The industry has come a long way developing tools and means for the public to participate in the crypto market. Only a few years ago, there were a handful of providers allowing investors to buy and sell Bitcoin and other currencies. Today, the trading landscape has grown increasingly complex and multi-faceted. In this piece, we take a look at the various ways to engage with the emerging cryptoasset market, and the pros and cons that come with the individual platforms.

Centralized cryptocurrency exchanges

Description

Centralized exchanges work similar to traditional stock markets, facilitating matchmaking between buyers and sellers through an order-book-based price discovery system. These exchanges are owned and operated by a company that has total control over all transactions and hold custody over the user’s funds.

Advantages

- Accessibility and ease-of-use

- High liquidity

- Advanced trading tools (margin trading, stop loss, lending, etc.)

Disadvantages

- Users do not have access to the private keys, meaning the exchanges have full control over the users’ money

- As the exchanges hold custody over large sums of money, they are a common target for hackers

- Transactions happen off-chain, giving users no way to track them

- Possibility of manipulative practices (front-running, wash-trading, etc.)

Providers

- Binance

- Bittrex

- Bitfinex

- Coinbase

- Kraken

Decentralized cryptocurrency exchanges

Description

Decentralized exchanges follow the spirit of the industry by disintermediating the centralized exchanges. They work as fully autonomous, decentralized applications (DApps), which allow traders to transact without giving control over their money to a trusted central authority, as is the case with their centralized counterparts. As a result, decentralized exchanges do not hold a customer’s funds or personal information, and only serve as a matching and routing layer for trade orders.

Advantages

- All transactions are recorded and executed on-chain, providing full transparency

- Everyone can participate, as there is no verification process, exclusion of specific countries or other requirements to participate

- Users are in full control over their private keys / funds, meaning the exchanges themselves are not prone to attacks / hacks

- Complete anonymity

Disadvantages

- No fiat-cypto trading

- Harder to use than centralized exchanges

- Low liquidity (so far)

Providers

- IDEX

- WavesDex

- Bancor Protocol

- Kyber Network

- EtherDelta

- AirSwap

Broker-dealers

Description

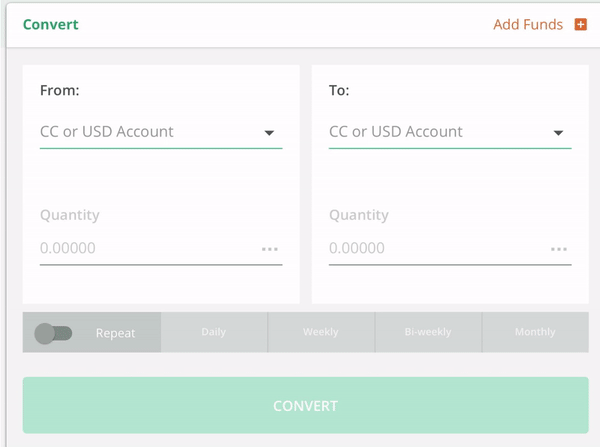

Just like cryptocurrency exchanges, broker-dealers facilitate buying and selling of specific cryptoassets. But while price discovery on exchanges works based on an order book, broker-dealers pool liquidity from different sources and execute trades at the best price. Broker-dealers often charge a small commission on trades in return for routing orders to exchanges’ liquidity as well as value-added services (custom currency pairings, usability, etc.).

Advantages

- Custom currency pairings that are not listed anywhere else on the market

- High liquidity as broker-dealers can tap into several liquidity pools simultaneously

- Vastly improved user experience

- No need for placing orders and waiting for their execution

Disadvantages

- Exchange rates often include a small premium over market prices

- Broker-dealers sometimes have custody over the funds, reducing the user’s control

Providers

- 1Konto

- Robinhood

Direct trading platforms

Description

These platforms facilitate peer-to-peer trading between buyers and sellers, without an exchange that acts as an intermediary. Direct tracing platforms focus on matchmaking between market participants and leave the actual transaction completely up to themselves.

Advantages

- Fiat-crypto trades possible

- Various payment methods possible (Credit card, cash, bank transfer, PayPal, Western Union, etc.)

- Cash and other forms of offline payments allow for improved privacy

- No or very low fees

- Public rating system

Disadvantages

- Lack of trusted intermediaries combined with off-chain payments of the fiat transaction (i.e. bank transfer) leads to possible scams and payment disputes

- Very low liquidity as transactions only takes place between one buyer and one seller

- Execution of trades takes a lot of time and effort

Providers

- LocalBitcoins

- LocalEthereum

- Paxful

Cryptocurrency ATMs

Description

While crypto ATMs often look pretty much like traditional ATMs, they do not deduct money from a bank account. Rather, they work as a self-service kiosk, exchanging cash to cryptocurrency. These machines allow for an easy on-ramp into the world of cryptocurrencies but are generally not the best choice for advanced traders as they charge a significant surplus for the convenience they provide.

Advantages

- Fiat-crypto trades possible

- High privacy

- Fast transactions and improved convenience

Disadvantages

- Availability is restricted depending on location

- High premiums are usually added to the market exchange rate

- Risk of fraudulent or hacked ATMs

Providers

There are already more than 3,500 crypto ATMs in operation worldwide from various providers. Coin ATM Radar keeps track of them here: https://coinatmradar.com/

Conclusion

There is no one trading tool that is perfect for everybody, each has its own pros and cons. It really comes down to what the individual user values, whether it is high liquidity, privacy, low fees, security or other features. We at 1Konto are focused on building the best way to buy and sell cryptoassets for people looking for high liquidity, custom currency pairs combined with a great user-experience. If you want to learn more, make sure to visit our website and/or subscribe to our social media channels (links below).

👏 If you enjoyed reading this piece leave us an upvote or comment below. We are curious to hear your thoughts!

Stay informed

💬 Join our Telegram Community

🐦 Follow us on Twitter

📰 Read more stories from 1Konto

👤 Visit our Facebook page

💻 Get free trades!