Introduction

Compound is a DAPP that run on the Ethereum network and provide an easy way to access money without asking your bank. It is good to know where you can access quickly some liquidity.

Sometimes you have an opportunity but you don't have immediate liquidity. You have a variety of reasons to you use a service like Compound on the Ethereum Network.

You need to use MetaMask to interact with the interface of this DAPP and send your crypto in and out. This is a software that you need to install in your browser and you are ready to go.

Compound

What you need to keep in mind is that Compound is a peer to peer lending platform. You can make interests right away by sending your tokens on a pool.

An awesome point is you don't need to wait for the loan to mature to withdraw your money. The liquidity remains in the pool and this is a great feature of this DAPP.

The philosophy of Compound

Instead of having your tokens sit on trading exchanges or a cold wallet while you HODL in the hope of buying a Lambo, why not take advantage of the Compound website to make some interest from your crypto?

if you are really patient and dedicate toward that strategy, passive income can make you rich in the long run.

Use cases to borrow on Compound

A borrower can use Compound for different purposes but here are the use cases extracted from the whitepaper:

- To finance ICOs or Initial Exchange Offering without rebalancing your crypto portfolio.

- Traders can borrow to short a token and make a profit in the process.

- Anything that comes to your mind to access liquidity rapidly.

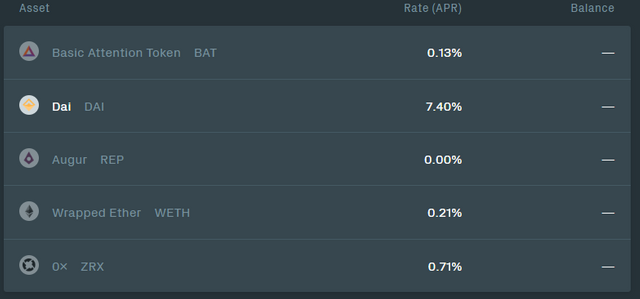

Coins supported on Compound

Compound does not offer a native coin of their own and for me, this is a major inconvenient. You are limited to borrow or make interest on the following tokens:

As you can see only BAT, DAI, REP, WETH, and ZRK are supported. Compound need to offer more coins and the possibility to expand the capability of this DAPP.

The one that offers the best return on investment is DAI. Today, its annual percentage rate is 7.41% and this is the way to go. In comparison, a traditional bank offers you to leave your money in a saving account that generates a meaningless interest of 1% to 2% a year!

You might consider it as a great opportunity to generate a 7.41% interest. The interest can vary in function of the supply and demand of the tokens between both parties.

Compound FAQ and money market protocol

You want to learn more and read the official documentation of this DAPP? The FAQ can point out some of the questions that might pop in your head. Maybe you want to understand how the protocol works under the hood? If so, you may want to read the money market protocol document.

The links to the official documents:

Compound FAQ:

https://medium.com/compound-finance/faq-1a2636713b69

Money market protocol: https://compound.finance/documents/Compound.Whitepaper.v04.pdf

Conclusion

Compound is a nice DAPP that run over the Ethereum network that provides you a way to make interest. Borrowers can ask for a loan and to access liquidity without asking a bank with the power of Compound ecosystem.

What I would suggest improving is to see more coins available. I believe that the 5 tokens limit is not enough. It could support great tokens like Bitcoin and many others that provide a lot of liquidity on the market.

What I find the most appealing is the possibility to buy the stablecoin DAI and make interest with it on the Compound infrastructure. As of today, you can generate 7.41% interest rate and this is good.

My personal rating for this DAPP: ✰✰✰

Check the stats of this DAPP on State of the Dapp website: https://www.stateofthedapps.com/dapps/compound

Posted from my blog with SteemPress : https://chesatochi.com/compound-dapp-review/