Fifty traders who use Indian crypto mart Instashift have shared their thoughts on the current crypto environment in India. Most of them said that they “hodl” and would protract to invest in crypto despite regulatory uncertainty.

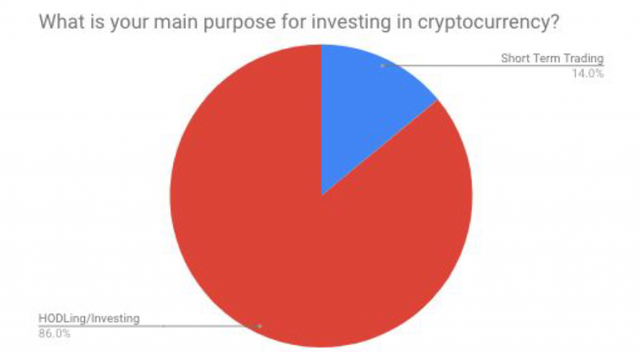

Most Respondents Are Hodlers

Fifty zippy traders in India participated. The goal of the survey was to find out what they think well-nigh various crypto-related issues including their investment concerns, the crypto financial ban by the Reserve Bank of India (RBI), and whether they will alimony investing in crypto despite regulatory uncertainty.

Among the 50 traders who responded, 43 said that they hodl while seven revealed that they invest short-term.

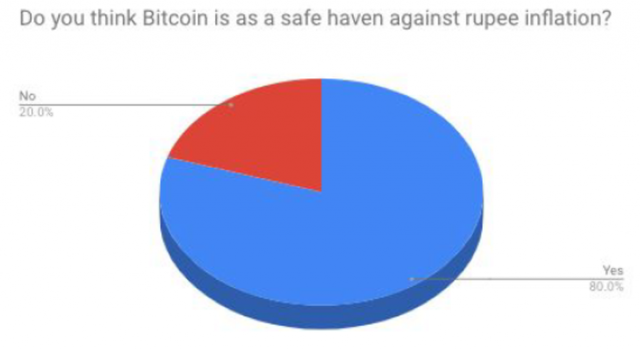

Furthermore, 40 traders believe bitcoin is a unscratched oasis versus rupee inflation while 10 traders disagree.

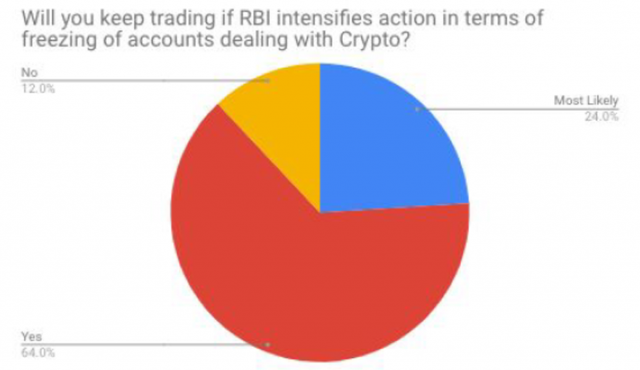

Crypto Investing Despite RBI Ban

India is currently drafting crypto regulations which were supposed to be ready in September but have been delayed. Meanwhile, RBI, the country’s inside bank, has vetoed financial institutions under its jurisdiction from providing services to crypto businesses. A number of petitions have been filed versus the ban. The country’s supreme magistrate has been trying to hear them since Sept. 11, but the hearing has continually been postponed.

The financial ban by the inside wall has adversely impacted some exchanges. One of the country’s largest crypto trading platforms, Zebpay, recently shut lanugo its mart operations due to the financial problem.

Despite the ban, 32 Instashift traders said that they would protract to invest in crypto plane if the RBI intensifies its crackdown such as freezing crypto accounts. Another 12 traders noted that they are moreover likely to protract trading while six respondents said they would discontinue crypto trading.

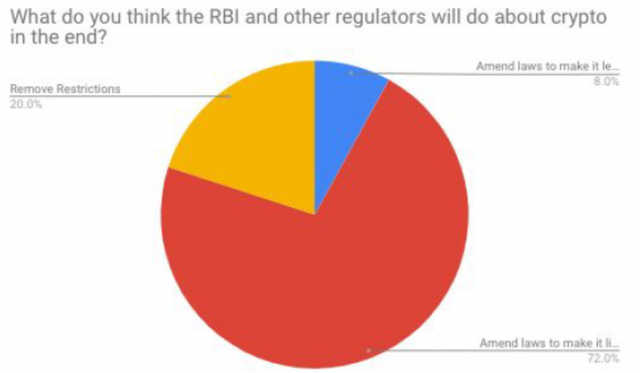

In addition, 36 traders believe that the Indian government will update existing laws to unbend cryptocurrencies. Ten respondents believe that the regulators will remove restrictions on crypto. However, only four traders believe that crypto will be legalized and regulated in India.

