This is a two-part article about investing in Silver.

It's about investing in Silver (and other precious metals) not just to grow wealth, but also about investing for a rainy day. And by “rainy day”, I mean a Category 5+ hurricane.

Silver has become a popular investment vehicle. Unlike Gold, it’s relatively cheap to get into. Yes, Gold is divisible, but which makes more sense to hold: a regular size 1 oz Silver coin or a minute amount of Gold? At bullion prices, roughly 0.35 g of Gold is equivalent in value to 1 oz (31.1 g) of Silver. To put that into perspective: The Canadian Mint produces 1 g Gold coins (like this one) which are a mere 8mm in diameter. That’s the width of a pea, and a lot flatter! They even make 0.5 g coins, but seriously, how do you store those without losing them? They’re rather ridiculous little things, you'd need a magnifying glass just to appreciate what’s printed on them!

The point is that even those teeny tiny 0.5 g coins are still worth more than a 1 oz Silver coin. At that minuscule size, they’re just too tiny to use in a practical fashion. They aren't the kind of thing you can keep in a wallet or a pocket. It also bears mentioning that economies of scale are not kind to such tiny coins, the costs of manufacture/shipping/storage/etc begin to add up and become an appreciable portion of the price of the coin over and above its bullion value. 0.5 g coins sell for $84.95 (CAD), 21% above bullion price. That’s not desirable for someone who wishes to protect the value of their investment. This is why we stick to Silver in a practical survivalist situation.

But what is a survivalist situation? And why should it matter to any of us?

Survivalist situations:

See this as a set of doom-and-gloom scenarios if you like, you’re free to do so. Similarly, I’m free to accuse you of having your head buried in the sand if you see it that way. If it makes you feel any better: should I be wrong about the doom-and-gloom part, you’ll still be sitting on a very good investment if you acquire Silver.

Situation 1 - Massive economic crash

Cryptocurrency enthusiasts (such as myself) often warn of the dangers of fiat currencies and the ENORMOUS house-of-cards which they are perched atop of. It’s not just the crypto community, the precious metals investors will warn you about the same thing. Perhaps the property investors will too. Finance gurus like the well-respected Robert Kiyosaki have been warning about it for years.

A massive economic collapse may arrive on the back of a trade war, a massively overblown derivatives market, the collapse of a property bubble, ponzi-style global pension funds falling apart, QE , factors, nations defaulting on debts, political scandals or perhaps something that analysts normally don’t even consider e.g. the runaway prices of medical care. It doesn’t matter what the cause is, maybe it will be a combination of ALL of the above! What matters is that the roots of fiat economies are already disturbingly shaky and are only becoming worse. I believe that widespread economic collapse within the next few years is almost inevitable.

The nasty thing about an economic crash is that nobody is safe. Even if you live in a Utopian society in the best country on earth, it’s still going to have an impact on your finances.

To quote an article from DinarDirham:

“According to a study of 775 fiat currencies by DollarDaze.org, there is no historical precedence for a fiat currency that has succeeded in holding its value. Twenty percent failed through hyperinflation,

21% were destroyed by war, 12% destroyed by independence, 24% were monetarily reformed, and 23% are still in circulation approaching one of the other outcomes. The average life expectancy for a fiat currency is 27 years, with

the shortest life span being one month.”

This is a scenario which you are most likely to encounter. Are you prepared?

Situation 2 - Inflation

“By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” ~ John Maynard Keynes

Even if you miraculously avoid Situation 1, then Situation 2 will still definitely get you!

Inflation - that’s not so bad, right? Well, sort of. There are ways to mitigate inflation, for instance, you can save your fiat money in a long-term, high-interest savings account. Then you just sit back and let compound interest keep you afloat. But how much money can you seriously afford to just set aside and not use? Most people don’t have a big whack of cash that they can put away from several months or even years at a time. It varies from nation to nation, bank to bank and how much you are willing to invest, but generally speaking, you need to stash cash away for at least a good few months to qualify for a decent inflation-beating interest rate.

Even if you do get an inflation-beating rate, you still sacrifice the ability to use that money for something else. In other words, the money you have stashed away has an opportunity cost attached to it - you can’t invest it in anything else while it is sitting in the bank vault (figuratively speaking).

There’s more to this:

If you can afford to save very large amounts of money in high interest accounts, then you’re probably also knowledgeable enough to find even better ways to invest your cash for higher rates of return. Also, you’re probably the kind of person who may be able to “weather a storm” thanks to other factors - such as a continued large income, property investments or valuable assets you can dispose of, offshore investments etc.

But Average Joe is not a great saver (after all, he is constantly encouraged to spend, spend, spend and to live in debt!) and Average Joe doesn’t have the ability to put large amounts of cash away into high-interest investments. So Average Joe is going to get hit hard by inflation.

