.png)

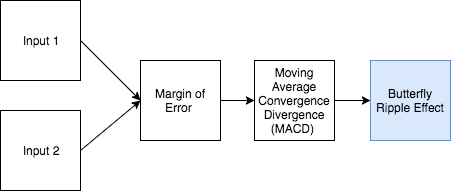

Traders aim to exploit the margin of error between tangentially correlated assets, incentivized to take advantage of the market arbitrage generated by a theoretical butterfly ripple effect, an implication of chaos theory in volatile markets.

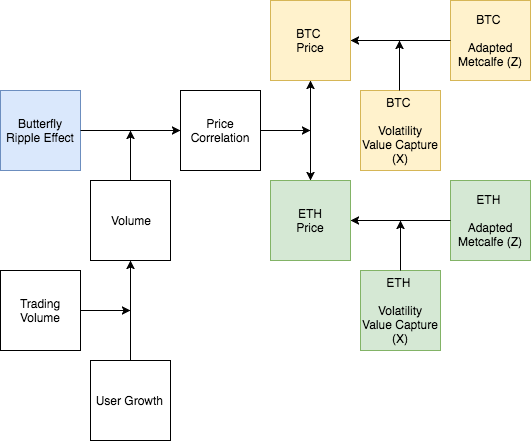

In cryptoassets, this process unfolds within the confines of the relationship between an asset pair, such as bitcoin (BTC) and ethereum (ETH), for example. The normalized margin of error as a determinant of two overlapping variables (either positively or negatively correlated) leads to convergence or divergence in terms of the directional energetic flow of underlying entanglement (the strength and direction of the relationship). To date, this process is exponentially compounded due to algorithmic high-frequency trading. We assume this impact can be measured by volume, in terms of exchange trading and user growth.

.png)

As demonstrated in previous work (cite), in synthesizing the theoretical foundations of Moore's (date) and Metcalfe' (date) laws of exponential computing power (in its current state, machine and deep learning) and network value?, respectively, a pattern emerges in which volume is a determinant of value. In light of trends in the areas of neural nets, artificial intelligence, and quantum computing, this leads to a discussion regarding the exploitation of financial relationships and the role of centralized systems such as the form of many cryptoasset trading exchanges today.

Multiple points of failure vulnerabilities, as demonstrated by inefficient network slowdown and outages that often plague centralized exchanges, lead customers to feel as if their assets are being held hostage. This presents a custodial agency problem. Coupled with increasing transaction and network fees, a redistribution of wealth is demonstrated in the long-term economic impact of cryptoassets tilted towards those with a technological advantage in terms of computing power. Historically, this centralization of power leads to an emergence of an upper class, the top one percent of the top one percent, as centralized systems inherently concentrate power in the form of financial and political institutions.

The tokenized solution is described as open source democracy in which an even playing field and transparency are incentivized. Fundamentally, in this system buyer and supplier power are limited only to the influence of the players within the transaction, as opposed to fee-based service delivery providers. As a measure of this one-to-one, direct connection transaction, the value of the direct consumer relationship is certified and signified. Virality and scarcity are determined by individual and group voting within the network. For instance, the rate of growth and decline of the token's limited supply (inflationary and deflationary policy) is consistently elected by the nodes within the network (one node, one vote). Moreover, stakeholders vote in terms of public trustworthiness by donating tokens or buying them on secondary exchanges. In this "fee-free economy", the value held at the token holder's public address acts as a signal of its commitment to transact directly with end consumers and not charge fees. In this respect, the value of this network can be paralleled to the value of Amazon in eliminating intermediaries and auxiliaries, ultimately the value of brand equity. In the same way that consumers rely on Amazon customer reviews, Google reviews, Yelp or a host of other review sites, the fee-free economy token (FFE) is poised to enhance loyalty by providing valid price and quality information about the vendor's (merchant or individual) commitment to transact directly with the consumer. In the long run, this technology can adopt a regulatory function beyond the informational symmetries provided by consumer feedback from the likes of the Better Business Bureau (BBB) or Consumer Financial Protection Bureau (CFPB) (both of which have no enforcement authority), towards something more akin to the Securities and Exchange Commission (SEC) and Federal Reserve. Ultimately, the network and the community will act and determine the token's fate, as sole judge and arbiter of future blockchain certification applications. The FFE use case represents insularity from the inevitable manipulation of centralization because its network value is determined by the value users place on fee-free peer-to-peer custodial asset transfer transactions in a decentralized economy. The mission is for every consumer to recognize the "Fee Free" stamp of approval, as measured by the amount of FFE tokens at any given vendor's public address, as proof of commitment to dectralization.

.png)

Congratulations @chillblinton! You received a personal award!

Click here to view your Board of Honor

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations @chillblinton! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit