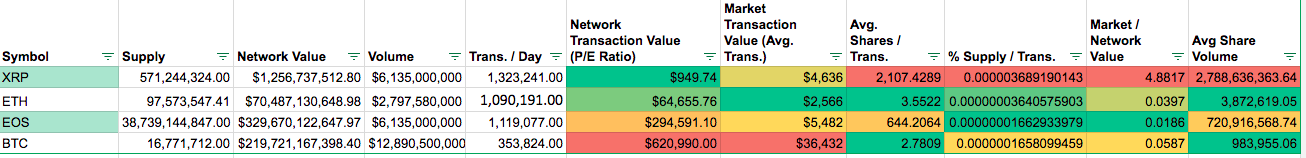

Looks like the market (Avg. Trans. Price) values XRP 4.8x more than the network (Market Cap / Daily Trans.).

In addition, compared to its peers (ETH, EOS, BTC), it also has higher share volume, a higher average amount of shares (and thus supply %) per transaction.

Unsure how to interpret this.

Looks like the market (as measured by avg. trans. price) is placing bets on XRP's future utility that the network (market cap & transactions) hasn't yet recognized.

Update: wrong EOS volume