Anything that Average Joe does manage to save is going to be eroded by inflation. That erosion occurs because Average Joe can’t get an inflation-beating investment with his puny fiat savings, even though they may be large by his own standards. In addition to this, whatever Average Joe earns (his salary or wages) gets eroded by the same process of inflation. Average Joe is forever doomed to fight for inflation-beating salary increases or to find increasingly high paying jobs. As soon as he fails to do so, he becomes poorer in real terms.

It’s not a survivalist situation per se, but it does hit you harder than you realise. The analogy of placing a frog in a pot of water and then slowly raising the temperature applies here. As long as you keep raising the temperature slowly, the frog is content to sit in the pot of water. Eventually the frog boils alive - still sitting happily in the pot. You’re a frog. You’re in a pot.

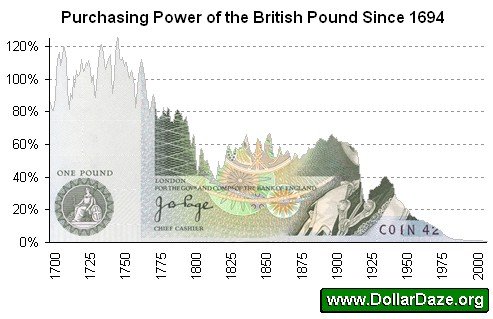

Look at how your water temperature has changed over time:

From http://www.marketoracle.co.uk/Article8100.html

To quote the same DinarDirhan article I linked to earlier:

“Founded in 1694, the British pound Sterling is the oldest fiat currency in existence. At a ripe old age of 317 years it must be considered a highly successful fiat currency. However, success is relative. The British pound was defined as 12 ounces of silver, so it’s worth less than 1/200 or 0.5% of its original value. In other words, the most successful long standing currency in existence has lost 99.5% of its value.”

From http://www.marketoracle.co.uk/Article8100.html

...and those charts are already more than 10 years old...

Situation 3 - Internal Unrest

This is a more obvious “survivalist situation”. Internal unrest becomes more popular by the day. What is it? Blatant tyranny/coups/revolutions - sometimes a combination of all of those. As the chickens of reality come home to roost, so countries are increasingly falling apart. Iran is there right now. Chile got there last year. As did Hong Kong. Argentina is knocking at the door. North Korea has been there for ages, it just hasn’t let its citizens know that. The examples are numerous, I can go on: Venezuela, Zimbabwe - these are not trivial internal conflicts!

Internal unrest situations are disturbingly common in the third world. I know that it’s hard to appreciate this from the comfort of a first world home, but such situations arise fast and have dire consequences for millions of people each year. This is often through no fault of the people themselves, especially if they are part of an unpopular minority group. People are often forced to flee their homes, to literally take what they can carry and leave - fast. For example: Zimbabwean farmers experienced gangs of armed men arriving on their farms. They were told “you have an hour to pack, then this farm is mine and you and your family may no longer be here”. Resistance was not an option - especially as the land grabs were government sanctioned.

In such cases it is prudent to have an exit strategy. Even if events happen fast , they should never catch you completely unprepared. If they do catch you off-guard, then once again I blame you for having your head in the sand.

Situation 4 - War

Society is weak. You have probably all seen this before:

From https://stefanaarnio.com/2016/11/19/weak-men-create-hard-times-hard-times-create-strong-men/

We are now in the beginning phases of the final frame. This is why you see liberals, wannabe socialists and people of imaginary genders everywhere. (Often congregating in "safe spaces"). It's why Millennials are notoriously soft, arrogant, lazy and entitled - don't blame them - they were raised to be that way! It doesn't take a genius to see what comes next.

As an old military man it amuses me, in a tragic way, how secure people feel in the knowledge that they will never have to live through a war.

Wrong. Horribly wrong!

Wars have this nasty little habit of being completely unpredictable. Indeed, the wise enemy attacks when you feel safest. “Surprise” is one of the fundamental “Principles of War” - and then one which I personally consider to be the most important. You don’t have to believe me, the history books are littered with examples. The history of mankind IS the history of warfare. Wars often start with a treacherous and/or unexpected event - probably more often than not!

The “weak men” of planet Earth have a very good chance of seeing their fragile little fairy world ripped out from beneath them. Some already have, though at this stage the wars are still generally confined to less developed nations, nations whose people have grown up tougher and with greater character.

The effect of war on an economy can be catastrophic. Apart from more obvious effects such as having your home bombed or having to flee the country, war leads to financial effects such as greatly increased national debt or hyperinflation. For example: in 1919 (the beginning or World War I) The Gold-backed German Mark was taken off the Gold Standard and became a fiat currency called the Papiermark. In April 1919, 1 US Dollar was worth 12 German Mark. By December 1923 - not even five years later - 1 US Dollar was worth 4 200 000 000 000 Mark! Could you afford your fiat savings to decrease in value by a factor of 350 BILLION ?

