· The final breaths and gasps of this current exhaustion move higher in Bitcoin is signaling the end of one part of the cryptomarket and the beginning of another.

· Rotation of capital into altcoins is imminent!

The end of the alt-pocalypse is nigh

If you or someone you know has a majority of their cryptocurrency holdings in altcoins, then you probably feel their pain. Altcoins have just been absolutely slaughtered against Bitcoin’s rise. Today (June 26th, 2019) has been particularly horrible. Just look at some of the Altcoin BTC pairs:

ADABTC: -10.76%

BTGBTC: -12.93%

GNTBTC: -10.41%

ICXBTC: -16.91%

IOTABTC: -12.44%

KMDBTC: -19.44%

MCOBTC: -26.64%

ONTBTC: -15.46%

ZRXBTC: -13.87%

That’s ugly. To add some insult to injury, almost every single altcoin has continued the trend of creating new all-time lows against Bitcoin, something that has been a trend for many altcoins for over 30+ trading days. But many altcoins have lost over 80% of their value over the past 90 trading days. Ontology (ONT), for example, has lost -64.25% of its value against Bitcoin over 97 days. Polymath (POLY) has lost over -82.49% of it’s value over the past 93 days. 0x (ZRX) has lost over -71.06% in 80 days. Komodo (KMD) has lost a staggering -61.06% in just 16 days. While all of these examples sound fairly bearish, there is some light at the end of the tunnel. First, while these Bitcoin pairs have generated new all time lows and major double digit negative moves, many of these pairs’ US Dollar values have gained in value.

A good example of this behavior is Cardano’s Bitcoin pair and US Dollar pair. Cardano is currently down -8.58% against Bitcoin but is up +6.77% against the US Dollar. What does this mean? If this current condition remains, then we are seeing the first examples of capital rotation. The final piece of evidence of a bull market in altcoins will be known if Bitcoin, for example, is down -8% and we see the altcoin market experience +12% gains against Bitcoin and the US Dollar. But I think we have sufficient evidence of that happening right now. Look at the image below:

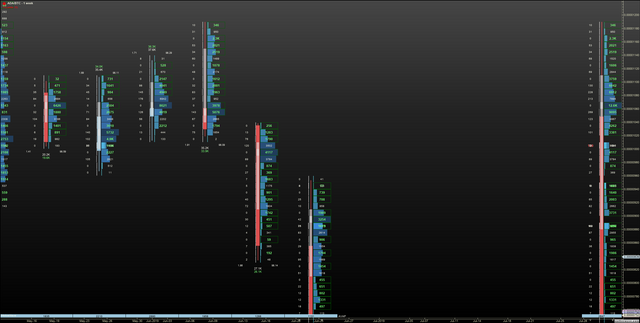

The image above is a too called Volume Imprint – it is one of the most powerful and amazing tools I’ve ever used and it is part of the MotiveWave charting software. What you are seeing is two columns of numbers on the left and right side of a candlestick. This is called a ‘ladder’ – it displays the Bids (left) and the Ask/Offer (right). You may also notice that some numbers are bold and highlighted neon green and may have a green box around the value. Without going into substantial detail here on how to interpret this type of analysis, I just want to point out a couple of facts. First, the candlesticks represent a week – the candle on the far right is the monthly candle. Second, over the past 7 weeks, every weekly candle has over 98% more buy volume than sell volume. This is a common occurrence over all the major altcoins in the top 30 market cap. This is a clear sign of accumulation and a clear sign of imminent and violent changes in the current trend of altcoins.

The altcoin bull market is about to begin.

BTC is once again doing the hard work and raising attention to crypto, soon enough people will have their focus on finding new investments and Altcoins will boom like they always do.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit