,011 and rising about $35 per day.

So, what do some proforma situations look like where Bitcoin may be unappreciated, average valued and overvalued? No, these are not prognostications.

( )

Maybe Jamie Dimon is not so off his rocker after all with a $100,000 price expectation.

We are in a very unique period of human history where the collective globe is rethinking what money is and Bitcoin is in the ring battling for complete domination. Is or will it be fit for purpose?

As I have said many times before, if Bitcoin is fit for this resolution then this is the chief wealth transfer in the history of the world.

)

Maybe Jamie Dimon is not so off his rocker after all with a $100,000 price expectation.

We are in a very unique period of human history where the collective globe is rethinking what money is and Bitcoin is in the ring battling for complete domination. Is or will it be fit for purpose?

As I have said many times before, if Bitcoin is fit for this resolution then this is the chief wealth transfer in the history of the world.

DEDUCTION

Well, this has been a brief investigation of where I think Bitcoin is at the end of November 2017.

The seven network effects are taking root enormously fast and exponentially reinforcing each other. The technological dominance of Bitcoin is unrivaled.

The world is rethinking what money is. Even CEOs of the largest banks and partners of the largest VC funds are honing in on Bitcoin's beacon.

While no one has a crystal ball; when I look in mine I see Bitcoin's future being very bright.

Currently, almost everyone who has bought Bitcoin and hodled is sitting on unrealized gains as measured in fiat currency. That is, after all, what uncharted territory with daily all-time highs do!

But perhaps there is a larger lesson to be learned here.

Riches are getting gradually slippery because no one has a reliable defined tool to measure them with. Times like these require incredible amounts of humility and intelligence guided by macro instincts.

Possibly everyone should start keeping books in three numéraires: USD, gold and Bitcoin.

Both gold and Bitcoin have never been worth nothing. But USD is a fiat currency and there are thousands of those in the fiat exchange graveyard. How low can the world replacement currency go?

After all, what is the risk-free strength? And, whatever it is, in The Great Credit Contraction you want it!

What do you think? Disagree with some of my advices or assertions? Please, eviscerate them in the comments!

Please upvote, resteem and follow me. Thank you.

Welcome to steemit

You can join this discord channel to be taught how to go about how to succeed on steemit and learn business,poetry,art,crypto and get motivated,taught how to make good posts and comment and non plagiarised posts

https://discord.gg/WaeJXmE

Join the discord channel today and learn something

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

PLease upvote, comments & Follow me. I am already upvote, comments & follow you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @alphaaa, every updated is apreciated like as yours. Be steem on.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit