CNBC explains

If you are considering investing in cryptocurrencies, keep in mind that these are highly speculative ventures. In other words, you run the risk of losing most of your investment, if not all of it. And keep in mind that in every nascent industry, a golden goose is waiting to be discovered. Many believe that that this golden goose has already be unveiled (Bitcoin). Unfortunately, it is not always 1st to market that ends up the long-term winner. Just look at early movers in the internet, social media, computer tech and hardware sectors, Netscape, America Online, Sun Microsystems, Dell Computer, etc. All were considered 1st market movers.

1st the difference between fiat and cryptocurrencies

Before determining if cryptocurrency investments are a good fit, you must first understand the difference between fiat and cryptocurrencies.

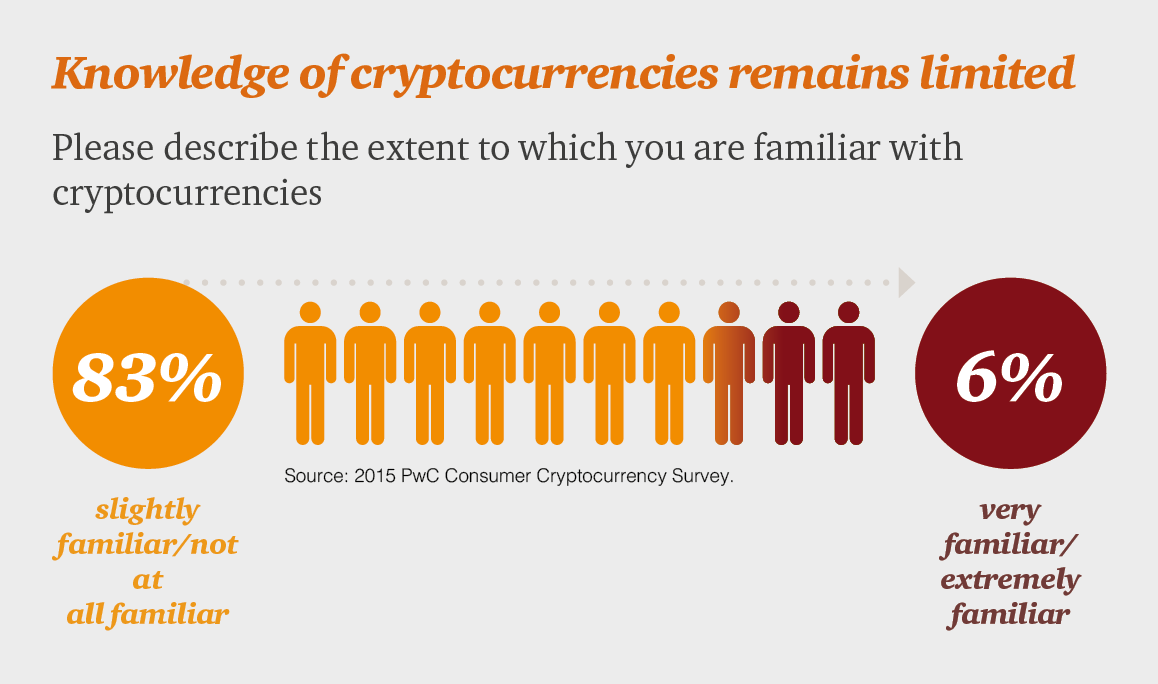

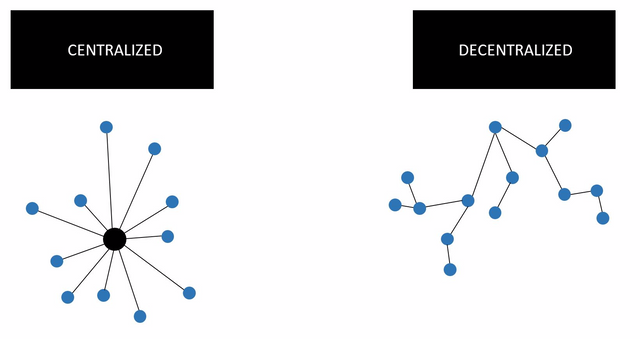

Some people struggle with the concept that traditional fiat currencies are “centralized”, and digital currencies are “decentralized”. If you don’t understand this simple concept don’t consider investing in this sector. Putting your hard-earned money into a venture you don’t understand is like walking into a dark den of snakes without a light. Simply put, centralized is controlled by a one system source. Decentralized is controlled more loosely by many systems.