No matter where you live, never EVER think that “war won’t happen to me”. I can’t think of a single nation that does not possess some sort of sizeable potential military threat, even if the odds of conflict are low for the time being. You name the country, I’ll tell you the threat. If war doesn’t find you - you’re lucky. If it does - you should be ready. Don’t say I didn’t warn you...

My grandfathers both fought in a war, my father fought in a war. So far I’ve been lucky enough to have avoided doing so myself, but I’m not naively counting on staying lucky.

In Part 2:

As introductions go, that was a lengthy one, but necessary. Without the correct context, much of the justification behind the kind of Silver investing I'll be speaking about will evaporate. There are very solid reasons to hold onto Silver, which is what I will go into in Part 2. We’ll look at what kind of Silver to buy, how much, and why I say that.

Don’t miss it, it may just save your bacon...

Yours in crypto

(and Silver)

Bit Brain

"The secret to success: find out where people are going and get there first"

~ Mark Twain

"Crypto does not require institutional investment to succeed; institutions require crypto investments to remain successful"

~ Bit Brain

Bit Brain recommends:

Crypto Exchanges:

Civilizations, rise, flourish and fall. We all know that.

Apart from the 'Hard times create strong men, etc' axiom, there is currently a more sofisticated approach based on IQ as layed out by Michael Woodley of Menie and Edward Dutton (https://www.amazon.co.uk/At-Our-Wits-End-Intelligent/dp/184540985X/ref=sr_1_1?keywords=dutton+woodley+of+menie&qid=1580158568&sr=8-1)

Since IQ is the best predictor for success for an individual, a society's IQ is the best predictor for the success of a society, or civilization, as explained in the above linked book.

Example 1: the bubonic plague killed approximately one third of the population in Europe, estimates are up to half the population were killed in the Mediterranean. Who dies? The poor, the sick, the stupid. Consequently the general IQ of those that survive is higher. About 200 years later, you get the Renaissance.

Example 2: in Britain all had many children, but less children of the poor survived compared with the children of the rich and successful. Consequently, the IQ rises in this survival of the richest. A couple of centuries later, you get the Industrial Revolution with an unprecedented amount of inventions. As a result, living standards rise and more poor children survive, dropping the society's IQ again. We are now back at the same level as in the 1600's they state.

On top of that, the increasing amount of surviving mutant genes negatively influence the remaining 'good' genes.

The explanation is very logical, very Darwinian, tough as a nail and, I think, very convicing. If you haven't heard of it yet, I think it will interest you. They have an entertaining YouTube channel also: The Jolly Heretic.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks, youp, your comments are very interesting.

IQ is something I have actually studied in depth, so I think I can contribute a few more thoughts to this discussion.

First note that IQ is a measure of POTENTIAL, not of success. But yes, statistically those with potential should trump those with less potential - leading to the effects you describe.

Unfortunately the modern world is a clusterf*** - there is just no other way to describe it. Wealth, to a large degree, can become a hindrance to intelligence. While the poor will always suffer the IQ reducing effects of malnutrition/disease etc, the rich suffer greatly because their lives have become too easy. The modern environment has created this obscene culture of entitlement, anti-intellectualism, and the worship of everything that is vacuous and fleeting. Social media is awash with fashion trends, celebrity gossip and pop music - all readily consumed by the richer masses.

The rich have lost the ability to do things for themselves (obviously I'm generalising), they've lost the ability to even THINK for themselves! Thus we now observe the Flynn Effect has gone into reverse, dropping the IQ of society on the whole. Scarily this is COMBINED with your very valid point about the weak surviving to further "pollute" the gene pool - so to speak. Incidentally, if anyone has objections to these comments being non-PC, then kindly get the hell out of here and never visit my page again. I have no interest in dealing with brainwashed drones.

The future is rather bleak - for multiple reasons. This is why I believe that it is prudent for everyone to start thinking along survivalist lines, not in a panicky build-an-underground-bunker kind of way, but to the degree that they have working contingency plans available in case they will ever need them.

When the inevitable does occur, there will be much pain and suffering. It angers me greatly, because much of it has been brought on by selfish greed. Had society developed along better lines, there would have been no need for anyone to suffer. But here we are, breeding like rabbits on Viagra and wondering why things are in rapid decline. One can only hope that the next iteration of society will learn from the mistakes of the past. History indicates that this is unlikely...

I'll go check out The Jolly Herectic, thanks for the suggestion and for taking the time to share your insights.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit