This post will be a continuation of my previous post on the best performers of the week (for the last 15 weeks). I made a mistake on the last post: Crypterium (CRPT) was also the best in a week when the market was down. So in this post I will talk about it, and additionally Swipe (SXP) and Quant (QNT). These are tokens that were the best in some of the previous 15 weeks, but when the market was moving sideways (not up nor down).

Crypterium (CRPT)

This token is rank 72 in market cap, with a maximum supply of 99,968,575 tokens (84 million currently in circulation), each traded at $0.680385.

Crypterium has some presence in the mainstream media, you can find their main members giving interviews in places like Forbes and Reuters. Their CEO, Steven Parker, was a former general manager of Visa. The fintech company developed a mobile payment solution based on QR scanning in 2013 (not yet blockchain-based), and started developing blockchain-related products in the beginning of 2017. Around June this year they launched their "Bitcoin card" -- a card for payment with Bitcoin and other major cryptocurrencies.

An interesting point about the CRPT token, which operates on the Ethereum blockchain, is that it is extremely deflationary. Whenever a user makes a payment via Crypterium systems, they have to pay a fee of 0.5% in CRPT tokens. These tokens are discounted from their account, and burned. Which means that the number of tokens will get ever smaller. From the 99 million tokens issued in the initial token sale, 70% were bought in the ICO and the rest was kept by Crypterium ("reserved for the project's needs", in their words).

CRPT saw a major drop in value during the whole year of 2018 since its ICO in January, when it peaked at $1.58, but 2019 has been an year of slow recovery: from $0.091 in January to $0.68 now. The price increased a lot in the last 20 days, so we may expect a huge correction in the next few weeks. It seems a project to keep an eye on.

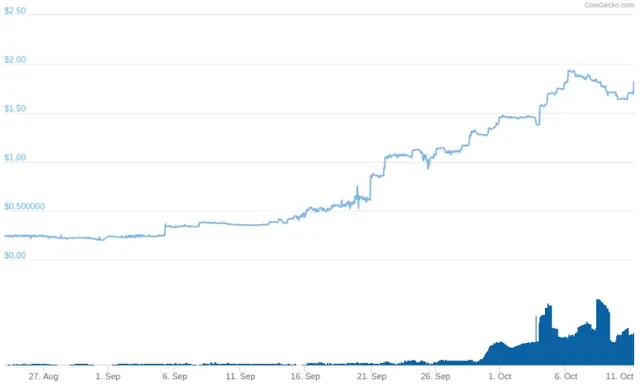

Swipe (SXP)

SXP is rank 47 in market cap, with a maximum supply of 300,000,000 tokens, but currently there are only 60,135,911 circulating. The price for 1 SXP is $1.82.

It looks like Swipe is in that initial enthusiasm phase of altcoins where there is a huge surge in price, just to lose 95% of value in next months. Looking at its website, we can see that Swipe Wallet LTD, a company based in London, does not have any famous name behind it. Also, it has a lot of similarities with the CRPT token above: it is an ERC-20 token on the Ethereum blockchain and its function is to serve as payment for fees in a crypto-based payment system. From their white paper:

Swipe will bring back the original purpose of cryptocurrencies and enable them to be used as currencies and offer its userbase a wide selection of services to bridge traditional financial systems to cryptocurrencies.

It's soon to say what will happen to Swipe, but I wouldn't buy it now at this early excitement stage.

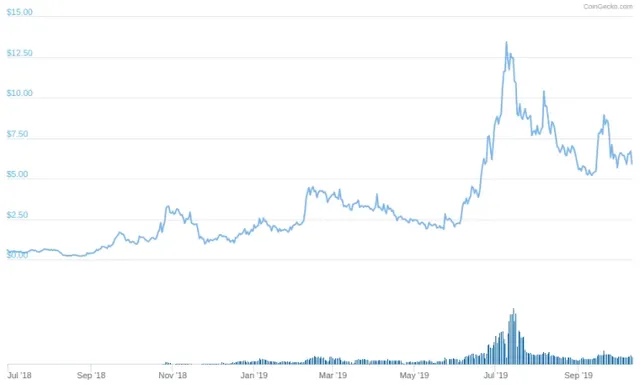

Quant (QNT)

Quant is the 68th largest currency in market cap, with 9,964,259 tokens in circulation out of a maximum of 14,612,493. The price is $5.90 per token.

Initially looking at their website I notice that the idea is similar to Chainlink and some of the projects discussed in the first part of this post, such as SEELE, HC and VSYS: to enable connections between blockchains, and between those and non-blockchain networks. This is confirmed by their white paper, with what they call Overledger. I quote:

Overledger is a new blockchain operating system intending to solve the problems of single-ledger dependency by increasing communicability among DLTs [distributed ledger technologies], allowing general purpose applications to run on top of different blockchains.

The project has some heavy weights as partners, including Oracle, Amazon and Nvidia.

Some of Quant Network's partners.

The token has seen astonishing growth since June, around the time it announced its partnership with SIA, an European giant of payment solutions (but I don't know whether there's a causal connection).

Since the European launch of our private infrastructure SIAchain, we are at the forefront of innovation in blockchain technology with the aim of supporting financial markets with a high-performance and secure architecture and a clear governance model. We actively continue on our path of innovation and the achievement of a fully interoperable blockchain network is the foremost objective we want to reach with the collaboration of Quant Network and its disruptive vision on DLT -- says Daniele Savarè, Innovation & Business Solutions Director, SIA.

Anyone who uses a MApp (a multichain app making use of Overledger) or who wants to develop a MApp has to hold QNT tokens. Think of QNT as a fee that is paid to access the Overledger. Licenses will also be used: a smart contract will lock the QNTs until the license expires -- during this period the user can access the network. The QNT tokens can also be used to monetise such MApps. QNT is also an ERC-20 Ethereum token. The company holds currently around one third of the 14 million tokens, and the rest was sold to the public in the ICO.

This guy predicts a value of $34 in 2020 and $689 in 2024, based on technical analysis. And this guy is probably rich at this point. But I don't know. What do you guys think about QNT?

PS: Mr. Crypto Wiki just published an overview on the Quant Network.

Conclusions

There are a lot of new blockchain projects and cryptocurrencies still in their first years of existence. Just as Bitcoin was worthless and became valuable with time, some of these projects may turn out to be a new jewel. Time will tell.

My original post here.