Please continue reading.

I am sure you’ve heard people say that fiat currency can be printed on-demand. Truth is that every fiat currency is created, “out of thin air.” This leads us to believe that increasing the total supply of fiat will make all money in circulation become less valuable; however, although there is truth in this statement many people fail to understand what gives fiat currency its value. The true value (foundation) of fiat currency is the productivity of the country that prints the fiat. For this reason the U.S. dollar is the defacto world currency. The U.S. economy is the strongest and most stable in the world. This is why other countries are willing to loan the U.S. government money. They are investing in the future generation of wealth of the American people. There is no need to tie the U.S. dollar or any fiat currency to a tangible asset as long as the nation that prints it continues to generate economic output. Therefore it is felt that fiat currency has no inherent or intrinsic value whatsoever. And if it did what could you possibly tether it to, gold? Gold is just a piece of metal…

I will not go into a full review of the US Treasury; but here is the kicker. You should know that there are twelve Federal Reserve Banks. Two of these Federal Reserve Banks are privately-owned, creating a non-transparent ecosystem in which a handful of people determines the wealth of an entire nation. And because the United States is the most economically viable nation on earth, this activity also has a great effect upon the world economy. In addition there is no direct control from any government level office. This is not a positive, as there have been multiple financial crises over the years. Even worse, the Federal Reserve can inject new money into all sorts of financial vehicles. They can purchase Treasury Bonds or they can use this money to purchase loans with the sole purpose of financing the debt of the entire United States. And this is what is happening today. The future of anyone under the age of 35 is being mortgaged.

This is where I have a problem with fiat currency particularly in the United States. I am not an economist and I don’t know enough about the central banks of other nations to comment on how they manage their currencies but I do know that other nations are performing similar transactions. Nobody really knows what is going on.

How is Decentralized Currency Different?

In the world of fiat currency, people (the collective) give value to currency just as they do in the cryptocurrency world. They do this through their economic output and some speculation; however this is where the similarities end. As discussed above, in the centralized world of fiat currencies, you have central figures that attempt to mold and/or control economic output and the supply of currency.

A decentralized system does not have one person or one organization that controls the currency. Instead of a government that prints money, everyone can mine a cryptocurrency (like Bitcoin). Instead of putting trust in a government that manipulates their fiat currency to maintain value, cryptocurrency value comes from the network of people using it. Every person in the network is connected to every other person, so there’s no central point of failure. If a central authority fails in its duty to keep their currency stable or to increase or decrease the value of their fiat currency as they deem necessary for economic reasons, the economy of the tethered currency can fail. Without this central authority the value of cryptocurrencies is unaffected but is still subject to market fluctuations perpetrated by the activities of those that possess the currencies.

Decentralization takes power away from the institutions and distributes it to everyone else. So now the question is, “Cryptocurrency Market Boom or Bust? (Is it a good investment?)

How does future investment look?

Some believe the jury is yet to return, but I see a revolutionary system of storing value for trade that is poised to reorganize the world. As cryptocurrency is used to finance and power the blockchain, the future looks bright. This new form of wealth creation is completely consumer driven, trustless, sustainable by projects and companies that are only now beginning to take full advantage of a system of currency tethered to technology that will change the way we do everything from conduct large business transactions to performing the most mundane tasks. As witnessed in China and South Korea, there will be some government regulation of this industry. As I write this, the SEC is taking a long look at ICOs. Ripple has met with U.S. regulators and I’m sure the U.S. treasury and the central banks want a piece of the action. But fear not; the industry is already too big to stop. Companies like Ripple and Ethereum have contracts with large banks and industries that have great interest in blockchain technology. And we already have a strong understanding that cryptocurrency is used to power these new platforms.

In short, this industry of currency exchange is and will remain robust. It is early, but now is the time to invest. Doing so will take a strong stomach and a lot of common sense as there are over 1,000 cryptocurrencies and many are or will be completely worthless. Strong due diligence is very important in this space.

If I have peaked your interest… if you want to generate serious long or short term income, follow me on SteemIt, read my posts and please upvote and ReSteem my posts.

Peace

Boom not Burst

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Absolutely! But when pouring your money into any venture, especially when the venture lays withing a nascent industry, strong due diligence is the difference between losing your money, earning a little, or creating real wealth. Cheers!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@cannabisinvestor, your picture appear two times ;)

I still upvote you for the intention, but fix it it's can only be better :p

night night i go sleep

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @cannabisinvestor! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDownvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit