Formed from the original geek idea, now an industry that is constantly progressing in innovation, there are few such subversive products of Uniswap and ETX that can bring us. To be pleasantly surprised, I really look forward to their success.

Uniswap is arguably the most successful decentralized exchange so far. It is different from the traditional decentralized exchange’s “chain order, on-chain matching” trading method. All transaction processes of Uniswap are completed on the chain. The key point is that it uses smart contracts for fund pool matching transactions.

What is Uniswap’s fund pool matching?

It can be understood with a simple formula: a➗b=k. The value of K is the price reflected in real time. Let’s take Ethereum (ETH) as an example. Assuming that there is no ETH/USDT trading pair in Uniswap, we first need to inject liquidity to act as a “market maker”. If we inject 1 ETH and 400 USDT at the same time, then the real-time transaction/exchange price is 1ETH=400USDT; if another market maker injects 400USDT and 0.5ETH liquidity at this time, the price will become (400+400USDT)➗(1+0.5ETH) =533.33USDT. What about players who need ‘flash cash’? One-way injection of liquidity can be instantly traded and exchanged for another cryptocurrency of choice. Depending on the amount of funds injected, a certain “slippage” will occur (Editor’s note: slippage refers to the point where the order is placed and the last transaction There is a gap between the points). With the increasing size of Uniswap’s capital pool, most of the slippage generated by the transaction of ERC20 tokens with a large market value is within 1%. *

Why Uniswap get succeed?

Uniswap is aimed at the fast exchange needs of price-insensitive users: if you want to make a quick transaction on a centralized exchange, you can only choose the market price and upload your personal privacy information (most centralized exchanges require mobile email authentication, KYC Verified). The market price transaction is fast, but it will inevitably bear higher handling fees and certain “slippage”. Instead of this, why not choose Uniswap which is faster, more convenient and safer?

Uniswap is a combination of DEX and DEFI: the user’s counterparty is not the user, but the fund pool and algorithm. Providing a fund pool can get a fee share, so a large number of arbitrage players will be attracted to deposit in the fund pool to reduce slippage. In this process, Uniswap does not even need to issue platform currency to attract the entry of the capital pool. It has completed the utopian ideal of “I am for everyone, everyone for me” on the chain; besides, there are many arbitrage market making. Business Tigers is ready to increase the liquidity of the fund pool at any time. Is it the same logic as DEFI? This is the logic of most DEFI products. If I provide DEFI product liquidity, then I can get token rewards for the project.

Is there any problem with Uniswap that needs to be solved urgently?

Everything has two sides. In the mechanism design of Uniswap, in order to reflect the real market supply and demand, arbitrage almost occupies a key position after each transaction, due to changes in inventory, the model will assign new prices to the transaction assets. If the price deviates from the market price, it will When arbitrage opportunities appear, arbitrageurs can trade at deviated prices, obtain a return on the difference, and make up for the lack of assets into the pool.

Uniswap’s arbitrageurs have pushed ETH’s gas by almost an order of magnitude, and at the same time caused long-term blockage of the Ethereum network, and users are miserable.

In addition, Uniswap has its limitations. Uniswap is built on the ETH network and cannot complete cross-chain asset transactions. Many public chains that claim to be cross-chain asset transactions often have nothing to do with the hot spots.

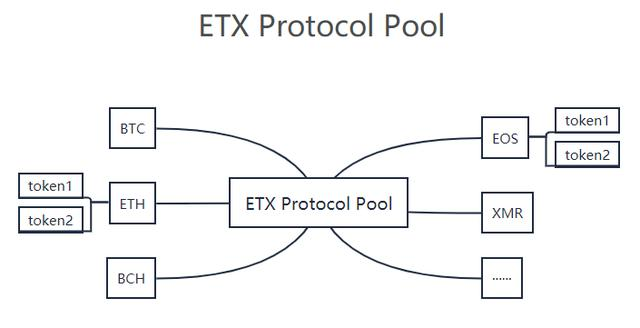

The ETX (Ethereumx·NET) POC protocol pool breaks the ice.

Image for post

The ETX protocol pool indicates

Is there a decentralized exchange that allows mixed transactions of all different main chains?

The answer is yes.

The difficulty of cross-chain lies in the different protocols used by different digital assets. ETX’s economic white paper mentions a feasible method: establishing a protocol pool interactive system. *The ‘protocol pool’ here has the same effect as Uniswap’s fund pool. The agreement is submitted on demand, and the fully decentralized cross-chain transaction may not be far from us.

Blockchain was formed from an initial geek concept and is now an industry that is constantly progressing in innovation. Few products such as Uniswap and ETX can surprise us. The author really looks forward to their success.

*According to data from Coingecko, as of August 11, the total liquidity of UniswapV1 and V2 exceeded 200 million dollars, and the 24-hour trading volume has exceeded 250 million U.S. dollars, almost evenly sharing half of the world in the DEX world.

*According to the ETX economic white paper, after the DEX (Decentralized EXchange) is opened, there will be independent ETX trading pairs in the DEX. At the same time, there will be a certain depth of requirements for each currency connected to the protocol pool. To meet the depth requirements, you need to prepare in advance A certain amount of ETX is entered into the pending order book as the transaction target of the currency, so as to ensure that the transaction is completed immediately.

This article does not constitute investment advice.