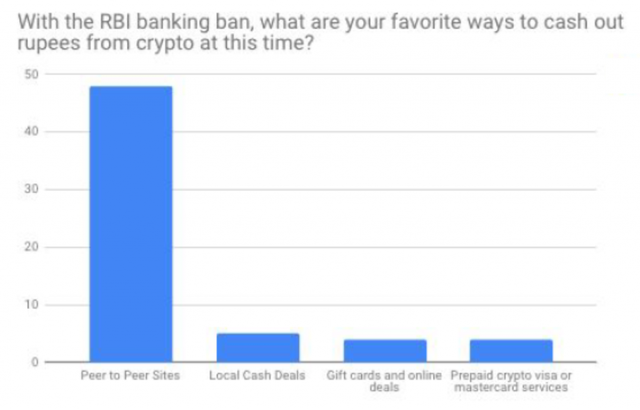

Preferred Cash-Out Methods

A number of crypto exchanges in India have come up with their own solutions to the RBI ban. Some have introduced exchange-escrowed peer-to-peer trading services, which they requirement have gained much popularity.

Respondents were asked well-nigh their preferred methods of cashing out cryptocurrencies into rupees. Forty-eight traders said they prefer to mazuma out using peer-to-peer sites. Five traders prefer to use local mazuma deals, four prefer to use souvenir cards and online deals, and four others prefer to mazuma out using prepaid crypto Visa and Mastercard services.

On Sunday, flipside cash-out method was introduced by one of India’s largest crypto exchanges, Unocoin. The visitor has launched crypto ATMs to shirk the RBI ban and indulge its users to petrifaction and withdraw rupees. This option was spoken without the Instashift survey had concluded, so it was not included in the survey.

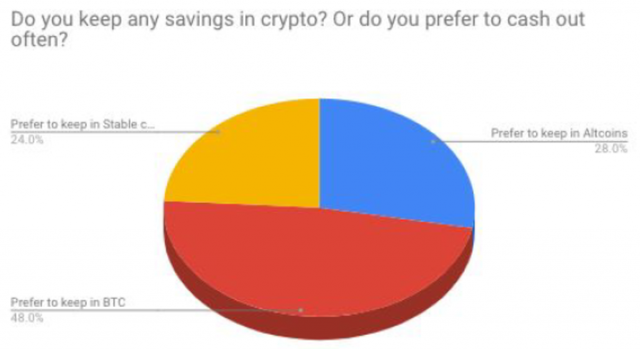

As for where to alimony their funds, 24 traders prefer to alimony them in BTC, 14 prefer altcoins, and 12 specifically prefer stablecoins. Recently, an increasing number of crypto exchanges in India have started listing stablecoins such as tether (USDT) and trueusd (TUSD).

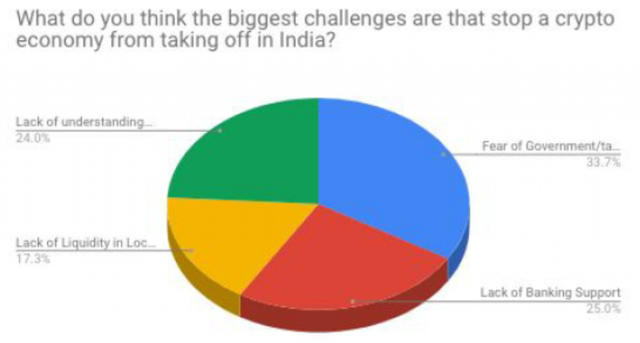

Future Prospects of Crypto Ecosystem in India

Amid the financial ban, 35 respondents believe that the fear of regulatory uncertainty is the biggest hurdle stopping the Indian crypto economy from flourishing. Twenty-six traders believe that the lack of financial support is the biggest challenge. Twenty-five traders put the lack of understanding of the crypto industry as the most important factor, while 18 traders attributed the lack of liquidity in the market as the top reason.

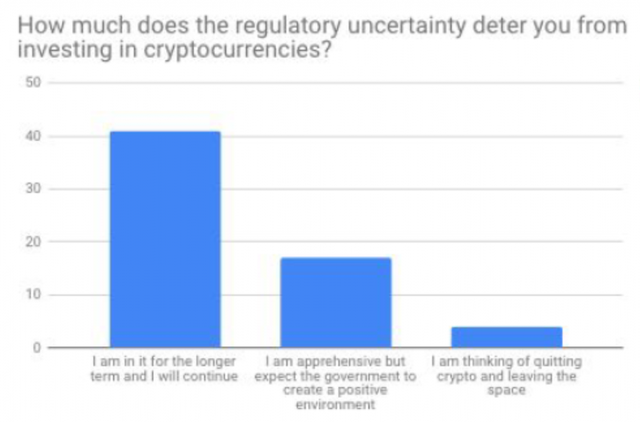

Despite all the hurdles, 41 traders said that they are long-term investors and will protract to invest in crypto. Seventeen traders admitted that they are wondering but expect the government to sooner create a positive environment for cryptocurrencies. However, four respondents are entertaining the idea of exiting the crypto space altogether.

Source: News

What do you think of the current crypto environment in India?

Let us know in the comments section below.

Thank you

@chetanyaswaroop