Cryptocurrency trading is caught between its freewheeling, amateur roots and its current volume and complexity, which demand a more professional approach. That is also the demand of major investors from the field of mainstream finance, whose growing interest in cryptocurrencies is tempered by the chaotic and fragmented nature of this market. According to CoinMarketCap, there are 218 active cryptocurrency exchanges as of this writing. Trading through them, especially on a large scale, can be an arduous and inefficient process that major players are reluctant to tolerate.

XTRD wants to remake the cryptocurrency market by using the tools of traditional finance. Through its software, it would bring together multiple cryptocurrency exchanges on a unified platform which shall be equipped with the options its clients are used to. The company also promises to develop a number of advanced cryptocurrency trading services.

How will clients trade with XTRD?

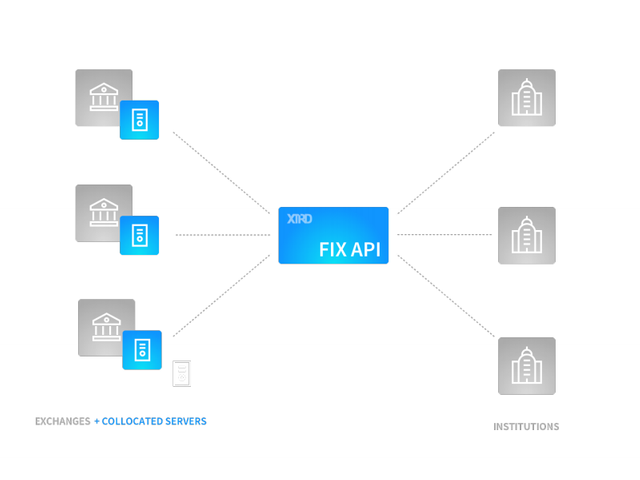

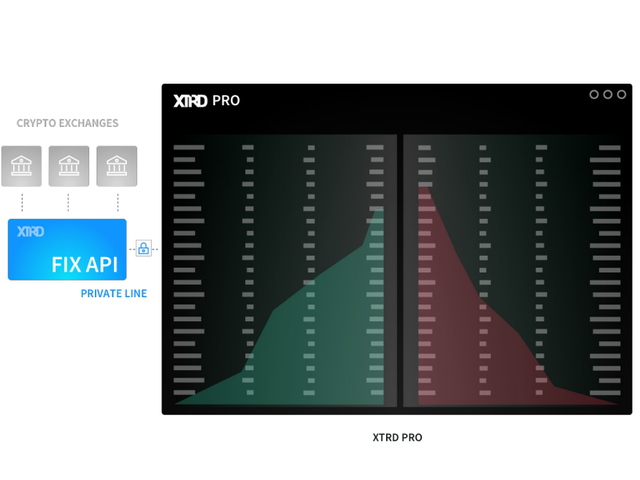

XTRD will launch an API based on the financial industry's standard FIX protocol that would allow all existing exchanges to communicate with each other. This will create a universal data stream that shall be made available to institutional investors and their algorithms. Clients would gain the ability to trade on all exchanges through a single trading platform app, connected to its API and providing more sophisticated features such as automatically combined order books, hotkey entry and the customisation of orders.

Later in its development, XTRD hopes to set up a cross-exchange execution feature, letting companies execute certain orders across several exchanges at once to clear transactions at an optimal cost. Exchanges will act as custodians in this process. XTRD could function as a credit sleeve in transactions between different participants on its platform. It could also allow clients to upload their encrypted trading strategies on the platform's Virtual Private Server for higher performance in their trades, for a fee. Finally, XTRD will establish a KYC-compliant dark pool, allowing businesses to trade directly with each other in large amounts of cryptocurrencies and fiat.

All fees on the platform (whether for specific actions or subscriptions for particular components) will be valued in dollars, but could be paid with XTRD tokens. XTRD holders will have 25% discounts, while those who stake 50,000 or more XTRD will receive 40% discounts on all services. One further revenue stream for the platform will involve the gathering and monthly selling of market data from the unified stream.

What are XTRD's main advantages?

This platform is aimed entirely at professional and institutional investors moving into the cryptocurrency world. That grants it a sharp business focus, allowing it to focus on meeting its clients' needs. In addition to the convenience and familiarity of its time-tested technologies, XTRD offers them higher efficiency when trading in large volumes of fiat and cryptocurrencies. It promises to standardise and optimise the trading flow, making the prospect of investing in cryptocurrencies much more appealing than it would be now. The chance of attracting major investors should, in turn, encourage cryptocurrency exchanges to cooperate.

XTRD was founded by Wall Street veterans from different trading firms, with extensive experience of, and familiarity with, conventional financial technologies and procedures. It will operate out of New York, and its private network will initially be set up through the NY4 and LD4 data centres, suiting the needs of most key players. The company will continue to take steps to increase the speed of transactions on its system. XTRD has already acquired several cryptocurrency exchanges as partners. By providing technology and working with and through such partners in delivering many of its services, the company hopes to avoid most regulatory hurdles.

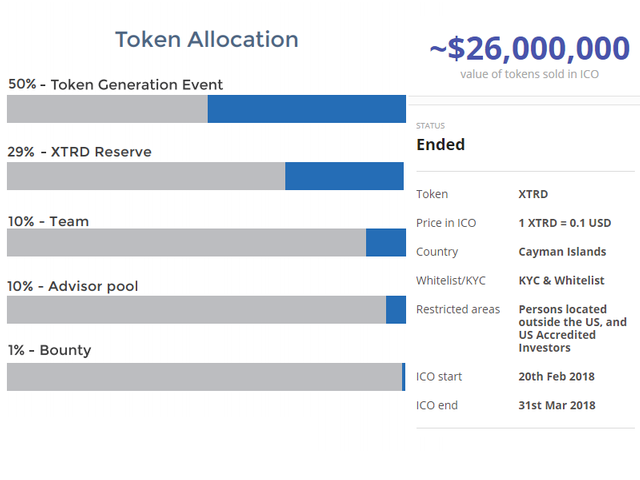

Token sale details

The vanguard of mainstream cryptocurrency investment

Mainstream interest in cryptocurrencies is a major trend that has reached big-time investors in the conventional finance world. Their interest in this volatile yet promising type of asset goes without saying, but the fragmented and technically underserved state of cryptocurrency trading is a serious stumbling block. If XTRD can come through with the promise of bringing all the major exchanges together through its platform, it would make it much easier for big companies to get in, both through its services and its market data. As that would be in the interest of the cryptoindustry as a whole, it is easy to see why XTRD's ICO was such a huge success.

Still, it is not enough to raise funds. To succeed, XTRD will require the interest and the cooperation of major exchanges. It will also need to make sure that its technology is up to its promised standards. There is also the minor but troublesome issue of its rebranding efforts (away from Xtrade), which have confused some part of the community. If it handles those aspects as well as it did the token sale, XTRD could play a vital role in the maturing of the cryptocurrency market.

Links:

Website: https://xtrd.io/

WhitePaper: https://xtrd.io/xtrd_whitepaper.pdf

Telegram: https://t.me/xtradecommunity

Facebook: https://www.facebook.com/xtradeio/

Twitter: https://twitter.com/xtradeio

Medium: https://medium.com/xtradeio

ANN: https://bitcointalk.org/index.php?topic=4477503.0

Author: https://bitcointalk.org/index.php?action=profile;u=980049

This article was created in exchange for a potential token reward through Bounty0x

Bounty0x username: the1arty

Disclaimer

This review by Bonanza Kreep is all opinion and analysis, not investment advice.